Berkshire Hathaway 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

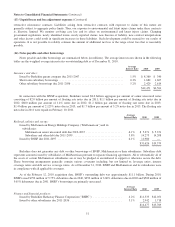

Notes to Consolidated Financial Statements (Continued)

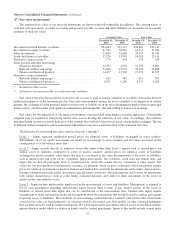

(7) Receivables (Continued)

As a part of the evaluation process, credit quality indicators are reviewed and loans are designated as performing or

non-performing. At December 31, 2010, approximately 98% of consumer installment and commercial loan balances were

determined to be performing and approximately 93% of those balances were current as to payment status.

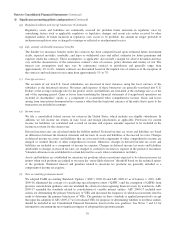

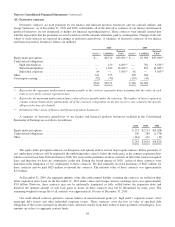

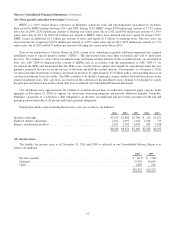

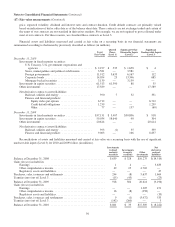

(8) Inventories

Inventories are comprised of the following (in millions).

2010 2009

Raw materials ............................................................................ $1,066 $ 908

Work in process and other ................................................................... 509 438

Finished manufactured goods ................................................................ 2,180 1,975

Goods acquired for resale ................................................................... 3,346 2,826

$7,101 $6,147

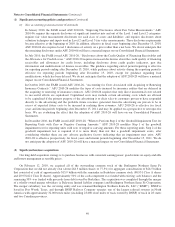

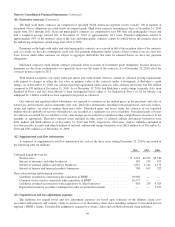

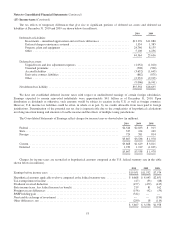

(9) Goodwill and other intangible assets

A reconciliation of the change in the carrying value of goodwill is as follows (in millions).

2010 2009

Balance at beginning of year ............................................................... $33,972 $33,781

Acquisition of BNSF ..................................................................... 14,803 —

Other ................................................................................. 231 191

Balance at end of year .................................................................... $49,006 $33,972

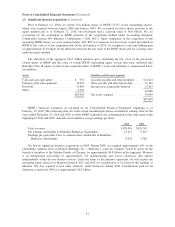

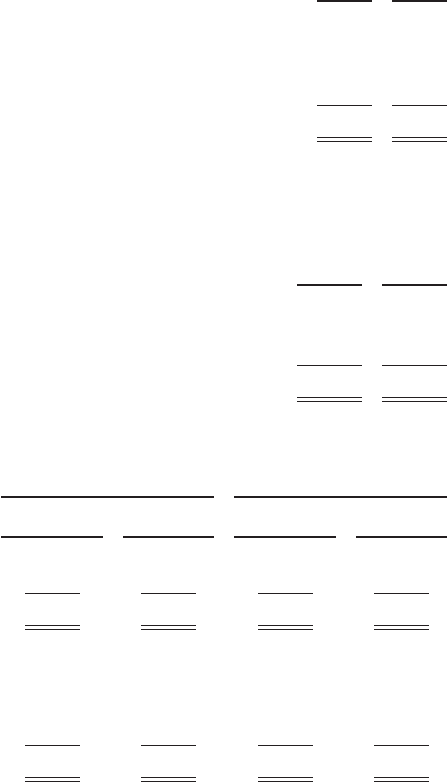

Intangible assets other than goodwill are included in other assets and are summarized as follows (in millions).

2010 2009

Gross carrying

amount

Accumulated

amortization

Gross carrying

amount

Accumulated

amortization

Insurance and other ........................................ $6,944 $1,816 $6,334 $1,632

Railroad, utilities and energy ................................. 2,082 306 76 24

$9,026 $2,122 $6,410 $1,656

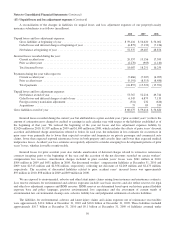

Trademarks and tradenames ................................. $2,027 $ 166 $2,013 $ 114

Patents and technology ...................................... 2,922 1,013 1,656 808

Customer relationships ...................................... 2,676 612 2,080 426

Other .................................................... 1,401 331 661 308

$9,026 $2,122 $6,410 $1,656

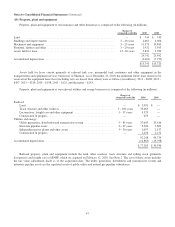

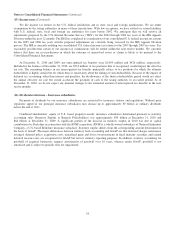

Intangible assets with definite lives are amortized based on the estimated pattern in which the economic benefits are

expected to be consumed or on a straight-line basis over their estimated economic lives. Amortization expense was

$692 million in 2010, $414 million in 2009 and $362 million in 2008. Estimated amortization expense over the next five

years is as follows (in millions): 2011 – $720; 2012 – $700; 2013 – $681; 2014 – $632; and 2015 – $345. Intangible assets

with indefinite lives as of December 31, 2010 and 2009 were $1,635 million and $1,127 million, respectively. Intangible

assets are reviewed for impairment when events or changes in circumstances indicate that the carrying amount may not be

recoverable.

46