Berkshire Hathaway 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(15) Income taxes (Continued)

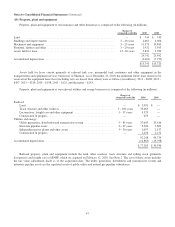

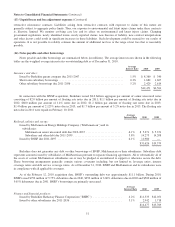

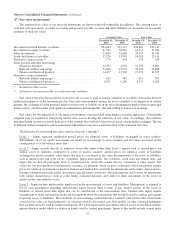

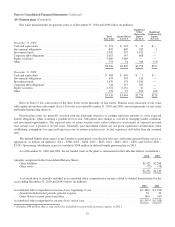

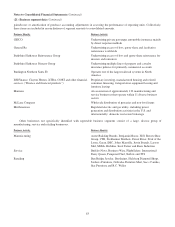

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax

liabilities at December 31, 2010 and 2009 are shown below (in millions).

2010 2009

Deferred tax liabilities:

Investments – unrealized appreciation and cost basis differences .................... $13,376 $11,880

Deferred charges reinsurance assumed ......................................... 1,334 1,385

Property, plant and equipment ............................................... 24,746 8,135

Other ................................................................... 5,108 4,236

44,564 25,636

Deferred tax assets:

Unpaid losses and loss adjustment expenses .................................... (1,052) (1,010)

Unearned premiums ....................................................... (508) (500)

Accrued liabilities ......................................................... (3,652) (1,643)

Derivative contract liabilities ................................................ (862) (875)

Other ................................................................... (2,932) (2,913)

(9,006) (6,941)

Net deferred tax liability ........................................................ $35,558 $18,695

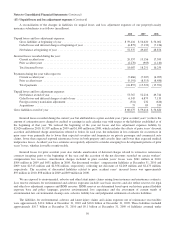

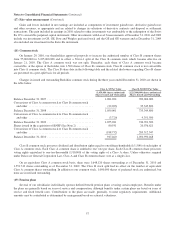

We have not established deferred income taxes with respect to undistributed earnings of certain foreign subsidiaries.

Earnings expected to remain reinvested indefinitely were approximately $4.1 billion as of December 31, 2010. Upon

distribution as dividends or otherwise, such amounts would be subject to taxation in the U.S. as well as foreign countries.

However, U.S. income tax liabilities could be offset, in whole or in part, by tax credits allowable from taxes paid to foreign

jurisdictions. Determination of the potential net tax due is impracticable due to the complexities of hypothetical calculations

involving uncertain timing and amounts of taxable income and the effects of multiple taxing jurisdictions.

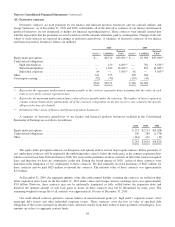

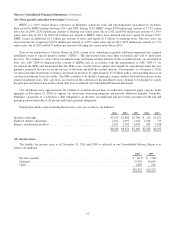

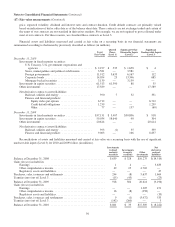

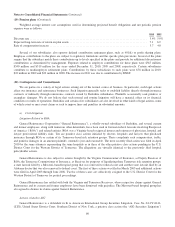

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions).

2010 2009 2008

Federal ............................................................... $4,546 $2,833 $ 915

State ................................................................. 337 124 249

Foreign .............................................................. 724 581 814

$5,607 $3,538 $ 1,978

Current .............................................................. $3,668 $1,619 $ 3,811

Deferred ............................................................. 1,939 1,919 (1,833)

$5,607 $3,538 $ 1,978

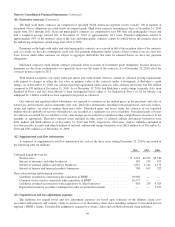

Charges for income taxes are reconciled to hypothetical amounts computed at the U.S. federal statutory rate in the table

shown below (in millions).

2010 2009 2008

Earnings before income taxes ...................................................... $19,051 $11,552 $7,574

Hypothetical amounts applicable to above computed at the federal statutory rate .............. $ 6,668 $ 4,043 $2,651

Tax-exempt interest income ........................................................ (27) (33) (88)

Dividends received deduction ...................................................... (477) (479) (415)

State income taxes, less federal income tax benefit ...................................... 219 81 162

Foreign tax rate differences ........................................................ (154) (92) (59)

BNSF holding gain ............................................................... (342) — —

Non-taxable exchange of investment ................................................. — — (154)

Other differences, net ............................................................. (280) 18 (119)

$ 5,607 $ 3,538 $1,978

53