Berkshire Hathaway 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(5) Other investments

Other investments include fixed maturity and equity securities of The Goldman Sachs Group, Inc. (“GS”), General Electric

Company (“GE”), Wm. Wrigley Jr. Company (“Wrigley”), Swiss Reinsurance Company Ltd. (“Swiss Re”) and The Dow

Chemical Company (“Dow”). As of December 31, 2009, we also owned 22.5% of BNSF’s outstanding common stock, which

we accounted for pursuant to the equity method and included in other investments of insurance and other businesses in our

Consolidated Balance Sheet. Upon acquiring all remaining outstanding shares of BNSF on February 12, 2010, we discontinued

using the equity method and began consolidating the accounts of BNSF. See Note 2. A summary of other investments follows

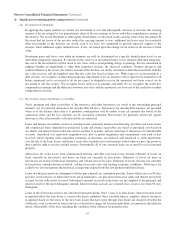

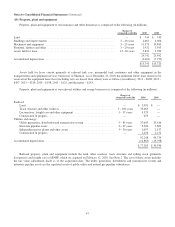

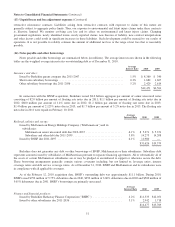

(in millions).

Cost

Unrealized

Gains

Fair

Value

Carrying

Value

December 31, 2010

Other fixed maturity and equity securities:

Insurance and other ................................................ $15,700 $4,758 $20,458 $19,333

Finance and financial products ....................................... 2,742 947 3,689 3,676

$18,442 $5,705 $24,147 $23,009

December 31, 2009

Other fixed maturity and equity securities:

Insurance and other ................................................ $18,347 $5,451 $23,798 $22,854

Finance and financial products ....................................... 2,742 428 3,170 3,160

Equity method-BNSF .................................................. 5,851 1,721 7,572 6,586

$26,940 $7,600 $34,540 $32,600

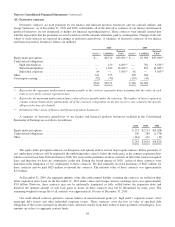

We own 50,000 shares of 10% Cumulative Perpetual Preferred Stock of GS (“GS Preferred”) and warrants to purchase

43,478,260 shares of common stock of GS (“GS Warrants”) which we acquired in 2008 for a combined cost of $5 billion. The

GS Preferred may be redeemed at any time by GS at a price of $110,000 per share ($5.5 billion in aggregate). The GS Warrants

expire in 2013 and can be exercised for an additional aggregate cost of $5 billion ($115/share). In 2008, we also acquired 30,000

shares of 10% Cumulative Perpetual Preferred Stock of GE (“GE Preferred”) and warrants to purchase 134,831,460 shares of

common stock of GE (“GE Warrants”) for a combined cost of $3 billion. The GE Preferred may be redeemed by GE beginning

in October 2011 at a price of $110,000 per share ($3.3 billion in aggregate). The GE Warrants expire in 2013 and can be

exercised for an additional aggregate cost of $3 billion ($22.25/share).

We own $4.4 billion par amount of 11.45% Wrigley subordinated notes due in 2018 and $2.1 billion of 5% Wrigley

preferred stock, which we acquired in 2008. In December 2009, we also acquired $1.0 billion par amount of Wrigley senior

notes due in 2013 and 2014. The Wrigley subordinated and senior notes are classified as held-to-maturity and we carry these

investments at cost, adjusted for foreign currency exchange rate changes that apply to certain of the senior notes. We carry the

Wrigley preferred stock at fair value classified as available-for-sale.

We own 3,000,000 shares of Series A Cumulative Convertible Perpetual Preferred Stock of Dow (“Dow Preferred”), which

we acquired in 2009 for a cost of $3 billion. Under certain conditions, each share of the Dow Preferred is convertible into

24.201 shares of Dow common stock. Beginning in April 2014, if Dow’s common stock price exceeds $53.72 per share for any

20 trading days in a consecutive 30-day window, Dow, at its option, at any time, in whole or in part, may convert the Dow

Preferred into Dow common stock at the then applicable conversion rate. The Dow Preferred is entitled to dividends at a rate of

8.5% per annum.

In 2009, we also acquired a 12% convertible perpetual capital instrument issued by Swiss Re at a cost of $2.7 billion. The

instrument had a face amount of 3 billion Swiss Francs (“CHF”). The terms of the instrument allowed Swiss Re to redeem at its

option the instrument under certain conditions. On November 3, 2010, we entered into an agreement with Swiss Re regarding

the redemption of the instrument in exchange for aggregate consideration of approximately CHF 3.9 billion of which CHF

180 million was received on November 25, 2010 with the remainder to be paid to us in 2011. As of December 31, 2010, the

amount due (and subsequently received on January 10, 2011) was classified in our Consolidated Balance Sheet as a component

of receivables of insurance and other businesses.

44