Berkshire Hathaway 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Railroad (“Burlington Northern Santa Fe”)

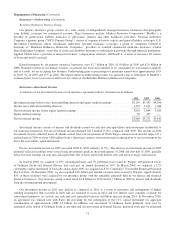

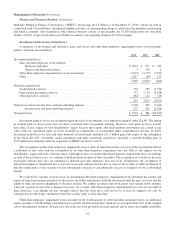

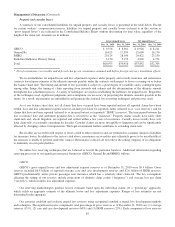

We acquired control of Burlington Northern Santa Fe Corporation (“BNSF”) on February 12, 2010. BNSF’s revenues and

operating results are included in our consolidated results beginning immediately after the acquisition. In 2009 and for the period

between January 1, 2010 and February 12, 2010, we accounted for our interest in BNSF pursuant to the equity method. Our

share of BNSF’s earnings for those periods is included in net investment income of our insurance group. Earnings of BNSF

following the acquisition are summarized below (in millions). BNSF’s earnings for the years ending December 31, 2010 and

2009 are provided for comparison, although these results are not consolidated in our financial statements.

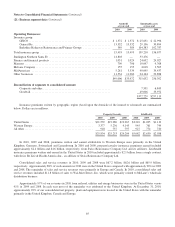

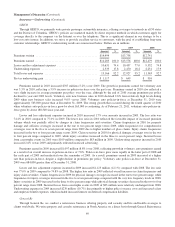

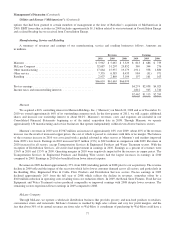

Feb. 13, 2010 to

Dec. 31, 2010 2010 2009

Revenues ................................................................. $15,059 $16,850 $14,016

Operating expenses ......................................................... 11,013 12,355 10,762

Interest expense ............................................................ 435 507 613

11,448 12,862 11,375

Pre-tax earnings ............................................................ 3,611 3,988 2,641

Income taxes .............................................................. 1,376 1,529 920

Net earnings ............................................................... $ 2,235 $ 2,459 $ 1,721

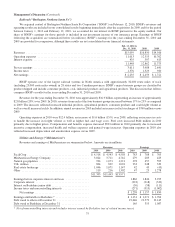

BNSF operates one of the largest railroad systems in North America with approximately 32,000 route miles of track

(including 23,000 route miles owned) in 28 states and two Canadian provinces. BNSF’s major business groups are classified by

product shipped and include consumer products, coal, industrial products and agricultural products. The discussion that follows

compares BNSF’s results for the years ending December 31, 2010 and 2009.

Revenues for the year ending December 31, 2010 were approximately $16.9 billion, representing an increase of approximately

$2.8 billion (20%) over 2009. In 2010, revenues from each of the four business groups increased between 17% to 23% as compared

to 2009. The increases reflected increased industrial products, agricultural products, consumer products and coal freight volume as

well as overall increased yields. In addition, annual revenues in 2010 included an increase in fuel surcharges of $740 million versus

2009.

Operating expenses in 2010 were $12.4 billion, an increase of $1.6 billion (15%) over 2009, reflecting an increase in costs

to handle the increase in freight volume as well as higher fuel and wage costs. Fuel costs increased $644 million in 2010

primarily due to higher prices. Compensation and benefits expense increased $523 million in 2010 primarily due to increased

incentive compensation, increased health and welfare expenses and general wage increases. Operating expenses in 2010 also

reflected increased depreciation and amortization expense versus 2009.

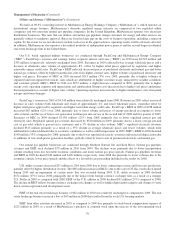

Utilities and Energy (“MidAmerican”)

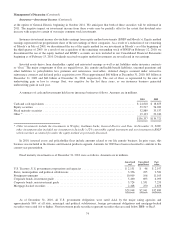

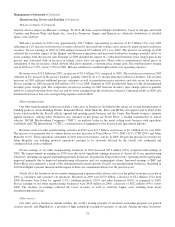

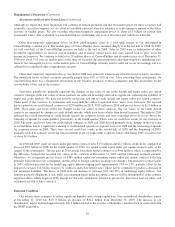

Revenues and earnings of MidAmerican are summarized below. Amounts are in millions.

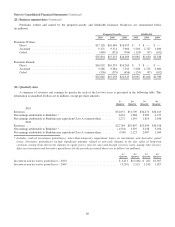

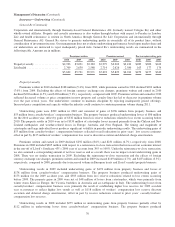

Revenues Earnings

2010 2009 2008 2010 2009 2008

PacifiCorp ........................................... $ 4,518 $ 4,543 $ 4,558 $ 783 $ 788 $ 703

MidAmerican Energy Company .......................... 3,824 3,711 4,742 279 285 425

Natural gas pipelines ................................... 994 1,073 1,221 378 457 595

U.K. utilities ......................................... 804 829 1,001 333 248 339

Real estate brokerage .................................. 1,046 1,071 1,147 42 43 (45)

Other ............................................... 119 216 1,302 47 25 1,278

$11,305 $11,443 $13,971

Earnings before corporate interest and taxes ................ 1,862 1,846 3,295

Corporate interest ..................................... (323) (318) (332)

Interest on Berkshire junior debt .......................... (30) (58) (111)

Income taxes and noncontrolling interests .................. (271) (313) (1,002)

Net earnings ...................................... $ 1,238 $ 1,157 $ 1,850

Earnings attributable to Berkshire * ....................... $ 1,131 $ 1,071 $ 1,704

Debt owed to others at December 31 ...................... 19,646 19,579 19,145

Debt owed to Berkshire at December 31 ................... 165 353 1,087

*Net of noncontrolling interests and includes interest earned by Berkshire (net of related income taxes).

75