Berkshire Hathaway 2010 Annual Report Download - page 16

Download and view the complete annual report

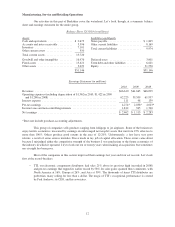

Please find page 16 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Next to Marmon, the two largest earners in this sector are Iscar and McLane. Both had excellent years.

In 2010, Grady Rosier’s McLane entered the wine and spirits distribution business to supplement its $32 billion

operation as a distributor of food products, cigarettes, candy and sundries. In purchasing Empire Distributors, an

operator in Georgia and North Carolina, we teamed up with David Kahn, the company’s dynamic CEO. David is

leading our efforts to expand geographically. By yearend he had already made his first acquisition, Horizon Wine

and Spirits in Tennessee.

At Iscar, profits were up 159% in 2010, and we may well surpass pre-recession levels in 2011. Sales

are improving throughout the world, particularly in Asia. Credit Eitan Wertheimer, Jacob Harpaz and Danny

Goldman for an exceptional performance, one far superior to that of Iscar’s main competitors.

All that is good news. Our businesses related to home construction, however, continue to struggle.

Johns Manville, MiTek, Shaw and Acme Brick have maintained their competitive positions, but their profits are

far below the levels of a few years ago. Combined, these operations earned $362 million pre-tax in 2010

compared to $1.3 billion in 2006, and their employment has fallen by about 9,400.

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some

point. Consequently: (1) At MiTek, we have made, or committed to, five bolt-on acquisitions during the past

eleven months; (2) At Acme, we just recently acquired the leading manufacturer of brick in Alabama for

$50 million; (3) Johns Manville is building a $55 million roofing membrane plant in Ohio, to be completed next

year; and (4) Shaw will spend $200 million in 2011 on plant and equipment, all of it situated in America. These

businesses entered the recession strong and will exit it stronger. At Berkshire, our time horizon is forever.

Regulated, Capital-Intensive Businesses

We have two very large businesses, BNSF and MidAmerican Energy, with important common

characteristics that distinguish them from our many others. Consequently, we give them their own sector in this

letter and split out their financial statistics in our GAAP balance sheet and income statement.

A key characteristic of both companies is the huge investment they have in very long-lived, regulated

assets, with these funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is

not needed: Both businesses have earning power that, even under very adverse business conditions, amply covers

their interest requirements. For example, in recessionary 2010 with BNSF’s car loadings far off peak levels, the

company’s interest coverage was 6:1.

Both companies are heavily regulated, and both will have a never-ending need to make major

investments in plant and equipment. Both also need to provide efficient, customer-satisfying service to earn the

respect of their communities and regulators. In return, both need to be assured that they will be allowed to earn

reasonable earnings on future capital investments.

Earlier I explained just how important railroads are to our country’s future. Rail moves 42% of

America’s inter-city freight, measured by ton-miles, and BNSF moves more than any other railroad – about 28%

of the industry total. A little math will tell you that more than 11% of all inter-city ton-miles of freight in the U.S.

is transported by BNSF. Given the shift of population to the West, our share may well inch higher.

All of this adds up to a huge responsibility. We are a major and essential part of the American

economy’s circulatory system, obliged to constantly maintain and improve our 23,000 miles of track along with

its ancillary bridges, tunnels, engines and cars. In carrying out this job, we must anticipate society’s needs, not

merely react to them. Fulfilling our societal obligation, we will regularly spend far more than our depreciation,

with this excess amounting to $2 billion in 2011. I’m confident we will earn appropriate returns on our huge

incremental investments. Wise regulation and wise investment are two sides of the same coin.

At MidAmerican, we participate in a similar “social compact.” We are expected to put up ever-

increasing sums to satisfy the future needs of our customers. If we meanwhile operate reliably and efficiently, we

know that we will obtain a fair return on these investments.

14