Berkshire Hathaway 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

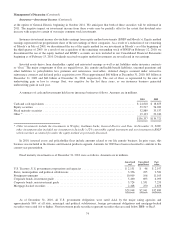

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

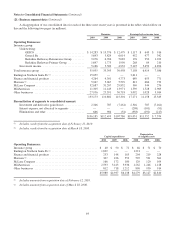

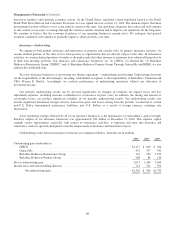

Retroactive reinsurance policies generally provide very large, but limited, indemnification of unpaid losses and loss

adjustment expenses with respect to past loss events that are generally expected to be paid over long periods of time. Premiums

earned in 2010 included approximately $2.25 billion from a reinsurance contract entered into with Continental Casualty

Company, a subsidiary of CNA Financial Corporation, and several of its other insurance subsidiaries (collectively the “CNA

Companies”). Under the terms of the reinsurance contract, BHRG assumed certain asbestos and environmental pollution

liabilities of the CNA Companies subject to an aggregate limit of indemnification of $4 billion of covered losses and allocated

loss adjustment expenses. The premiums earned related to this contract were offset by a corresponding amount of losses

incurred (comprised of estimated loss reserves of approximately $2.45 billion less a deferred charge asset of approximately

$200 million), thus resulting in no immediate impact on underwriting results. Premiums earned from retroactive reinsurance in

2009 included 2.0 billion Swiss Francs (approximately $1.7 billion) from an adverse loss development contract with Swiss

Reinsurance Company Ltd. and its affiliates (“Swiss Re”) covering substantially all of Swiss Re’s non-life insurance losses and

allocated loss adjustment expenses for loss events occurring prior to January 1, 2009.

Underwriting losses from retroactive reinsurance include the recurring amortization of deferred charges that are established

with respect to these contracts. At the inception of a contract, deferred charges represent the difference between the premium

received and the estimated ultimate losses payable. Deferred charges are subsequently amortized over the estimated claims

payment period using the interest method and are based on estimates of the timing and amount of loss payments. Amortization

charges are recorded as a component of losses and loss adjustment expenses. The relatively low underwriting losses in 2010

reflected the impact of net reductions in ultimate reserve estimates on certain large contracts and generally slower than expected

loss payments, which resulted in lower rates of deferred charge amortization. At December 31, 2010, unamortized deferred

charges for all of BHRG’s retroactive contracts were approximately $3.7 billion and gross unpaid losses were approximately

$18.7 billion.

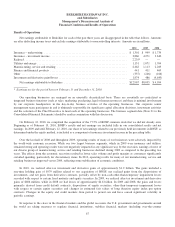

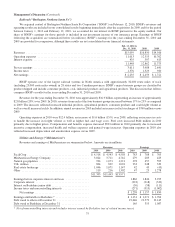

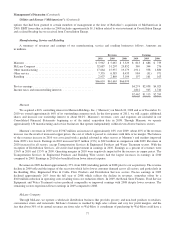

Other multi-line property and casualty premiums earned included $2.4 billion in 2010, $2.8 billion in 2009 and $1.8 billion

in 2008 from a 20% quota-share reinsurance contract with Swiss Re covering substantially all of Swiss Re’s property/casualty

risks incepting from January 1, 2008 and running through December 31, 2012. Excluding the Swiss Re quota-share contract,

premiums earned in 2010 from other multi-line business declined $75 million (7%) from 2009, which declined $969 million

(46%) compared to 2008.

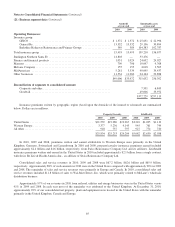

Underwriting results from other multi-line business are affected by the timing and magnitude of catastrophe losses and

unrealized foreign currency transactions. Underwriting results in 2010 for our other multi-line business included estimated

catastrophe losses of approximately $308 million from the Chilean and New Zealand earthquakes, the Gulf of Mexico BP

Deepwater Horizon oil rig explosion and the Australian floods. There were no significant catastrophe losses in 2009.

Underwriting results in 2008 included approximately $435 million of estimated catastrophe losses from Hurricanes Gustav and

Ike. Underwriting results also included losses of approximately $168 million in 2010 and $280 million in 2009 and gains of

approximately $930 million in 2008 from unrealized foreign currency transaction gains and losses arising from the conversion

of certain reinsurance loss reserves and other liabilities denominated in foreign currencies into U.S. Dollars as of the balance

sheet dates. Excluding the effects of the currency gains/losses, other multi-line business produced underwriting gains of

$371 million in 2010, $295 million in 2009 and $32 million in 2008.

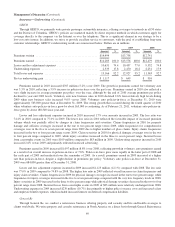

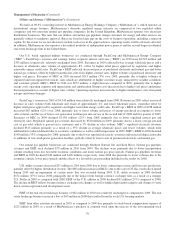

In January 2010, BHRG entered in to a life reinsurance contract with Swiss Re Life & Health America Inc. (“SRLHA”).

Under the agreement, BHRG assumed the liabilities and subsequent renewal premiums associated with a closed block of yearly

renewable term reinsurance business reinsuring permanent and term products and universal life products written, assumed or

subsequently acquired by SRLHA. BHRG assumes the mortality risk on the underlying lives with respect to the SRLHA

business effective as of October 1, 2009, until the underlying yearly renewable term reinsured policy non-renews or the insurer

ceding the business to SRLHA recaptures the business. Premiums earned in 2010 from this contract were $2.1 billion and

underwriting losses were $83 million. The agreement is expected to remain in-force for several decades and, over time, is

expected to result in substantial premiums earned and life benefits incurred. The underwriting results of the life and annuity

business also included periodic interest charges arising from accretion of discounted annuity reserves. At December 31, 2010,

the net reserves for all life and annuity benefits were approximately $2.8 billion.

72