Berkshire Hathaway 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

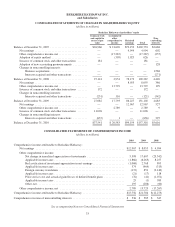

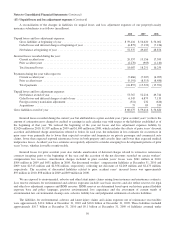

Notes to Consolidated Financial Statements (Continued)

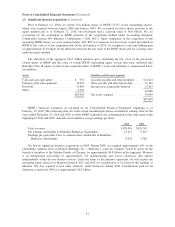

(3) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2010 and 2009 are summarized below (in millions).

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2010

U.S. Treasury, U.S. government corporations and agencies ................... $ 2,151 $ 48 $ (2) $ 2,197

States, municipalities and political subdivisions ............................ 3,356 225 — 3,581

Foreign governments ................................................. 11,721 242 (51) 11,912

Corporate bonds ..................................................... 11,773 2,304 (23) 14,054

Mortgage-backed securities ............................................ 2,838 312 (11) 3,139

$31,839 $3,131 $ (87) $34,883

Insurance and other .................................................. $30,862 $3,028 $ (87) $33,803

Finance and financial products ......................................... 977 103 — 1,080

$31,839 $3,131 $ (87) $34,883

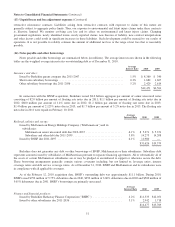

December 31, 2009

U.S. Treasury, U.S. government corporations and agencies ................... $ 2,362 $ 46 $ (1) $ 2,407

States, municipalities and political subdivisions ............................ 3,689 275 (1) 3,963

Foreign governments ................................................. 11,518 368 (42) 11,844

Corporate bonds ..................................................... 13,094 2,080 (502) 14,672

Mortgage-backed securities ............................................ 3,961 310 (26) 4,245

$34,624 $3,079 $(572) $37,131

Insurance and other .................................................. $33,317 $2,984 $(572) $35,729

Finance and financial products ......................................... 1,307 95 — 1,402

$34,624 $3,079 $(572) $37,131

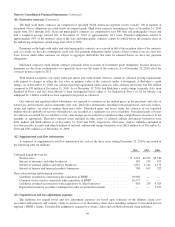

Unrealized losses include $24 million at December 31, 2010 and $471 million at December 31, 2009, related to securities

that have been in an unrealized loss position for 12 months or more. During the fourth quarter of 2010, we recorded other-than-

temporary impairment charges of $1,020 million with respect to certain fixed maturity securities where we concluded that we

were unlikely to receive all remaining contractual principal and interest amounts when due. These securities had been in an

unrealized loss position for more than two years.

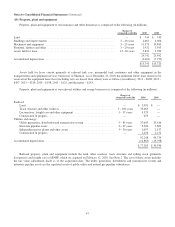

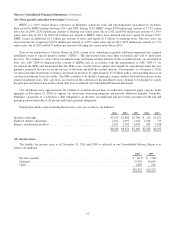

The amortized cost and estimated fair value of securities with fixed maturities at December 31, 2010 are summarized

below by contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of the

securities retain early call or prepayment rights. Amounts are in millions.

Due in one

year or less

Due after one

year through

five years

Due after five

years through

ten years

Due after

ten years

Mortgage-backed

securities Total

Amortized cost ........................... $7,095 $14,734 $4,448 $2,724 $2,838 $31,839

Fair value ............................... 7,231 16,146 5,091 3,276 3,139 34,883

42