Berkshire Hathaway 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

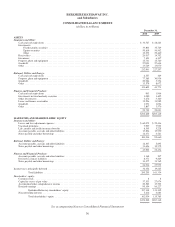

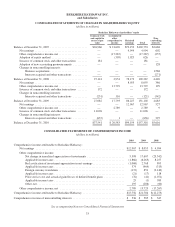

BERKSHIRE HATHAWAY INC.

and Subsidiaries

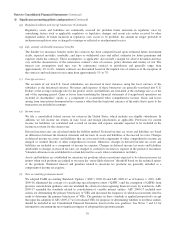

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(dollars in millions)

Berkshire Hathaway shareholders’ equity

Non-

controlling

interests

Common stock

and capital in

excess of par

value

Accumulated

other

comprehensive

income

Retained

earnings Total

Balance at December 31, 2007 .......................... $26,960 $ 21,620 $72,153 $120,733 $2,668

Net earnings ..................................... — — 4,994 4,994 602

Other comprehensive income, net .................... — (17,267) — (17,267) (255)

Adoption of equity method ......................... — (399) 1,025 626 —

Issuance of common stock and other transactions ....... 181 — — 181 —

Adoption of new accounting pronouncements .......... — — — — 128

Changes in noncontrolling interests:

Business acquisitions .......................... — — — — 1,568

Interests acquired and other transactions .......... — — — — (271)

Balance at December 31, 2008 .......................... 27,141 3,954 78,172 109,267 4,440

Net earnings ..................................... — — 8,055 8,055 386

Other comprehensive income, net .................... — 13,729 — 13,729 199

Issuance of common stock and other transactions ....... 172 — — 172 —

Changes in noncontrolling interests:

Interests acquired and other transactions .......... (231) 110 — (121) (342)

Balance at December 31, 2009 .......................... 27,082 17,793 86,227 131,102 4,683

Net earnings ..................................... — — 12,967 12,967 527

Other comprehensive income, net .................... — 2,789 — 2,789 9

Issuance of common stock and other transactions ....... 11,096 — — 11,096 —

Changes in noncontrolling interests:

Interests acquired and other transactions .......... (637) 1 — (636) 397

Balance at December 31, 2010 .......................... $37,541 $ 20,583 $99,194 $157,318 $5,616

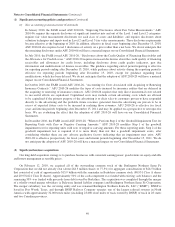

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(dollars in millions)

2010 2009 2008

Comprehensive income attributable to Berkshire Hathaway:

Net earnings .............................................................. $12,967 $ 8,055 $ 4,994

Other comprehensive income:

Net change in unrealized appreciation of investments .......................... 5,398 17,607 (23,342)

Applicable income taxes ................................................. (1,866) (6,263) 8,257

Reclassification of investment appreciation in net earnings ...................... (1,068) 2,768 895

Applicable income taxes ................................................. 374 (969) (313)

Foreign currency translation .............................................. (172) 851 (2,140)

Applicable income taxes ................................................. (21) (17) 118

Prior service cost and actuarial gains/losses of defined benefit plans .............. (76) (41) (1,071)

Applicable income taxes ................................................. 25 (1) 389

Other, net ............................................................. 195 (206) (60)

Other comprehensive income, net ............................................. 2,789 13,729 (17,267)

Comprehensive income attributable to Berkshire Hathaway ............................. $15,756 $21,784 $(12,273)

Comprehensive income of noncontrolling interests .................................... $ 536 $ 585 $ 347

See accompanying Notes to Consolidated Financial Statements

33