Berkshire Hathaway 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

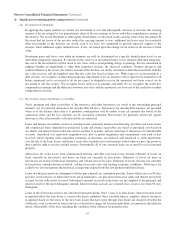

(1) Significant accounting policies and practices (Continued)

(f) Derivatives

We carry derivative contracts at estimated fair value in the accompanying Consolidated Balance Sheets. Such

balances reflect reductions permitted under master netting agreements with counterparties. The changes in fair value

of derivative contracts that do not qualify as hedging instruments for financial reporting purposes are recorded in

earnings as derivative gains/losses.

Cash collateral received from or paid to counterparties to secure derivative contract assets or liabilities is included in

other liabilities or assets. Securities received from counterparties as collateral are not recorded as assets and securities

delivered to counterparties as collateral continue to be reflected as assets in our Consolidated Balance Sheets.

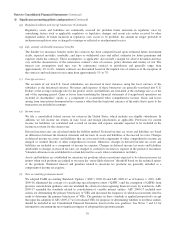

(g) Fair value measurements

As defined under GAAP, fair value is the price that would be received to sell an asset or paid to transfer a liability

between market participants in the principal market or in the most advantageous market when no principal market

exists. Adjustments to transaction prices or quoted market prices may be required in illiquid or disorderly markets in

order to estimate fair value. Different valuation techniques may be appropriate under the circumstances to determine

the value that would be received to sell an asset or paid to transfer a liability in an orderly transaction. Market

participants are assumed to be independent, knowledgeable, able and willing to transact an exchange and not under

duress. Nonperformance or credit risk is considered in determining the fair value of liabilities. Considerable judgment

may be required in interpreting market data used to develop the estimates of fair value. Accordingly, estimates of fair

value presented herein are not necessarily indicative of the amounts that could be realized in a current or future market

exchange.

(h) Inventories

Inventories consist of manufactured goods and goods acquired for resale. Manufactured inventory costs include raw

materials, direct and indirect labor and factory overhead. Inventories are stated at the lower of cost or market. As of

December 31, 2010, approximately 39% of the total inventory cost was determined using the last-in-first-out

(“LIFO”) method, 32% using the first-in-first-out (“FIFO”) method, with the remainder using the specific

identification method or average cost methods. With respect to inventories carried at LIFO cost, the aggregate

difference in value between LIFO cost and cost determined under FIFO methods was $637 million and $575 million

as of December 31, 2010 and 2009, respectively.

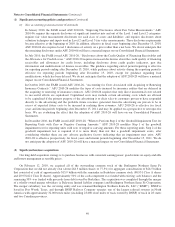

(i) Property, plant and equipment

Additions to property, plant and equipment are recorded at cost. The cost of major additions and betterments are

capitalized, while the cost of replacements, maintenance and repairs, that do not improve or extend the useful lives of

the related assets are expensed as incurred. Interest over the construction period is capitalized as a component of cost

of constructed assets. The cost of constructed assets of certain of our regulated utility and energy subsidiaries that are

subject to ASC 980 Regulated Operations also includes an equity allowance for funds used during construction. Also

see Note 1(p).

Depreciation is provided principally on the straight-line method over estimated useful lives. Depreciation of assets of

regulated utility and energy subsidiaries is provided over recovery periods based on composite asset class lives.

Railroad properties are depreciated using the group method in which a single depreciation rate is applied to the gross

investment in a particular class of property, despite differences in the service life or salvage value of individual

property units within the same class.

We evaluate property, plant and equipment for impairment when events or changes in circumstances indicate that the

carrying value of such assets may not be recoverable or the assets are being held for sale. Upon the occurrence of a

triggering event, we review the asset to assess whether the estimated undiscounted cash flows expected from the use

of the asset plus residual value from the ultimate disposal exceeds the carrying value of the asset. If the carrying value

exceeds the estimated recoverable amounts, we write down the asset to the estimated fair value. Impairment losses are

reflected in the Consolidated Statements of Earnings, except with respect to impairments of assets of certain domestic

regulated utility and energy subsidiaries where impairment losses are offset by the establishment of a regulatory asset

to the extent recovery in future rates is probable.

36