Berkshire Hathaway 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Manufacturing, Service and Retailing (Continued)

McLane Company (Continued)

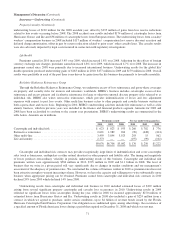

material adverse impact on McLane’s earnings. In 2010, McLane acquired Empire Distributors, based in Georgia and North

Carolina and Horizon Wine and Spirits Inc., based in Tennessee. Empire and Horizon are wholesale distributors of distilled

spirits, wine and beer.

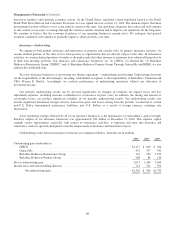

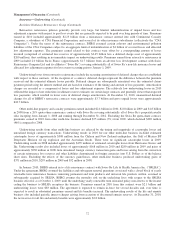

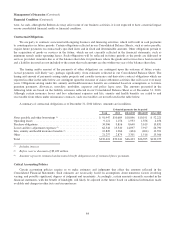

McLane’s revenues in 2010 were approximately $32.7 billion, representing an increase of $1.5 billion (5%) over 2009

reflecting an 11% increase in foodservice revenues (driven by increased unit volume) and a relatively minor increase in grocery

revenues. Pre-tax earnings in 2010 of $369 million increased $25 million (7%) over 2009. The increase in earnings in 2010

reflected the favorable impact of the Empire and Horizon acquisitions and increased foodservice earnings, partially offset by

lower earnings from the grocery unit. Earnings in 2009 included the impact of a substantial inventory price change gain in the

grocery unit associated with an increase in federal excise taxes on cigarettes. Many tobacco manufacturers raised prices in

anticipation of the tax increase, which allowed McLane to generate a one-time price change gain. The combined gross margin

rate in 2010 was 5.75% versus 5.72% in 2009. McLane continues to maintain tight control over operating expenses.

Revenues were $31.2 billion in 2009, an increase of $1.4 billion (5%) compared to 2008. The increase in revenues in 2009

reflected an 8% increase in the grocery business, partially offset by an 11% decline from the foodservice business. The revenue

increases in 2009 reflected additional grocery customers as well as manufacturer price increases and state excise tax increases.

Pre-tax earnings in 2009 increased $68 million (25%) over 2008. Earnings in 2009 included the impact of the aforementioned

inventory price change gain. The comparative increase in earnings in 2009 from the inventory price change gain was partially

offset by a related one-time floor stock tax and by lower earnings from the foodservice business. Operating results in 2009 also

benefited from lower fuel costs and operating expense control efforts.

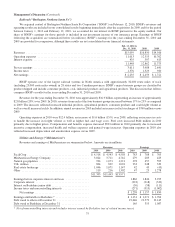

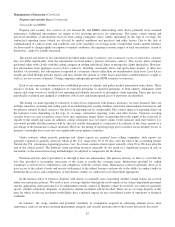

Other manufacturing

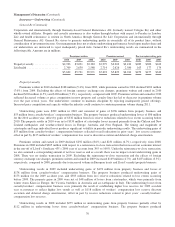

Our other manufacturing businesses include a wide array of businesses. Included in this group are several manufacturers of

building products (Acme Building Brands, Benjamin Moore, Johns Manville, Shaw and MiTek) and apparel (led by Fruit of the

Loom which includes the Russell athletic apparel and sporting goods business and the Vanity Fair Brands women’s intimate

apparel business). Among other businesses also included in this group are Forest River, a leading manufacturer of leisure

vehicles, ISCAR Metalworking Companies (“IMC”), an industry leader in the metal cutting tools business with operations

worldwide and CTB International (“CTB”), a manufacturer of equipment for the livestock and agricultural industry.

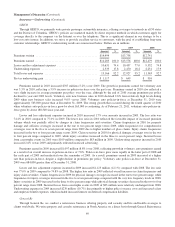

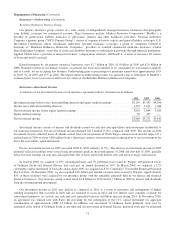

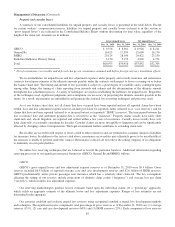

Revenues from our other manufacturing activities in 2010 were $17.7 billion, an increase of $1.7 billion (11%) over 2009.

The increase was primarily due to volume driven revenue increases of Forest River (57%), IMC (41%), CTB (20%) and Johns

Manville (12%). These operations rebounded in 2010 from slow business activity in 2009. Despite the increase in revenues by

Johns Manville, our building products operations continue to be adversely affected by the overall soft residential and

commercial real estate conditions.

Pre-tax earnings of our other manufacturing businesses in 2010 increased $953 million (99%) compared with earnings in

2009. The improvements in earnings in 2010 were driven by significant earnings increases at almost all of our manufacturing

businesses, including our apparel and building products businesses. In particular, Fruit of the Loom’s operating results significantly

improved primarily due to improved manufacturing efficiencies and cost management efforts. Increased earnings at IMC and

Forest River were primarily a result of the aforementioned revenue growth. Overall, our manufacturing businesses benefitted in

2010 from higher customer demand and the impact of their cost containment efforts over the past two years.

Nearly all of the businesses in our manufacturing group experienced the adverse effects of the global economic recession in

2009 as consumers and customers cut purchases. Revenues in 2009 were $15.9 billion, a decrease of $3.2 billion (17%) from

2008. Revenues were lower for apparel (11%), building products (20%) and other businesses (16%) as compared to 2008.

Pre-tax earnings of our other manufacturing businesses were $958 million in 2009, a decrease of $922 million (49%) versus

2008. The declines in earnings reflected the lower revenues as well as relatively higher costs resulting from lower

manufacturing efficiencies.

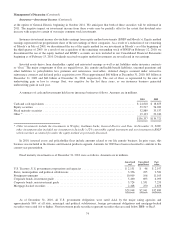

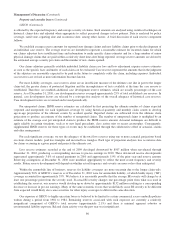

Other service

Our other service businesses include NetJets, the world’s leading provider of fractional ownership programs for general

aviation aircraft, and FlightSafety, a provider of high technology training to operators of aircraft. Among the other businesses

78