Berkshire Hathaway 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Derivative contract liabilities (Continued)

issuer credit default contracts, our fair values are generally based on credit default spread information obtained from a widely

used reporting source. We monitor and review pricing data for consistency as well as reasonableness with respect to current

market conditions. We generally base estimated fair values on the ask prices (the average of such prices if more than one

indication is obtained). We make no significant adjustments to the pricing data referred to above. Further, we make no

significant adjustments to fair values for non-performance risk. We concluded that the values produced from this data (without

adjustment) reasonably represented the values for which we could have transferred these liabilities. However, our contract terms

(particularly the lack of collateral posting requirements) likely preclude any transfer of the contracts to third parties.

Accordingly, prices in a current actual settlement or transfer could differ significantly from the fair values used in the financial

statements. We do not operate as a derivatives dealer and currently we do not utilize offsetting strategies to hedge these

contracts. We intend to allow our credit default contracts to run off to their respective expiration dates.

We determine the estimated fair value of equity index put option contracts based on the widely used Black-Scholes

option valuation model. Inputs to the model include the current index value, strike price, discount rate, dividend rate and

contract expiration date. The weighted average discount and dividend rates used as of December 31, 2010 were 3.7% and

2.9%, respectively, and were approximately 4.0% and 2.7%, respectively, as of December 31, 2009. The discount rates

as of December 31, 2010 and 2009 were approximately 82 basis points and 55 basis points (on a weighted average basis),

respectively, over benchmark interest rates and represented an estimate of the spread between our borrowing rates and

the benchmark rates for comparable durations. The spread adjustments were based on spreads for our obligations and

obligations for comparably rated issuers. We believe the most significant economic risks relate to changes in the index value

component and to a lesser degree to the foreign currency component. For additional information, see our Market Risk

Disclosures.

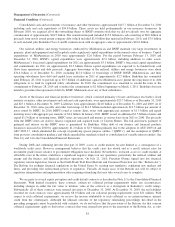

The Black-Scholes model also incorporates volatility estimates that measure potential price changes over time. The

weighted average volatility used as of December 31, 2010 was approximately 21.5%, which was relatively unchanged from year

end 2009. The weighted average volatilities are based on the volatility input for each equity index put option contract weighted

by the notional value of each equity index put option contract as compared to the aggregate notional value of all equity index

put option contracts. The volatility input for each equity index put option contract is based upon the implied volatility at the

inception of each equity index put option contract. The impact on fair value as of December 31, 2010 ($6.7 billion) from

changes in volatility is summarized below. The values of contracts in an actual exchange are affected by market conditions and

perceptions of the buyers and sellers. Actual values in an exchange may differ significantly from the values produced by any

mathematical model. Dollars are in millions.

Hypothetical change in volatility (percentage points) Hypothetical fair value

Increase 2 percentage points .............................................................. $7,221

Increase 4 percentage points .............................................................. 7,732

Decrease 2 percentage points .............................................................. 6,208

Decrease 4 percentage points .............................................................. 5,711

Other Critical Accounting Policies

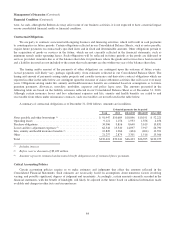

We record deferred charges with respect to liabilities assumed under retroactive reinsurance contracts. At the inception

of these contracts, the deferred charges represent the difference between the consideration received and the estimated

ultimate liability for unpaid losses. Deferred charges are amortized using the interest method over an estimate of the ultimate

claim payment period with the periodic amortization reflected in earnings as a component of losses and loss adjustment

expenses. Deferred charge balances are adjusted periodically to reflect new projections of the amount and timing of loss

payments. Adjustments to these assumptions are applied retrospectively from the inception of the contract. Unamortized

deferred charges were approximately $3.8 billion at December 31, 2010. Significant changes in the estimated amount and

payment timing of unpaid losses may have a significant effect on unamortized deferred charges and the amount of periodic

amortization.

Our Consolidated Balance Sheet as of December 31, 2010 includes goodwill of acquired businesses of $49.0 billion,

which includes $14.8 billion arising from our acquisition of BNSF in February 2010. We evaluate goodwill for impairment

at least annually and conducted our most recent annual review in the fourth quarter of 2010. Such tests include determining

the estimated fair values of our reporting units. There are several methods of estimating a reporting unit’s fair value,

92