Berkshire Hathaway 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

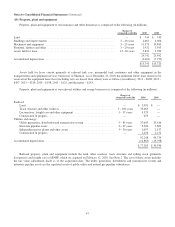

Notes to Consolidated Financial Statements (Continued)

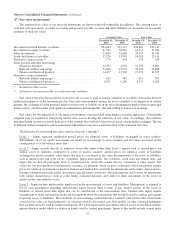

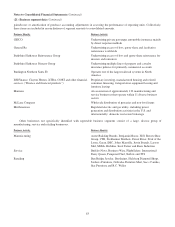

(17) Fair value measurement (Continued)

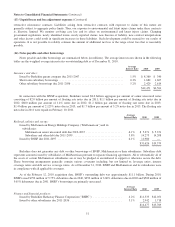

Gains and losses included in net earnings are included as components of investment gains/losses, derivative gains/losses

and other revenues, as appropriate and are related to changes in valuations of derivative contracts and disposal or settlement

transactions. The gain included in earnings in 2010 related to other investments was attributable to the redemption of the Swiss

Re 12% convertible perpetual capital instrument. Other investments with Level 3 measurements at December 31, 2010 and 2009

include our investments in GS, GE, Dow and Wrigley preferred stock and the GS and GE warrants and at December 31, 2009

also included our investment in the Swiss Re instrument.

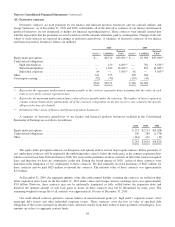

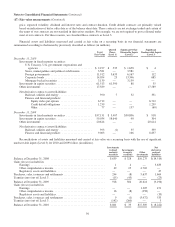

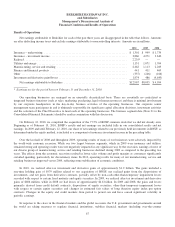

(18) Common stock

On January 20, 2010, our shareholders approved proposals to increase the authorized number of Class B common shares

from 55,000,000 to 3,225,000,000 and to effect a 50-for-1 split of the Class B common stock which became effective on

January 21, 2010. The Class A common stock was not split. Thereafter, each share of Class A common stock became

convertible, at the option of the holder, into 1,500 shares of Class B common stock. Class B common stock is not convertible

into Class A common stock. The Class B share data in the following table and the related disclosures regarding Class B shares

are presented on a post-split basis for all periods.

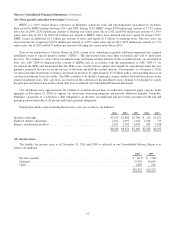

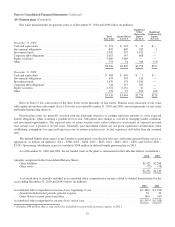

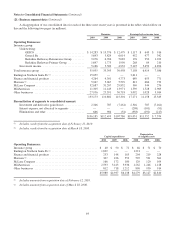

Changes in issued and outstanding Berkshire common stock during the three years ended December 31, 2010 are shown in

the table below.

Class A, $5 Par Value Class B, $0.0033 Par Value

(1,650,000 shares authorized)

Shares Issued and Outstanding

(3,225,000,000 shares authorized)

Shares Issued and Outstanding

Balance December 31, 2007 ................................ 1,081,024 700,004,000

Conversions of Class A common stock to Class B common stock

and other ............................................. (22,023) 35,345,800

Balance December 31, 2008 ................................ 1,059,001 735,349,800

Conversions of Class A common stock to Class B common stock

and other ............................................. (3,720) 9,351,500

Balance December 31, 2009 ................................ 1,055,281 744,701,300

Shares issued in the acquisition of BNSF (See Note 2) ........... 80,931 20,976,621

Conversions of Class A common stock to Class B common stock

and other ............................................. (188,752) 285,312,547

Balance December 31, 2010 ................................ 947,460 1,050,990,468

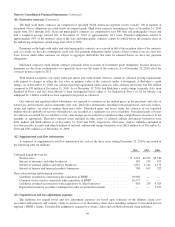

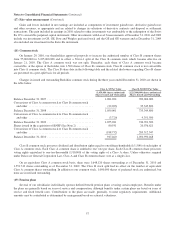

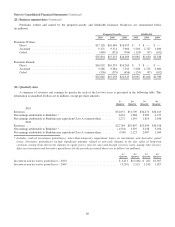

Class B common stock possesses dividend and distribution rights equal to one-fifteen-hundredth (1/1,500) of such rights of

Class A common stock. Each Class A common share is entitled to one vote per share. Each Class B common share possesses

voting rights equivalent to one-ten-thousandth (1/10,000) of the voting rights of a Class A share. Unless otherwise required

under Delaware General Corporation Law, Class A and Class B common shares vote as a single class.

On an equivalent Class A common stock basis, there were 1,648,120 shares outstanding as of December 31, 2010 and

1,551,749 shares outstanding as of December 31, 2009. The Class B stock split had no effect on the number of equivalent

Class A common shares outstanding. In addition to our common stock, 1,000,000 shares of preferred stock are authorized, but

none are issued and outstanding.

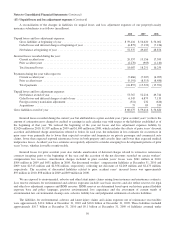

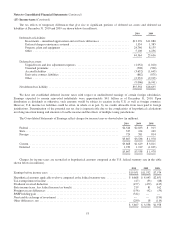

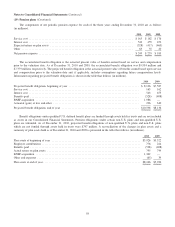

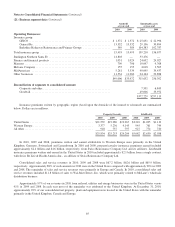

(19) Pension plans

Several of our subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under

the plans are generally based on years of service and compensation, although benefits under certain plans are based on years of

service and fixed benefit rates. Contributions to the plans are made, generally, to meet regulatory requirements. Additional

amounts may be contributed as determined by management based on actuarial valuations.

57