Berkshire Hathaway 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

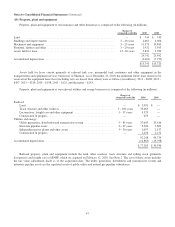

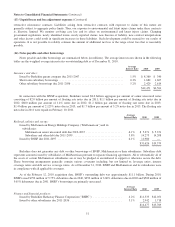

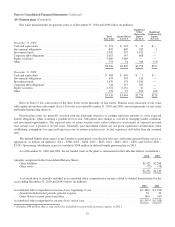

(17) Fair value measurements

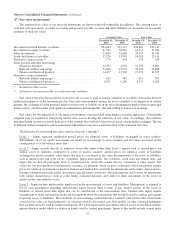

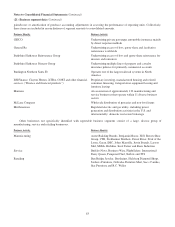

The estimated fair values of our financial instruments are shown in the following table (in millions). The carrying values of

cash and cash equivalents, accounts receivable and accounts payable, accruals and other liabilities are deemed to be reasonable

estimates of their fair values.

Carrying Value Fair Value

December 31,

2010

December 31,

2009

December 31,

2010

December 31,

2009

Investments in fixed maturity securities .......................... $34,883 $37,131 $34,883 $37,131

Investments in equity securities ................................ 61,513 59,034 61,513 59,034

Other investments ........................................... 23,009 32,600 24,147 34,540

Loans and finance receivables ................................. 15,226 13,989 14,453 12,415

Derivative contract assets (1) .................................. 574 454 574 454

Notes payable and other borrowings:

Insurance and other ...................................... 12,471 4,561 12,705 4,669

Railroad, utilities and energy .............................. 31,626 19,579 33,932 20,868

Finance and financial products ............................. 14,477 13,769 15,191 14,355

Derivative contract liabilities:

Railroad, utilities and energy (2) ............................ 621 581 621 581

Finance and financial products ............................. 8,371 9,269 8,371 9,269

(1)Included in Other assets

(2) Included in Accounts payable, accruals and other liabilities

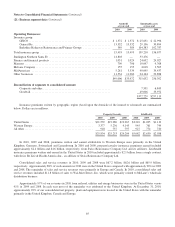

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants as of the measurement date. Fair value measurements assume the asset or liability is exchanged in an orderly

manner; the exchange is in the principal market for that asset or liability (or in the most advantageous market when no principal

market exists); and the market participants are independent, knowledgeable, able and willing to transact an exchange.

Fair values for substantially all of our financial instruments were measured using market or income approaches. Considerable

judgment may be required in interpreting market data used to develop the estimates of fair value. Accordingly, the estimates

presented herein are not necessarily indicative of the amounts that could be realized in an actual current market exchange. The use

of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair value.

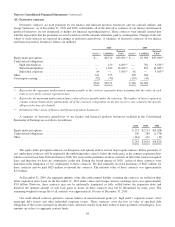

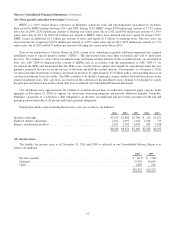

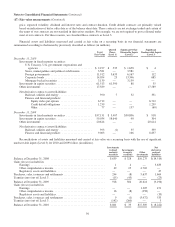

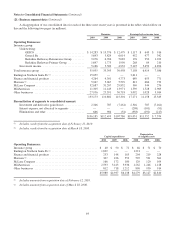

The hierarchy for measuring fair value consists of Levels 1 through 3.

Level 1 – Inputs represent unadjusted quoted prices for identical assets or liabilities exchanged in active markets.

Substantially all of our equity investments are traded on an exchange in active markets and fair values are based on the

closing prices as of the balance sheet date.

Level 2 – Inputs include directly or indirectly observable inputs (other than Level 1 inputs) such as quoted prices for

similar assets or liabilities exchanged in active or inactive markets; quoted prices for identical assets or liabilities

exchanged in inactive markets; other inputs that may be considered in fair value determinations of the assets or liabilities,

such as interest rates and yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates; and

inputs that are derived principally from or corroborated by observable market data by correlation or other means. Fair

values for our investments in fixed maturity securities are primarily based on price evaluations which incorporate market

prices for identical instruments in inactive markets and market data available for instruments with similar characteristics.

Pricing evaluations generally reflect discounted expected future cash flows, which incorporate yield curves for instruments

with similar characteristics, such as credit rating, estimated duration, and yields for other instruments of the issuer or

entities in the same industry sector.

Level 3 – Inputs include unobservable inputs used in the measurement of assets and liabilities. Management is required to

use its own assumptions regarding unobservable inputs because there is little, if any, market activity in the assets or

liabilities or related observable inputs that can be corroborated at the measurement date. Unobservable inputs require

management to make certain projections and assumptions about the information that would be used by market participants

in pricing assets or liabilities. Measurements of non-exchange traded derivative contracts and certain other investments

carried at fair value are based primarily on valuation models, discounted cash flow models or other valuation techniques

that are believed to be used by market participants. We value equity index put option contracts based on the Black-Scholes

option valuation model which we believe is widely used by market participants. Inputs to this model include current index

55