Berkshire Hathaway 2010 Annual Report Download - page 15

Download and view the complete annual report

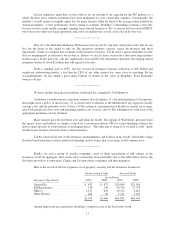

Please find page 15 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Forest River, our RV and boat manufacturer, had record sales of nearly $2 billion and record earnings

as well. Forest River has 82 plants, and I have yet to visit one (or the home office, for that matter).

There’s no need; Pete Liegl, the company’s CEO, runs a terrific operation. Come view his products at

the annual meeting. Better yet, buy one.

• CTB, our farm-equipment company, again set an earnings record. I told you in the 2008 Annual Report

about Vic Mancinelli, the company’s CEO. He just keeps getting better. Berkshire paid $140 million

for CTB in 2002. It has since paid us dividends of $160 million and eliminated $40 million of debt.

Last year it earned $106 million pre-tax. Productivity gains have produced much of this increase. When

we bought CTB, sales per employee were $189,365; now they are $405,878.

• Would you believe shoes? H. H. Brown, run by Jim Issler and best known for its Born brand, set a new

record for sales and earnings (helped by its selling 1,110 pairs of shoes at our annual meeting). Jim has

brilliantly adapted to major industry changes. His work, I should mention, is overseen by Frank

Rooney, 89, a superb businessman and still a dangerous fellow with whom to have a bet on the golf

course.

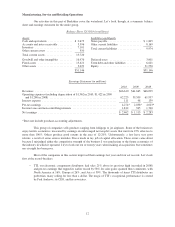

A huge story in this sector’s year-to-year improvement occurred at NetJets. I can’t overstate the

breadth and importance of Dave Sokol’s achievements at this company, the leading provider of fractional

ownership of jet airplanes. NetJets has long been an operational success, owning a 2010 market share five times

that of its nearest competitor. Our overwhelming leadership stems from a wonderful team of pilots, mechanics

and service personnel. This crew again did its job in 2010, with customer satisfaction, as delineated in our regular

surveys, hitting new highs.

Even though NetJets was consistently a runaway winner with customers, our financial results, since its

acquisition in 1998, were a failure. In the 11 years through 2009, the company reported an aggregate pre-tax loss

of $157 million, a figure that was far understated since borrowing costs at NetJets were heavily subsidized by its

free use of Berkshire’s credit. Had NetJets been operating on a stand-alone basis, its loss over the years would

have been several hundreds of millions greater.

We are now charging NetJets an appropriate fee for Berkshire’s guarantee. Despite this fee (which

came to $38 million in 2010), NetJets earned $207 million pre-tax in 2010, a swing of $918 million from 2009.

Dave’s quick restructuring of management and the company’s rationalization of its purchasing and spending

policies has ended the hemorrhaging of cash and turned what was Berkshire’s only major business problem into a

solidly profitable operation.

Dave has meanwhile maintained NetJets’ industry-leading reputation for safety and service. In many

important ways, our training and operational standards are considerably stronger than those required by the FAA.

Maintaining top-of-the-line standards is the right thing to do, but I also have a selfish reason for championing this

policy. My family and I have flown more than 5,000 hours on NetJets (that’s equal to being airborne 24 hours a

day for seven months) and will fly thousands of hours more in the future. We receive no special treatment and

have used a random mix of at least 100 planes and 300 crews. Whichever the plane or crew, we always know we

are flying with the best-trained pilots in private aviation.

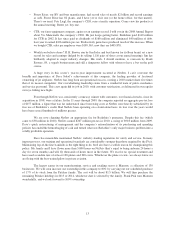

The largest earner in our manufacturing, service and retailing sector is Marmon, a collection of 130

businesses. We will soon increase our ownership in this company to 80% by carrying out our scheduled purchase

of 17% of its stock from the Pritzker family. The cost will be about $1.5 billion. We will then purchase the

remaining Pritzker holdings in 2013 or 2014, whichever date is selected by the family. Frank Ptak runs Marmon

wonderfully, and we look forward to 100% ownership.

13