Berkshire Hathaway 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(20) Contingencies and Commitments (Continued)

discovery has been ongoing. The FAI Liquidator previously dismissed his complaint against GRA and Cologne Re. GRA and

Cologne Re have finalized their settlement with the HIH Liquidator and as a result on March 24, 2010 court orders were entered

dismissing the HIH Liquidators action in its entirety.

We have established reserves for certain of the legal proceedings discussed above where we have concluded that the

likelihood of an unfavorable outcome is probable and the amount of the loss can be reasonably estimated. We believe that any

liability that may arise as a result of current pending civil litigation, including the matters discussed above, will not have a

material effect on our financial condition or results of operations.

b) Commitments

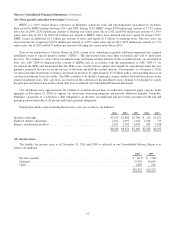

We lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent expense for all

operating leases was $1,204 million in 2010, $701 million in 2009 and $725 million in 2008. The increase in 2010 was due to

the BNSF acquisition. Minimum rental payments for operating leases having initial or remaining non-cancelable terms in excess

of one year are as follows. Amounts are in millions.

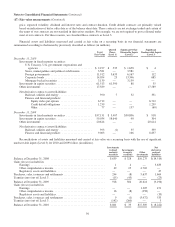

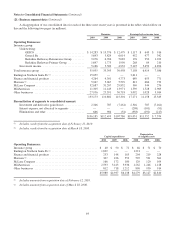

2011 2012 2013 2014 2015

After

2015 Total

$1,156 $1,043 $910 $816 $740 $4,456 $9,121

Several of our subsidiaries have made commitments in the ordinary course of business to purchase goods and services used

in their businesses. The most significant of these relate to our railroad, utilities and energy businesses. As of December 31,

2010, commitments under all such subsidiary arrangements were approximately $9.8 billion in 2011, $4.4 billion in 2012,

$4.3 billion in 2013, $3.1 billion in 2014, $2.5 billion in 2015 and $10.8 billion after 2015.

In the first quarter of 2011, we are acquiring an additional 16.6% of the outstanding common stock of Marmon, thus

increasing our total ownership interest to 80.2%. We currently estimate the cost of this additional share purchase to be

approximately $1.5 billion. The purchase of these shares is being accounted for as an acquisition of noncontrolling interest.

Accordingly, the difference of approximately $600 million between the consideration expected to be paid and the prior carrying

amount of the noncontrolling interest being acquired has been recorded as a reduction to Berkshire’s shareholders’ equity.

Berkshire will acquire substantially all of the remaining equity interests in Marmon in 2013 or 2014. However, the consideration

ultimately payable is contingent upon future operating results of Marmon and the per-share cost could be greater than or less

than the price in 2011.

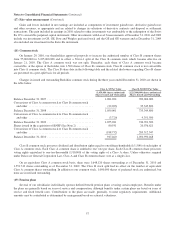

We currently own 80.1% of the outstanding common stock of Wesco Financial Corporation (“Wesco”) and on February 4,

2011, we entered into an agreement to acquire the 19.9% noncontrolling interests in Wesco that we did not already own for a

price that is based on Wesco’s estimated shareholders’ equity per share at the time the acquisition closes. Based on Wesco’s

shareholders’ equity at December 31, 2010, the cost to acquire these shares would be approximately $550 million, payable at the

election of the Wesco shareholders in either cash or Berkshire Class B common stock. The acquisition is subject to customary

prior approvals including the affirmative vote of holders of a majority of Wesco’s outstanding shares not owned by Berkshire.

Pursuant to the terms of shareholder agreements with noncontrolling shareholders in certain of our other less than wholly-

owned subsidiaries, we may be obligated to acquire their equity ownership interests. The consideration payable for such

interests is generally based on the fair value. If we acquired all such outstanding noncontrolling interests as of December 31,

2010, the cost would have been approximately $2.9 billion. However, the timing and the amount of any such future payments

that might be required are contingent on future actions of the noncontrolling owners and future operating results of the related

subsidiaries.

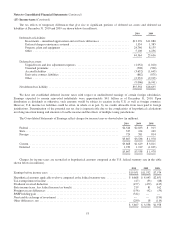

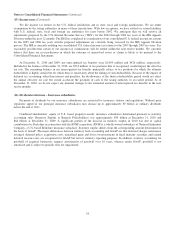

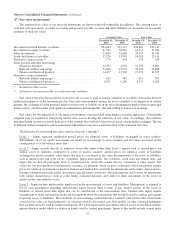

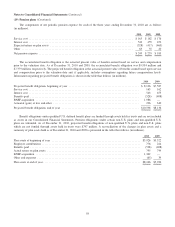

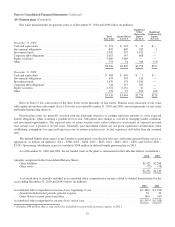

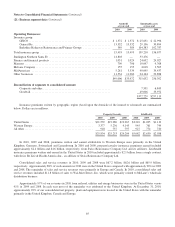

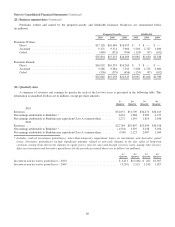

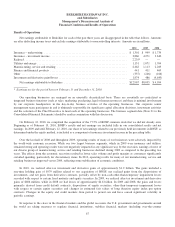

(21) Business segment data

Our reportable business segments are organized in a manner that reflects how management views those business activities.

Certain businesses have been grouped together for segment reporting based upon similar products or product lines, marketing,

selling and distribution characteristics, even though those business units are operated under separate local management.

The tabular information that follows shows data of reportable segments reconciled to amounts reflected in the Consolidated

Financial Statements. Intersegment transactions are not eliminated in instances where management considers those transactions

in assessing the results of the respective segments. Furthermore, our management does not consider investment and derivative

62