Berkshire Hathaway 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Investment and Derivative Gains/Losses (Continued)

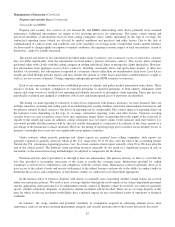

Although we expect that these businesses will continue to remain profitable and that the market prices for these securities will

eventually exceed our original cost, we could not establish sufficient objective evidence as to the timing or amount of the future

recovery in market prices. We also recorded other-than-temporary impairment losses of about $1.0 billion on certain debt

instruments where, after evaluation, we concluded that we would likely not receive all contractual cash flows when due.

Other-than-temporary impairment losses in 2009 predominantly relate to a loss with respect to our investment in

ConocoPhillips common stock. The market price of ConocoPhillips shares declined sharply over the last half of 2008. In 2009,

we sold over half of the ConocoPhillips position we held at the end of 2008. Sales in 2009 were in anticipation of other

investment opportunities, to increase overall liquidity and to realize capital losses that were carried back to prior years for

income tax purposes. We continue to hold over 29 million shares of ConocoPhillips and its market price as of December 31,

2010 was about 75% over its market price at the time we recorded the aforementioned other-than-temporary impairment loss.

None of the subsequent recovery in the market price of ConocoPhillips currently held is reflected in our net earnings but it is

reflected in accumulated other comprehensive income.

Other-than-temporary impairment losses recorded in 2008 were primarily related to investments in twelve equity securities.

The unrealized losses in these securities generally ranged from 40% to 90% of cost. After reviewing these investments, we

concluded that there was considerable uncertainty in the business prospects of these companies and thus uncertainty on the

recoverability of the cost of the security.

Derivative gains/losses primarily represent the changes in fair value of our credit default and equity index put option

contracts. Changes in the fair values of these contracts are reflected in earnings and can be significant, reflecting the volatility of

equity and credit markets. We have not actively traded into and out of credit default and equity index put option contracts.

Under many of the contracts, no settlements will occur until the contract expiration dates, many years from now. We reported

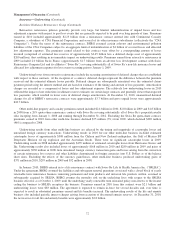

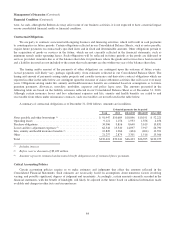

pre-tax gains on our credit default contracts of $250 million in 2010, $789 million in 2009 and pre-tax losses of $1.8 billion in

2008. These gains and losses reflect the changes in the fair values of these contracts. The fair values of our credit default

contracts are impacted by changes in credit default spreads, which have been volatile from period to period. The gains in 2010

reflected the overall narrowing of credit default spreads for corporate issuers and were somewhat offset by losses due to the

widening of spreads for municipalities, particularly in the fourth quarter. There were no credit loss events on our contracts in

2010. The gains and losses from our credit default contracts in 2009 and 2008 derived primarily from changes in the fair value

of our liabilities due to a significant widening of credit default spreads of corporate issuers in 2008 and the narrowing of spreads

for corporate issuers in 2009. There were several credit loss events in the second half of 2008 and the beginning of 2009,

primarily related to contracts involving non-investment grade (or high-yield) corporate issuers and during 2009 we paid losses

of about $1.9 billion.

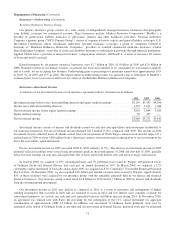

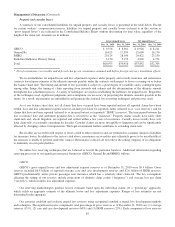

In 2010 and 2009, gains on equity index put option contracts were $172 million and $2.7 billion, respectively compared to

losses of $5.0 billion in 2008. In the fourth quarter of 2010, we settled certain equity index put option contracts early at the

request of the counterparty. The net gain in 2010 arising from these settled contracts was $561 million, which is represented by

the difference between the recorded fair values of the contracts at December 31, 2009 and the settlement payment amounts.

Otherwise, we recognized pre-tax losses of $389 million under our remaining equity index put option contracts reflecting

generally lower interest rate assumptions and the effect of foreign currency exchange rate changes. The derivative contract gains

in 2009 reflected increases in the underlying equity indexes ranging from approximately 19% to 23%, partially offset by the

impact of a weaker U.S. Dollar on non-U.S. contracts and lower interest rates. These factors combined to produce a decrease in

our estimated liabilities. The losses in 2008 reflected declines of between 30% and 45% in underlying equity indexes. Our

ultimate payment obligations, if any, under our remaining equity index put option contracts will be determined as of the contract

expiration dates, which begin in 2018. Except for the early settlements referred to previously, there have been no other cash

settlements related to these contracts.

Financial Condition

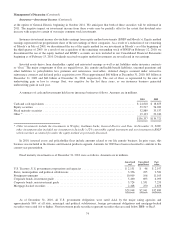

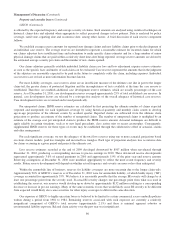

Our balance sheet continues to reflect significant liquidity and a strong capital base. Our consolidated shareholders’ equity

at December 31, 2010 was $157.3 billion, an increase of $26.2 billion from December 31, 2009. The increase in our

shareholders’ equity included approximately $10.6 billion related to the issuance of Berkshire common stock in connection with

the BNSF acquisition.

82