Berkshire Hathaway 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

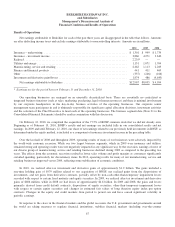

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

General Re (Continued)

Corporation and internationally through Germany-based General Reinsurance AG (formerly named Cologne Re) and other

wholly-owned affiliates. Property and casualty reinsurance is also written through brokers with respect to Faraday in London.

Life and health reinsurance is written in North America through General Re Life Corporation and internationally through

General Reinsurance AG. General Re strives to generate underwriting profits in essentially all of its product lines, without

consideration of investment income. Our management does not evaluate underwriting performance based upon market share and

our underwriters are instructed to reject inadequately priced risks. General Re’s underwriting results are summarized in the

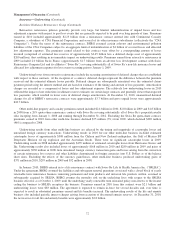

following table. Amounts are in millions.

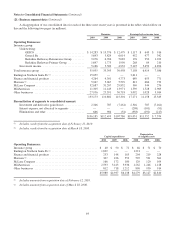

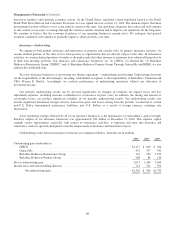

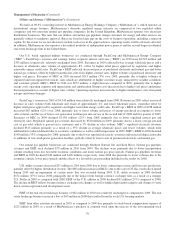

Premiums written Premiums earned Pre-tax underwriting gain

2010 2009 2008 2010 2009 2008 2010 2009 2008

Property/casualty ................. $2,923 $3,091 $3,383 $2,979 $3,203 $3,434 $289 $300 $163

Life/health ...................... 2,709 2,630 2,588 2,714 2,626 2,580 163 177 179

$5,632 $5,721 $5,971 $5,693 $5,829 $6,014 $452 $477 $342

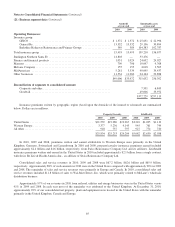

Property/casualty

Premiums written in 2010 declined $168 million (5.4%) from 2009, while premiums earned in 2010 declined $224 million

(7.0%) from 2009. Excluding the effects of foreign currency exchange rate changes, premiums written and earned in 2010

declined $202 million (6.5%) and $169 million (5.3%), respectively, compared with 2009. Premiums written and earned in 2010

reflected decreased volume as price competition in most property and casualty lines has led to decreases in premium volume

over the past several years. Our underwriters continue to maintain discipline by rejecting inadequately priced offerings.

Increased price competition and capacity within the industry could continue to constrain premium volume during 2011.

Underwriting gains were $289 million in 2010 and consisted of gains of $236 million from property business and

$53 million from casualty/workers’ compensation business. The property business produced underwriting losses of $96 million

for the 2010 accident year, offset by gains of $332 million from loss reserve reductions related to loss events occurring before

2010. The property results in 2010 were net of $339 million of catastrophe losses incurred primarily from the Chilean and New

Zealand earthquakes and weather-related losses in Europe, Australia and New England. The timing and magnitude of

catastrophe and large individual losses produces significant volatility in periodic underwriting results. The underwriting gains of

$53 million from casualty/workers’ compensation business reflected overall reductions in prior years’ loss reserve estimates

offset in part by $125 million of workers’ compensation loss reserve discount accretion and deferred charge amortization.

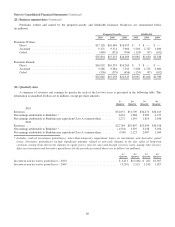

Premiums written and earned in 2009 declined $292 million (8.6%) and $231 million (6.7%), respectively, from 2008.

Premiums in 2008 included $205 million with respect to a reinsurance-to-close transaction that increased our economic interest

in the run-off of Lloyd’s Syndicate 435’s 2000 year of account from 39% to 100%. Under the reinsurance-to-close transaction,

we also assumed a corresponding amount of net loss reserves and as a result, there was no impact on net underwriting gains in

2008. There was no similar transaction in 2009. Excluding the reinsurance-to-close transaction and the effects of foreign

currency exchange rate changes, premiums written and earned in 2009 increased $149 million (4.7%) and $107 million (3.3%),

respectively, compared to 2008, primarily due to increased volume in European treaty and Lloyd’s market property business.

Underwriting results in 2009 included underwriting gains of $478 million from property business and losses of

$178 million from casualty/workers’ compensation business. The property business produced underwriting gains of

$173 million for the 2009 accident year, and $305 million from loss reserve reductions related to loss events occurring

before 2009. The property gains in 2009 were net of $48 million of losses from catastrophes, which were primarily from

winter storm Klaus in Europe, the Victoria bushfires in Australia and an earthquake in Italy. The underwriting losses from

casualty/workers’ compensation business were primarily the result of establishing higher loss reserves for 2009 accident

year occurrences to reflect higher loss trends as well as $118 million of workers’ compensation loss reserve discount

accretion and deferred charge amortization, offset in part by reserve reductions related to prior years’ casualty/workers’

compensation loss reserves.

Underwriting results in 2008 included $275 million in underwriting gains from property business partially offset by

$112 million in underwriting losses from casualty/workers’ compensation business. The property business produced

70