Berkshire Hathaway 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

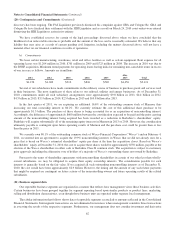

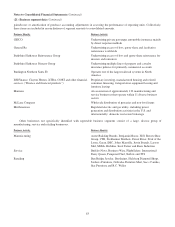

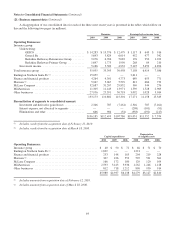

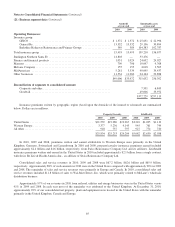

Notes to Consolidated Financial Statements (Continued)

(19) Pension plans (Continued)

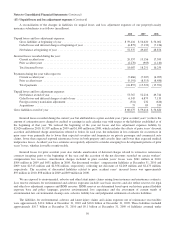

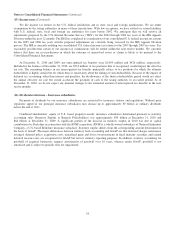

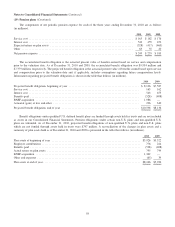

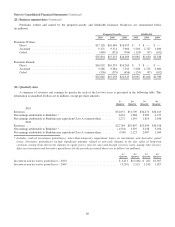

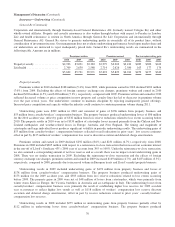

Weighted average interest rate assumptions used in determining projected benefit obligations and net periodic pension

expense were as follows.

2010 2009

Discount rate .................................................................................. 5.4% 5.9%

Expected long-term rate of return on plan assets ...................................................... 7.1 6.9

Rate of compensation increase .................................................................... 3.7 4.0

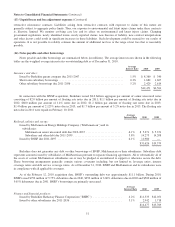

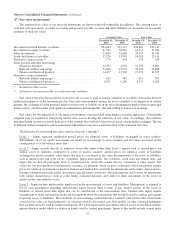

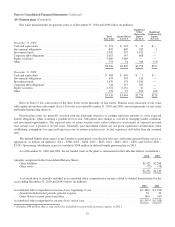

Several of our subsidiaries also sponsor defined contribution retirement plans, such as 401(k) or profit sharing plans.

Employee contributions to the plans are subject to regulatory limitations and the specific plan provisions. Several of the plans

require that the subsidiary match these contributions up to levels specified in the plans and provide for additional discretionary

contributions as determined by management. Expenses related to employer contributions for these plans were $567 million,

$540 million and $519 million for the years ended December 31, 2010, 2009 and 2008, respectively. Certain subsidiaries

contribute to multiemployer retirement plans. Contributions by these subsidiaries to such plans were $78 million in 2010,

$22 million in 2009 and $23 million in 2008. The increase in 2010 was due to contributions by BNSF.

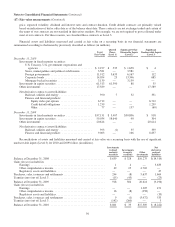

(20) Contingencies and Commitments

We are parties in a variety of legal actions arising out of the normal course of business. In particular, such legal actions

affect our insurance and reinsurance businesses. Such litigation generally seeks to establish liability directly through insurance

contracts or indirectly through reinsurance contracts issued by Berkshire subsidiaries. Plaintiffs occasionally seek punitive or

exemplary damages. We do not believe that such normal and routine litigation will have a material effect on its financial

condition or results of operations. Berkshire and certain of its subsidiaries are also involved in other kinds of legal actions, some

of which assert or may assert claims or seek to impose fines and penalties in substantial amounts.

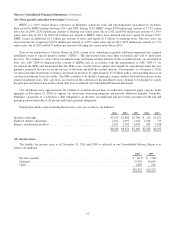

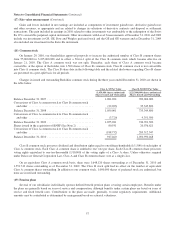

a) Civil Litigation

Litigation Related to ROA

General Reinsurance Corporation (“General Reinsurance”), a wholly-owned subsidiary of Berkshire, and several current

and former employees, along with numerous other defendants, have been sued in fourteen federal lawsuits involving Reciprocal

of America (“ROA”) and related entities. ROA was a Virginia-based reciprocal insurer and reinsurer of physician, hospital and

lawyer professional liability risks. Ten are putative class actions initiated by doctors, hospitals and lawyers that purchased

insurance through ROA or certain of its Tennessee-based risk retention groups. These complaints seek compensatory, treble,

and punitive damages in an amount plaintiffs contend is just and reasonable. The most recently filed action was filed in April

2010 by the same attorneys representing the same hospitals as in three of the other putative class actions pending in the U.S.

District Court for the Western District of Tennessee. The allegations are virtually identical to the previously filed hospital

policyholder actions.

General Reinsurance is also subject to actions brought by the Virginia Commissioner of Insurance, as Deputy Receiver of

ROA, the Tennessee Commissioner of Insurance, as Receiver for purposes of liquidating three Tennessee risk retention groups,

a state lawsuit filed by a Missouri-based hospital group that was removed to federal court and another state lawsuit filed by an

Alabama doctor that was also removed to federal court. The first of these actions was filed in March 2003 and additional actions

were filed in April 2003 through June 2006. Twelve of these cases are collectively assigned to the U.S. District Court for the

Western District of Tennessee for pretrial proceedings.

General Reinsurance has settled with both the Virginia and Tennessee Receivers, whose respective claims against General

Reinsurance and its current and former employees have been dismissed with prejudice. The Missouri-based hospital group has

also agreed to dismiss its claims against General Reinsurance.

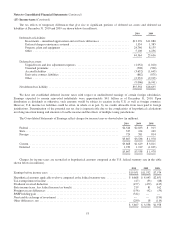

Actions related to AIG

General Reinsurance is a defendant in In re American International Group Securities Litigation, Case No. 04-CV-8141-

(LTS), United States District Court, Southern District of New York, a putative class action (the “AIG Securities Litigation”)

60