Berkshire Hathaway 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Finance and Financial Products

This, our smallest sector, includes two rental companies, XTRA (trailers) and CORT (furniture), and

Clayton Homes, the country’s leading producer and financer of manufactured homes.

Both of our leasing businesses improved their performances last year, albeit from a very low base.

XTRA increased the utilization of its equipment from 63% in 2009 to 75% in 2010, thereby raising pre-tax

earnings to $35 million from $17 million in 2009. CORT experienced a pickup in business as the year progressed

and also significantly tightened its operations. The combination increased its pre-tax results from a loss of

$3 million in 2009 to $18 million of profit in 2010.

At Clayton, we produced 23,343 homes, 47% of the industry’s total of 50,046. Contrast this to the peak

year of 1998, when 372,843 homes were manufactured. (We then had an industry share of 8%.) Sales would have

been terrible last year under any circumstances, but the financing problems I commented upon in the 2009 report

continue to exacerbate the distress. To explain: Home-financing policies of our government, expressed through

the loans found acceptable by FHA, Freddie Mac and Fannie Mae, favor site-built homes and work to negate the

price advantage that manufactured homes offer.

We finance more manufactured-home buyers than any other company. Our experience, therefore,

should be instructive to those parties preparing to overhaul our country’s home-loan practices. Let’s take a look.

Clayton owns 200,804 mortgages that it originated. (It also has some mortgage portfolios that it

purchased.) At the origination of these contracts, the average FICO score of our borrowers was 648, and 47%

were 640 or below. Your banker will tell you that people with such scores are generally regarded as questionable

credits.

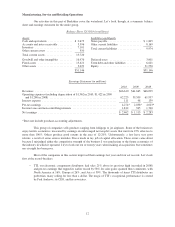

Nevertheless, our portfolio has performed well during conditions of stress. Here’s our loss experience

during the last five years for originated loans:

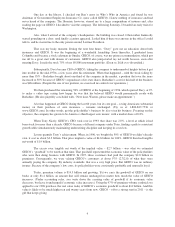

Year

Net Losses as a Percentage

of Average Loans

2006 .............................. 1.53%

2007 .............................. 1.27%

2008 .............................. 1.17%

2009 .............................. 1.86%

2010 .............................. 1.72%

Our borrowers get in trouble when they lose their jobs, have health problems, get divorced, etc. The

recession has hit them hard. But they want to stay in their homes, and generally they borrowed sensible amounts

in relation to their income. In addition, we were keeping the originated mortgages for our own account, which

means we were not securitizing or otherwise reselling them. If we were stupid in our lending, we were going to

pay the price. That concentrates the mind.

If home buyers throughout the country had behaved like our buyers, America would not have had the

crisis that it did. Our approach was simply to get a meaningful down-payment and gear fixed monthly payments

to a sensible percentage of income. This policy kept Clayton solvent and also kept buyers in their homes.

Home ownership makes sense for most Americans, particularly at today’s lower prices and bargain

interest rates. All things considered, the third best investment I ever made was the purchase of my home, though I

would have made far more money had I instead rented and used the purchase money to buy stocks. (The two best

investments were wedding rings.) For the $31,500 I paid for our house, my family and I gained 52 years of

terrific memories with more to come.

16