Berkshire Hathaway 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At my death, the Buffett family will not be involved in managing the business but, as very substantial shareholders, will help in

picking and overseeing the managers who do. Just who those managers will be, of course, depends on the date of my death. But I can

anticipate what the management structure will be: Essentially my job will be split into two parts. One executive will become CEO and

responsible for operations. The responsibility for investments will be given to one or more executives. If the acquisition of new

businesses is in prospect, these executives will cooperate in making the decisions needed, subject, of course, to board approval. We

will continue to have an extraordinarily shareholder-minded board, one whose interests are solidly aligned with yours.

Were we to need the management structure I have just described on an immediate basis, our directors know my recommendations

for both posts. All candidates currently work for or are available to Berkshire and are people in whom I have total confidence.

I will continue to keep the directors posted on the succession issue. Since Berkshire stock will make up virtually my entire estate

and will account for a similar portion of the assets of various foundations for a considerable period after my death, you can be sure that

the directors and I have thought through the succession question carefully and that we are well prepared. You can be equally sure that

the principles we have employed to date in running Berkshire will continue to guide the managers who succeed me and that our

unusually strong and well-defined culture will remain intact.

Lest we end on a morbid note, I also want to assure you that I have never felt better. I love running Berkshire, and if enjoying life

promotes longevity, Methuselah’s record is in jeopardy.

Warren E. Buffett

Chairman

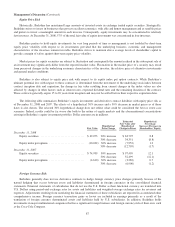

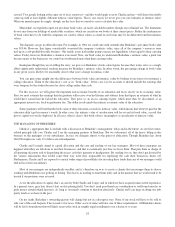

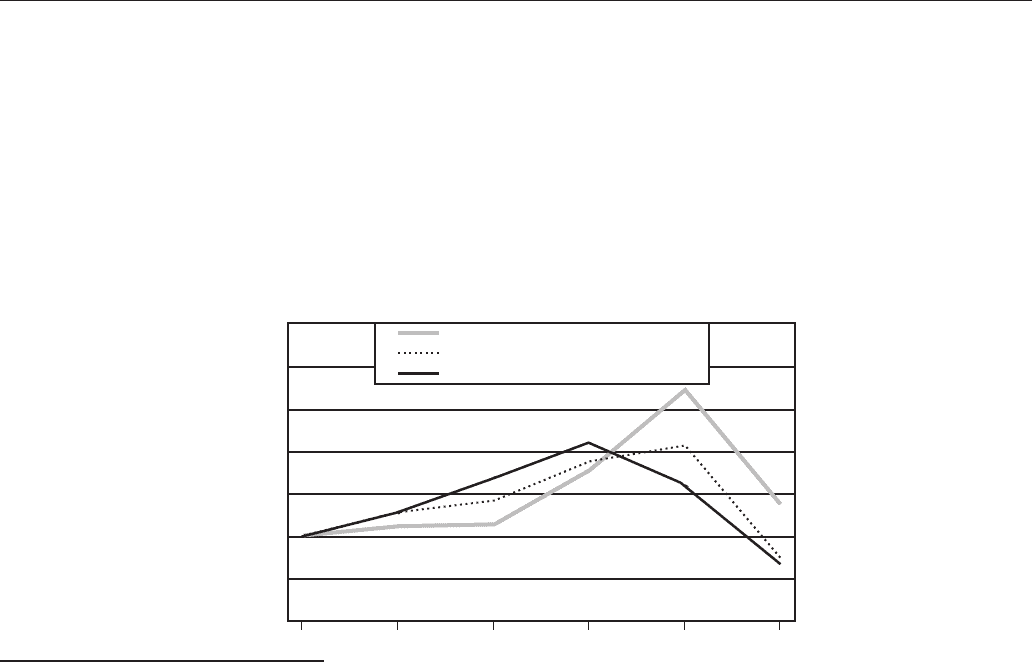

STOCK PERFORMANCE GRAPH

The following chart compares the subsequent value of $100 invested in Berkshire common stock on December 31, 2003 with a

similar investment in the Standard and Poor’s 500 Stock Index and in the Standard and Poor’s Property—Casualty Insurance

Index.**

Comparison of Five Year Cumulative Return*

DOLLARS

200820072006200520042003

60

80

100

120

140

160

180

100 104

110

111

105

116

127

135

143

131

142

168

90

87

H

E

E

E

E

E

B

B

B

B

B

B

S&P 500 Property & Casualty Insurance Index

S&P 500 Index

Berkshire Hathaway Inc.

H

E

B

115

123

H

H

H

H

H

E

* Cumulative return for the Standard and Poor’s indices based on reinvestment of dividends.

** It would be difficult to develop a peer group of companies similar to Berkshire. The Corporation owns subsidiaries engaged in

a number of diverse business activities of which the most important is the property and casualty insurance business and,

accordingly, management has used the Standard and Poor’s Property—Casualty Insurance Index for comparative purposes.

94