Berkshire Hathaway 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

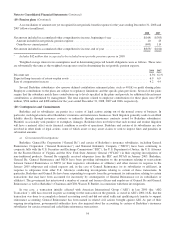

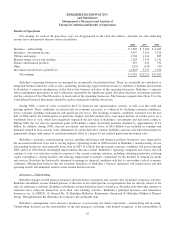

(19) Pension plans (Continued)

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation

prior to the valuation date. As of December 31, 2008 and 2007, the accumulated benefit obligation was $6,693 million and

$6,990 million, respectively. The projected benefit obligation is the actuarial present value of benefits earned based upon service

and compensation prior to the valuation date and, if applicable, includes assumptions regarding future compensation levels.

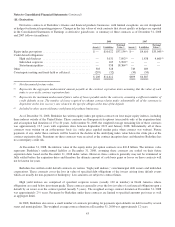

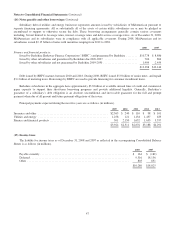

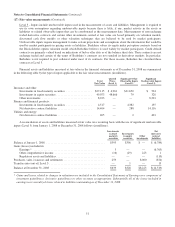

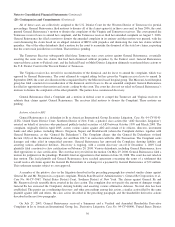

Information regarding the projected benefit obligations is shown in the table that follows (in millions).

2008 2007

Projected benefit obligation, beginning of year .................................................. $7,683 $7,926

Service cost .............................................................................. 176 202

Interest cost .............................................................................. 452 439

Benefits paid ............................................................................. (455) (476)

Business acquisitions ....................................................................... 249 —

Actuarial (gain) or loss and other ............................................................. (518) (408)

Projected benefit obligation, end of year ....................................................... $7,587 $7,683

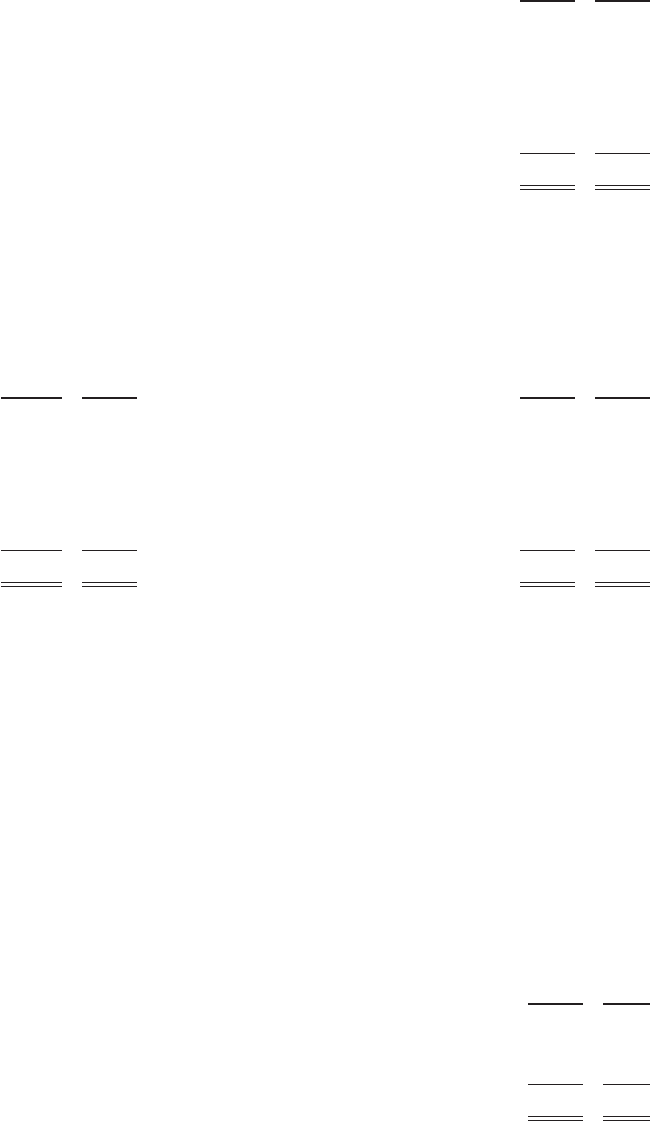

Benefit obligations under qualified U.S. defined benefit plans are funded through assets held in trusts and are not included

as assets in Berkshire’s Consolidated Financial Statements. Pension obligations under certain non-U.S. plans and non-qualified

U.S. plans are unfunded. As of December 31, 2008, projected benefit obligations of non-qualified U.S. plans and non-U.S. plans

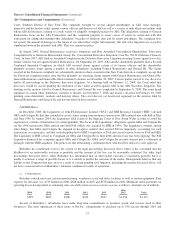

which are not funded through assets held in trusts were $604 million. A reconciliation of the changes in plan assets and a

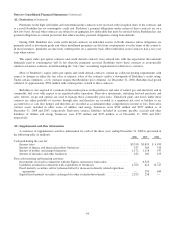

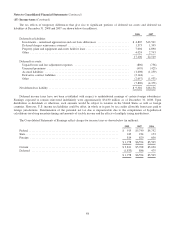

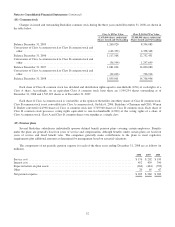

summary of plan assets held as of December 31, 2008 and 2007 is presented in the table that follows (in millions).

2008 2007 2008 2007

Plan assets at beginning of year .......... $7,063 $6,792 Cash and equivalents ................. $ 517 $ 427

Employer contributions ................. 279 262 U.S. Government obligations .......... 121 186

Benefits paid ......................... (455) (476) Mortgage-backed securities ............ 282 390

Actual return on plan assets .............. (1,244) 447 Corporate obligations ................ 942 1,005

Business acquisitions ................... 188 — Equity securities .................... 2,864 4,169

Other and expenses .................... (509) 38 Other ............................. 596 886

Plan assets at end of year ................ $5,322 $7,063 $5,322 $7,063

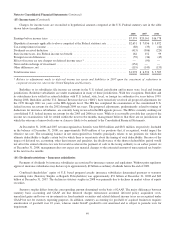

Pension plan assets are generally invested with the long-term objective of earning sufficient amounts to cover expected

benefit obligations, while assuming a prudent level of risk. There are no target investment allocation percentages with respect to

individual or categories of investments. Allocations may change as a result of changing market conditions and investment

opportunities. The expected rates of return on plan assets reflect Berkshire’s subjective assessment of expected invested asset

returns over a period of several years. Berkshire generally does not give significant consideration to past investment returns

when establishing assumptions for expected long-term rates of returns on plan assets. Actual experience will differ from the

assumed rates.

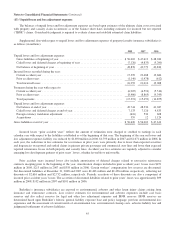

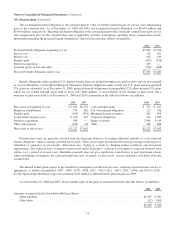

The defined benefit plans expect to pay benefits to participants over the next ten years, reflecting expected future service as

appropriate, as follows (in millions): 2009 – $405; 2010 – $398; 2011 – $413; 2012 – $431; 2013 – $446; and 2014 to 2018 -

$2,460. Sponsoring subsidiaries expect to contribute $245 million to defined benefit pension plans in 2009.

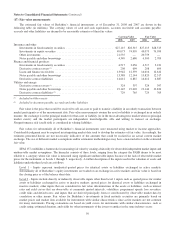

As of December 31, 2008 and 2007, the net funded status of the plans is summarized in the table that follows (in millions).

2008 2007

Amounts recognized in the Consolidated Balance Sheets:

Other liabilities ........................................................................ $2,357 $ 981

Other assets ........................................................................... (92) (361)

$2,265 $ 620

53