Berkshire Hathaway 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

ERKSHIRE

H

ATHAWAY

INC.

2010

ANNUAL REPORT

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2010 ANNUAL REPORT -

Page 2

... firm. Berkshire's finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation and Clayton Homes) and transportation equipment and furniture leasing (XTRA and CORT). McLane Company... -

Page 3

...Report of Independent Registered Public Accounting Firm ...Consolidated Financial Statements ...Management's Discussion ...Owner's Manual ...2 3 27 28 28 29 30 67 97 Common Stock Data ...103 Biennial Letter to Berkshire Managers ("All-Stars") ...104 Operating Companies ...106 Directors and Officers... -

Page 4

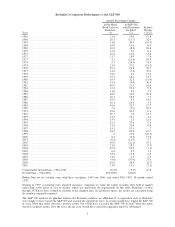

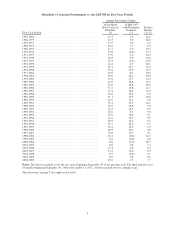

Berkshire's Corporate Performance vs. the S&P 500 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire Included (1) (2) 23.8 10.0 20.3 (11.7) 11.0 30.9 19.0 11.0 16.2 (8.4) 12.0 3.9 16.4 14.6 21.7 18.9 4.7 (14.8) 5.5 (26.4) 21.9 37.2 59.3 23.6 31.9 (7.4) 24.0 6.4 ... -

Page 5

...), book value has grown from $19 to $95,453, a rate of 20.2% compounded annually.* The highlight of 2010 was our acquisition of Burlington Northern Santa Fe, a purchase that's working out even better than I expected. It now appears that owning this railroad will increase Berkshire's "normal" earning... -

Page 6

... standards, managements are tempted to shoot the arrow of performance and then paint the bull's-eye around wherever it lands. In Berkshire's case, we long ago told you that our job is to increase per-share intrinsic value at a rate greater than the increase (including dividends) of the S&P 500. In... -

Page 7

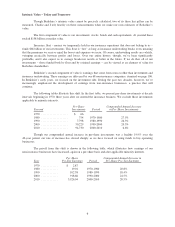

Berkshire's Corporate Performance vs. the S&P 500 by Five-Year Periods Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire...-2003 2000-2004 2001-2005 2002-2006 2003-2007 2004-2008 2005-2009 2006-2010 ... Relative Results (1)-(2) 12.2 10.8 4.7 9.3 15.7 17.4 10.7 15... -

Page 8

... when we make our own estimates of Berkshire's value. The first component of value is our investments: stocks, bonds and cash equivalents. At yearend these totaled $158 billion at market value. Insurance float - money we temporarily hold in our insurance operations that does not belong to us... -

Page 9

... annual gain in pre-tax, non-insurance earnings per share is 21.0%. During the same period, Berkshire's stock price increased at a rate of 22.1% annually. Over time, you can expect our stock price to move in rough tandem with Berkshire's investments and earnings. Market price and intrinsic value... -

Page 10

... the stake we needed to buy BNSF. Our final advantage is the hard-to-duplicate culture that permeates Berkshire. And in businesses, culture counts. To start with, the directors who represent you think and act like owners. They receive token compensation: no options, no restricted stock and, for that... -

Page 11

...customers had paid the company $2.8 billion in premiums. Consequently, we were valuing GEICO's customers at about 97% (2.7/2.8) of what they were annually paying the company. By industry standards, that was a very high price. But GEICO was no ordinary insurer: Because of the company's low costs, its... -

Page 12

... workers' compensation accidents, payments can stretch over decades. This collect-now, pay-later model leaves us holding large sums - money we call "float" - that will eventually go to others. Meanwhile, we get to invest this float for Berkshire's benefit. Though individual policies and claims... -

Page 13

... some terrific managers running some unusual businesses. We've already told you about GEICO, but we have two other very large operations, and a bevy of smaller ones as well, each a star in its own way First off is the Berkshire Hathaway Reinsurance Group, run by Ajit Jain. Ajit insures risks that... -

Page 14

...include purchase-accounting adjustments. This group of companies sells products ranging from lollipops to jet airplanes. Some of the businesses enjoy terrific economics, measured by earnings on unleveraged net tangible assets that run from 25% after-tax to more than 100%. Others produce good returns... -

Page 15

... record sales of nearly $2 billion and record earnings as well. Forest River has 82 plants, and I have yet to visit one (or the home office, for that matter). There's no need; Pete Liegl, the company's CEO, runs a terrific operation. Come view his products at the annual meeting. Better yet, buy one... -

Page 16

... not guaranteed by Berkshire. Our credit is not needed: Both businesses have earning power that, even under very adverse business conditions, amply covers their interest requirements. For example, in recessionary 2010 with BNSF's car loadings far off peak levels, the company's interest coverage was... -

Page 17

... spot was held by our other pipeline, Kern River. In its electric business, MidAmerican has a comparable record. Iowa rates have not increased since we purchased our operation there in 1999. During the same period, the other major electric utility in the state has raised prices more than 70% and now... -

Page 18

Finance and Financial Products This, our smallest sector, includes two rental companies, XTRA (trailers) and CORT (furniture), and Clayton Homes, the country's leading producer and financer of manufactured homes. Both of our leasing businesses improved their performances last year, albeit from a ... -

Page 19

...Total Common Stocks Carried at Market ... *This is our actual purchase price and also our tax basis; GAAP "cost" differs in a few cases because of write-ups or write-downs that have been required. In our reported earnings we reflect only the dividends our portfolio companies pay us. Our share of the... -

Page 20

... surprised to see our share of Coke's annual earnings exceed 100% of what we paid for the investment. Time is the friend of the wonderful business. Overall, I believe our "normal" investment income will at least equal what we realized in 2010, though the redemptions I described will cut our take in... -

Page 21

...get paid up-front when we enter into the contracts and therefore run no counterparty risk. That's important. Our first category of derivatives consists of a number of contracts, written in 2004-2008, that required payments by us if there were bond defaults by companies included in certain high-yield... -

Page 22

... that we will earn an underwriting profit as we originally anticipated. In addition, we have had the use of interest-free float that averaged about $2 billion over the life of the contracts. In short, we charged the right premium, and that protected us when business conditions turned terrible three... -

Page 23

...of our book value. Pay attention to the changes in that metric and to the course of our operating earnings, and you will be on the right track As a p.s., I can't resist pointing out just how capricious reported net income can be. Had our equity puts had a termination date of June 30, 2010, we would... -

Page 24

... of extra return. A little personal history may partially explain our extreme aversion to financial adventurism. I didn't meet Charlie until he was 35, though he grew up within 100 yards of where I have lived for 52 years and also attended the same inner-city public high school in Omaha from which... -

Page 25

23 -

Page 26

...who says money can't buy happiness simply hasn't learned where to shop. GEICO will have a booth staffed by a number of its top counselors from around the country, all of them ready to supply you with auto insurance quotes. In most cases, GEICO will be able to give you a shareholder discount (usually... -

Page 27

... if you had planned to rent a car in Omaha. At Nebraska Furniture Mart, located on a 77-acre site on 72nd Street between Dodge and Pacific, we will again be having "Berkshire Weekend" discount pricing. Last year the store did $33.3 million of business during its annual meeting sale, a volume that... -

Page 28

... requirements, files a 14,097page Federal income tax return along with state and foreign returns, responds to countless shareholder and media inquiries, gets out the annual report, prepares for the country's largest annual meeting, coordinates the Board's activities - and the list goes on and... -

Page 29

BERKSHIRE HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per-share data) 2010 Revenues: Insurance premiums earned (1) ...Sales and service revenues ...Revenues of railroad, utilities and energy businesses (2) ...Interest, dividend and other... -

Page 30

... about acquisitions that don't come close to meeting our tests: We've found that if you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales... -

Page 31

... FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. Omaha, Nebraska We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2010 and 2009, and the related consolidated statements of earnings... -

Page 32

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions) December 31, 2010 2009 ASSETS Insurance and Other: Cash and cash equivalents ...Investments: Fixed maturity securities ...Equity securities ...Other ...Receivables ...Inventories ...Property, plant and ... -

Page 33

..., annuity and health insurance benefits ...Insurance underwriting expenses ...Cost of sales and services ...Selling, general and administrative expenses ...Interest expense ...Railroad, Utilities and Energy: Cost of sales and operating expenses ...Interest expense ...Finance and Financial Products... -

Page 34

... cash equivalents at end of year are comprised of the following: Insurance and Other ...$ 34,767 $ 28,223 Railroad, Utilities and Energy ...2,557 429 Finance and Financial Products ...903 1,906 $ 38,227 See accompanying Notes to Consolidated Financial Statements 32 $ 30,558 $ 24,356 280 903 $ 25,539 -

Page 35

...CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (dollars in millions) 2010 2009 2008 Comprehensive income attributable to Berkshire Hathaway: Net earnings ...Other comprehensive income: Net change in unrealized appreciation of investments ...Applicable income taxes ...Reclassification of investment... -

Page 36

... and basis of consolidation Berkshire Hathaway Inc. ("Berkshire") is a holding company owning subsidiaries engaged in a number of diverse business activities, including property and casualty insurance and reinsurance, railroad, utilities and energy, finance, manufacturing, service and retailing. In... -

Page 37

... costs paid or fees received, which together with acquisition premiums or discounts, are deferred and amortized as yield adjustments over the life of the loan. Loans and finance receivables include loan securitizations issued when we have the power to direct and the right to receive residual returns... -

Page 38

... in the accompanying Consolidated Balance Sheets. Such balances reflect reductions permitted under master netting agreements with counterparties. The changes in fair value of derivative contracts that do not qualify as hedging instruments for financial reporting purposes are recorded in earnings as... -

Page 39

... where reports from ceding companies for the period are not contractually due until after the balance sheet date. For contracts containing experience rating provisions, premiums are based upon estimated loss experience under the contract. Sales revenues derive from the sales of manufactured products... -

Page 40

Notes to Consolidated Financial Statements (Continued) (1) Significant accounting policies and practices (Continued) (k) Revenue recognition (Continued) Railroad transportation revenues are recognized based upon the proportion of service provided as of the balance sheet date. Customer incentives, ... -

Page 41

Notes to Consolidated Financial Statements (Continued) (1) Significant accounting policies and practices (Continued) (p) Regulated utilities and energy businesses (Continued) Regulatory assets and liabilities are continually assessed for probable future inclusion in regulatory rates by considering ... -

Page 42

... Our long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and able and honest management at sensible prices. On February 12, 2010, we acquired all of the outstanding common stock of the Burlington Northern Santa Fe Corporation that we did... -

Page 43

... consolidated earnings data for the years ended December 31, 2010 and 2009, as if the BNSF acquisition was consummated on the same terms at the beginning of 2010 and 2009. Amounts are in millions, except earnings per share. 2010 2009 Total revenues ...Net earnings attributable to Berkshire Hathaway... -

Page 44

... Losses Fair Value December 31, 2010 U.S. Treasury, U.S. government corporations and agencies ...States, municipalities and political subdivisions ...Foreign governments ...Corporate bonds ...Mortgage-backed securities ...Insurance and other ...Finance and financial products ... $ 2,151 3,356... -

Page 45

... (in millions). Cost Basis Unrealized Gains Unrealized Losses Fair Value December 31, 2010 American Express Company ...The Coca-Cola Company ...The Procter & Gamble Company ...Wells Fargo & Company ...Other ...Insurance and other ...Railroad, utilities and energy * ...Finance and financial products... -

Page 46

...to Consolidated Financial Statements (Continued) (5) Other investments Other investments include fixed maturity and equity securities of The Goldman Sachs Group, Inc. ("GS"), General Electric Company ("GE"), Wm. Wrigley Jr. Company ("Wrigley"), Swiss Reinsurance Company Ltd. ("Swiss Re") and The Dow... -

Page 47

...(530) 255 $1,173 * Includes a one-time holding gain of $979 million related to the BNSF acquisition. See note 2. Net investment gains/losses are reflected in the Consolidated Statements of Earnings as follows. Insurance and other ...Finance and financial products ...$4,044 14 $4,058 $358 $1,166 (40... -

Page 48

...Consolidated Financial Statements (Continued) (7) Receivables (Continued) As a part of the evaluation process, credit quality indicators are reviewed and loans are designated as performing or non-performing. At December 31, 2010, approximately 98% of consumer installment and commercial loan balances... -

Page 49

... lease rentals to be received on the equipment lease fleet (including rail cars leased from others) were as follows (in millions): 2011 - $608; 2012 - $457; 2013 - $310; 2014 - $198; 2015 - $125; and thereafter - $243. Property, plant and equipment of our railroad, utilities and energy businesses... -

Page 50

... the premiums received would exceed the amounts ultimately paid to counterparties. Changes in the fair values of such contracts are reported in earnings as derivative gains/losses. A summary of derivative contracts of our finance and financial products businesses follows (in millions). 2010 Assets... -

Page 51

...Interest of insurance and other businesses ...Interest of railroad, utilities and energy businesses ...Interest of finance and financial products businesses ...Non-cash investing and financing activities: Liabilities assumed in connection with acquisition of BNSF ...Common stock issued in connection... -

Page 52

Notes to Consolidated Financial Statements (Continued) (13) Unpaid losses and loss adjustment expenses (Continued) A reconciliation of the changes in liabilities for unpaid losses and loss adjustment expenses of our property/casualty insurance subsidiaries is as follows (in millions). 2010 2009 2008... -

Page 53

... of 3.60% debentures due in 2020 and $500 million of 5.05% debentures due in 2041. BNSF's borrowings are primarily unsecured. Average Interest Rate 2010 2009 Finance and financial products: Issued by Berkshire Hathaway Finance Corporation ("BHFC") ...Issued by other subsidiaries due 2011-2036... -

Page 54

... in our Consolidated Financial Statements. Our subsidiaries have approximately $6.2 billion of available unused lines of credit and commercial paper capacity in the aggregate at December 31, 2010, to support our short-term borrowing programs and provide additional liquidity. Generally, Berkshire... -

Page 55

... to above computed at the federal statutory rate ...Tax-exempt interest income ...Dividends received deduction ...State income taxes, less federal income tax benefit ...Foreign tax rate differences ...BNSF holding gain ...Non-taxable exchange of investment ...Other differences, net ... $19,051... -

Page 56

..., deferred policy acquisition costs, unrealized gains and losses on investments in fixed maturity securities and related deferred income taxes are recognized for GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses requires amortization... -

Page 57

......Other investments ...Loans and finance receivables ...Derivative contract assets (1) ...Notes payable and other borrowings: Insurance and other ...Railroad, utilities and energy ...Finance and financial products ...Derivative contract liabilities: Railroad, utilities and energy (2) ...Finance and... -

Page 58

... Consolidated Financial Statements (Continued) (17) Fair value measurements (Continued) price, expected volatility, dividend and interest rates and contract duration. Credit default contracts are primarily valued based on indications of bid or offer data as of the balance sheet date. These contracts... -

Page 59

... (1/10,000) of the voting rights of a Class A share. Unless otherwise required under Delaware General Corporation Law, Class A and Class B common shares vote as a single class. On an equivalent Class A common stock basis, there were 1,648,120 shares outstanding as of December 31, 2010 and 1,551,749... -

Page 60

Notes to Consolidated Financial Statements (Continued) (19) Pension plans (Continued) The components of net periodic pension expense for each of the three years ending December 31, 2010 are as follows (in millions). 2010 2009 2008 Service cost ...$ 165 $ 162 $ 176 Interest cost ...543 455 452 ... -

Page 61

... to Consolidated Financial Statements (Continued) (19) Pension plans (Continued) Fair value measurements for pension assets as of December 31, 2010 and 2009 follow (in millions). Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) Total Fair Value Quoted Prices... -

Page 62

... to Consolidated Financial Statements (Continued) (19) Pension plans (Continued) Weighted average interest rate assumptions used in determining projected benefit obligations and net periodic pension expense were as follows. 2010 2009 Discount rate ...Expected long-term rate of return on plan assets... -

Page 63

... who purchased publicly-traded securities of AIG between October 1999 and March 2005. The complaint, originally filed in April 2005, asserts various claims against AIG and certain of its officers, directors, investment banks and other parties, including former employees of General Reinsurance... -

Page 64

... or product lines, marketing, selling and distribution characteristics, even though those business units are operated under separate local management. The tabular information that follows shows data of reportable segments reconciled to amounts reflected in the Consolidated Financial Statements... -

Page 65

... GEICO General Re Berkshire Hathaway Reinsurance Group Berkshire Hathaway Primary Group Burlington Northern Santa Fe BH Finance, Clayton Homes, XTRA, CORT and other financial services ("Finance and financial products") Marmon Underwriting private passenger automobile insurance mainly by direct... -

Page 66

... Earnings before income taxes 2010 2009 2008 Operating Businesses: Insurance group: Underwriting: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Investment income ...Total insurance group ...Burlington Northern Santa Fe ...Finance and financial... -

Page 67

...year-end 2010 2009 Operating Businesses: Insurance group: GEICO ...General Re ...Berkshire Hathaway Reinsurance and Primary Groups ...Total insurance group ...Burlington Northern Santa Fe ...Finance and financial products ...Marmon ...McLane Company ...MidAmerican ...Other businesses ... $ 1,372 13... -

Page 68

... to Consolidated Financial Statements (Continued) (21) Business segment data (Continued) Premiums written and earned by the property/casualty and life/health insurance businesses are summarized below (in millions). 2010 Property/Casualty 2009 2008 2010 Life/Health 2009 2008 Premiums Written: Direct... -

Page 69

.... 2010 2009 2008 Insurance - underwriting ...Insurance - investment income ...Railroad ...Utilities and energy ...Manufacturing, service and retailing ...Finance and financial products ...Other ...Investment and derivative gains/losses ...Net earnings attributable to Berkshire ...* Earnings are... -

Page 70

... and (4) Berkshire Hathaway Primary Group. Through General Re and BHRG, we also reinsure life and health risks. We view insurance businesses as possessing two distinct operations - underwriting and investing. Underwriting decisions are the responsibility of the unit managers; investing, with limited... -

Page 71

... year. Premiums earned in 2010 also reflected a very slight increase in average premiums per policy over the year, although by the end of 2010 average premiums per policy declined to year-end 2009 levels. Voluntary auto new business sales in 2010 declined 2.6% from relatively high levels during 2009... -

Page 72

... to reject inadequately priced risks. General Re's underwriting results are summarized in the following table. Amounts are in millions. 2010 Premiums written 2009 2008 2010 Premiums earned 2009 2008 Pre-tax underwriting gain 2010 2009 2008 Property/casualty ...Life/health ... $2,923 2,709 $5,632... -

Page 73

...multi-line business refers to other property and casualty business written on both a quota-share and excess basis. Beginning in 2010, BHRG's underwriting activities include life reinsurance as well as a life annuity business, which in previous years was included in the finance and financial products... -

Page 74

... contract with Swiss Re Life & Health America Inc. ("SRLHA"). Under the agreement, BHRG assumed the liabilities and subsequent renewal premiums associated with a closed block of yearly renewable term reinsurance business reinsuring permanent and term products and universal life products written... -

Page 75

... earnings on cash and cash equivalents due to lower short-term interest rates and lower average cash balances. In October 2008, we acquired 11.45% subordinated notes and 5% preferred stock issued by Wrigley and preferred stocks of Goldman Sachs and General Electric that each pay an annual dividend... -

Page 76

... in our Consolidated Financial Statements beginning as of February 13, 2010. Dividends received on equity method investments are not reflected in our earnings. Invested assets derive from shareholder capital and reinvested earnings as well as net liabilities under insurance contracts or "float." The... -

Page 77

...investment income of our insurance group. Earnings of BNSF following the acquisition are summarized below (in millions). BNSF's earnings for the years ending December 31, 2010 and 2009 are provided for comparison, although these results are not consolidated in our financial statements. Feb. 13, 2010... -

Page 78

... renewable energy credit sales. PacifiCorp's EBIT reflected decreased prices of purchased electricity and natural gas and lower natural gas volumes, offset by higher transmission costs from higher contract rates, higher volumes of purchased electricity and higher coal prices. Revenues of MEC in 2010... -

Page 79

... grocery and non-food products to retailers, convenience stores and restaurants. McLane's business is marked by high sales volume and very low profit margins, and the fact that about 30% of its annual revenues are from sales to Wal-Mart. A curtailment of purchasing by Wal-Mart could have a 77 -

Page 80

... manufacturing businesses, including our apparel and building products businesses. In particular, Fruit of the Loom's operating results significantly improved primarily due to improved manufacturing efficiencies and cost management efforts. Increased earnings at IMC and Forest River were primarily... -

Page 81

...The Buffalo News, a publisher of a daily and Sunday newspaper; and businesses that provide management and other services to insurance companies. In 2010, revenues of our other service businesses were $7.4 billion, an increase of $770 million (12%) compared to 2009. Pre-tax earnings in 2010 were $984... -

Page 82

... low utilization rates for over-the-road trailer and storage units, and lower furniture rentals. Significant cost components of this business are fixed (depreciation and facility expenses), so earnings declined disproportionately to revenues. Other finance business earnings include investment income... -

Page 83

.... 2010 2009 2008 Investment gains/losses Sales and other disposals of investments Insurance and other ...Finance and financial products ...Other-than-temporary impairment losses on investments ...Other ...Derivative gains/losses Credit default contracts ...Equity index put option contracts ...Other... -

Page 84

... equity index put option contracts will be determined as of the contract expiration dates, which begin in 2018. Except for the early settlements referred to previously, there have been no other cash settlements related to these contracts. Financial Condition Our balance sheet continues to reflect... -

Page 85

...and $7.9 billion of cash on hand, plus Berkshire Class A and B common stock with an aggregate value of approximately $10.6 billion. Our railroad, utilities and energy businesses conducted by MidAmerican and BNSF maintain very large investments in property, plant and equipment and will regularly make... -

Page 86

...are not currently reflected in the financial statements, such as minimum rentals under operating leases. Such obligations will be reflected in future periods as the goods are delivered or services provided. Amounts due as of the balance sheet date for purchases where the goods and services have been... -

Page 87

...in the Consolidated Balance Sheets without discounting for time value, regardless of the length of the claim-tail. Amounts are in millions. Gross unpaid losses Dec. 31, 2010 Dec. 31, 2009 Net unpaid losses * Dec. 31, 2010 Dec. 31, 2009 GEICO ...General Re ...BHRG ...Berkshire Hathaway Primary Group... -

Page 88

... in loss patterns. Data is analyzed by policy coverage, rated state, reporting date and occurrence date, among other factors. A brief discussion of each reserve component follows. We establish average reserve amounts for reported auto damage claims and new liability claims prior to the development... -

Page 89

..., the timing of reporting large per occurrence excess property losses or property catastrophe losses may not vary significantly from primary insurance. Under contracts where periodic premium and claims reports are required from ceding companies, such reports are generally required at quarterly... -

Page 90

... and case reserves are often increased as a result. In 2010, we conducted 314 claim reviews. Our actuaries classify all loss and premium data into segments ("reserve cells") primarily based on product (e.g., treaty, facultative and program) and line of business (e.g., auto liability, property, etc... -

Page 91

...This comparison provides a test of the adequacy of prior year-end IBNR reserves and forms the basis for possibly changing IBNR reserve assumptions during the course of the year. In 2010, for prior years' workers' compensation losses, our reported claims were less than expected claims by $148 million... -

Page 92

... indemnified or contracts that indemnify all losses paid by the counterparty after the policy effective date. We paid retroactive reinsurance losses and loss adjustment expenses of approximately $1.8 billion in 2010. The classification "reported case reserves" has no practical analytical value with... -

Page 93

... option contracts using Level 3 measurements under GAAP. The fair values of our high yield credit default contracts are primarily based on indications of bid/ask pricing data. The bid/ ask data represents non-binding indications of prices for which similar contracts would be exchanged. Pricing data... -

Page 94

... index put option contracts based on the widely used Black-Scholes option valuation model. Inputs to the model include the current index value, strike price, discount rate, dividend rate and contract expiration date. The weighted average discount and dividend rates used as of December 31, 2010 were... -

Page 95

... to assets. We strive to maintain high credit ratings so that the cost of debt is minimized. We utilize derivative products, such as interest rate swaps, to manage interest rate risks on a limited basis. The fair values of our fixed maturity investments and notes payable and other borrowings will... -

Page 96

... Fair Value December 31, 2010 Investments in fixed maturity securities ...Other investments (1) ...Loans and finance receivables ...Notes payable and other borrowings: Insurance and other ...Railroad, utilities and energy ...Finance and financial products ...December 31, 2009 Investments in fixed... -

Page 97

... instruments, including forwards, futures, options, swaps and other agreements, to effectively secure future supply or sell future production generally at fixed prices. The settled cost of these contracts is generally recovered from customers in regulated rates. Accordingly, net unrealized gains and... -

Page 98

...," "plans," "believes," "estimates," or similar expressions. In addition, any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future Berkshire actions, which may be provided by management... -

Page 99

... goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and... -

Page 100

... stock market is likely to present us with significant advantages. For one thing, it tends to reduce the prices at which entire companies become available for purchase. Second, a depressed market makes it easier for our insurance companies to buy small pieces of wonderful businesses - including... -

Page 101

... swaps, stock options, and convertible securities as well. We will not sell small portions of your company - and that is what the issuance of shares amounts to - on a basis inconsistent with the value of the entire enterprise. When we sold the Class B shares in 1996, we stated that Berkshire stock... -

Page 102

... just as good product or business acquisition ideas are. Therefore we normally will not talk about our investment ideas. This ban extends even to securities we have sold (because we may purchase them again) and to stocks we are incorrectly rumored to be buying. If we deny those reports but say "no... -

Page 103

...go in either direction. For example, in 1964 we could state with certitude that Berkshire's per-share book value was $19.46. However, that figure considerably overstated the company's intrinsic value, since all of the company's resources were tied up in a sub-profitable textile business. Our textile... -

Page 104

... of dividends. It would be difficult to develop a peer group of companies similar to Berkshire. The Corporation owns subsidiaries engaged in a number of diverse business activities of which the most important is the property and casualty insurance business and, accordingly, management has... -

Page 105

... Berkshire's Class A and Class B common stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List during the periods indicated: 2010... -

Page 106

Memo To: cc: Berkshire Hathaway Managers ("The All-Stars") Berkshire Directors From: Warren E. Buffett Date: July 26, 2010 This is my biennial letter to reemphasize Berkshire's top priority and to get your help on succession planning (yours, not mine!). The priority is that all of us continue to ... -

Page 107

...how the culture of your business develops. Culture, more than rule books, determines how an organization behaves. In other respects, talk to me about what is going on as little or as much as you wish. Each of you does a first-class job of running your operation with your own individual style and you... -

Page 108

... Home Furnishings ...2,270 World Book (1) ...177 XTRA ...480 Non-insurance total ...230,154 Corporate Office ...21 260,519 (1) (2) (3) (4) A Scott Fetzer Company A MidAmerican Energy Holdings Company A Fruit of the Loom, Inc. Company Approximately 130 manufacturing and service businesses that... -

Page 109

... Allen and Company Incorporated, an investment banking firm. THOMAS S. MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC RONALD L. OLSON, Partner of the law firm of Munger, Tolles & Olson LLP WALTER SCOTT, JR., Chairman of Level 3 Communications, a successor to certain businesses of... -

Page 110

BERKSHIRE HATHAWAY INC. Executive Offices - 3555 Farnam Street, Omaha, Nebraska 68131