Berkshire Hathaway 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Financial Condition (Continued)

were. As such, although the Reform Act may affect some of our business activities, it is not expected to have a material impact

on our consolidated financial results or financial condition.

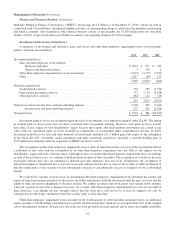

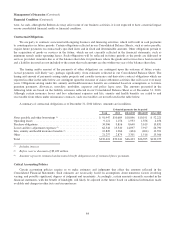

Contractual Obligations

We are party to contracts associated with ongoing business and financing activities, which will result in cash payments

to counterparties in future periods. Certain obligations reflected in our Consolidated Balance Sheets, such as notes payable,

require future payments on contractually specified dates and in fixed and determinable amounts. Other obligations pertain to

the acquisition of goods or services in the future, which are not currently reflected in the financial statements, such as

minimum rentals under operating leases. Such obligations will be reflected in future periods as the goods are delivered or

services provided. Amounts due as of the balance sheet date for purchases where the goods and services have been received

and a liability incurred are not included to the extent that such amounts are due within one year of the balance sheet date.

The timing and/or amount of the payments of other obligations are contingent upon the outcome of future events.

Actual payments will likely vary, perhaps significantly, from estimates reflected in our Consolidated Balance Sheet. The

timing and amount of payments arising under property and casualty insurance and derivative contract obligations which are

reported in other in the table below are contingent upon the outcome of claim settlement activities that will occur over many

years. Obligations arising under life, annuity and health insurance benefits are estimated based on assumptions as to future

premium payments, allowances, mortality, morbidity, expenses and policy lapse rates. The amounts presented in the

following table are based on the liability estimates reflected in our Consolidated Balance Sheet as of December 31, 2010.

Although certain insurance losses and loss adjustment expenses and life, annuity and health benefits are ceded to and

recoverable from others under reinsurance contracts, such recoverables are not reflected in the table below.

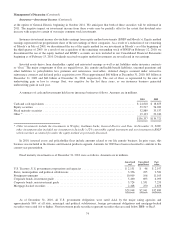

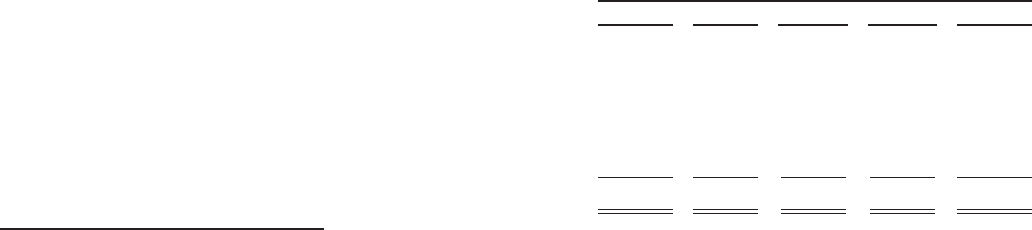

A summary of contractual obligations as of December 31, 2010 follows. Amounts are in millions.

Estimated payments due by period

Total 2011 2012-2013 2014-2015 After 2015

Notes payable and other borrowings (1) .......................... $ 91,947 $10,689 $18,846 $10,191 $ 52,221

Operating leases ............................................ 9,121 1,156 1,953 1,556 4,456

Purchase obligations ......................................... 34,906 9,816 8,640 5,619 10,831

Losses and loss adjustment expenses (2) .......................... 62,344 13,540 14,097 7,917 26,790

Life, annuity and health insurance benefits (3) ..................... 12,849 1,266 (404) (404) 12,391

Other ..................................................... 21,257 2,874 3,301 1,516 13,566

Total ..................................................... $232,424 $39,341 $46,433 $26,395 $120,255

(1) Includes interest.

(2) Before reserve discounts of $2,269 million.

(3) Amounts represent estimated undiscounted benefit obligations net of estimated future premiums.

Critical Accounting Policies

Certain accounting policies require us to make estimates and judgments that affect the amounts reflected in the

Consolidated Financial Statements. Such estimates are necessarily based on assumptions about numerous factors involving

varying, and possibly significant, degrees of judgment and uncertainty. Accordingly, certain amounts currently recorded in the

financial statements, with the benefit of hindsight, will likely be adjusted in the future based on additional information made

available and changes in other facts and circumstances.

84