Berkshire Hathaway 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We endorse mark-to-market accounting. I will explain later, however, why I believe the Black-

Scholes formula, even though it is the standard for establishing the dollar liability for options,

produces strange results when the long-term variety are being valued.

One point about our contracts that is sometimes not understood: For us to lose the full $37.1 billion

we have at risk, all stocks in all four indices would have to go to zero on their various termination

dates. If, however – as an example – all indices fell 25% from their value at the inception of each

contract, and foreign-exchange rates remained as they are today, we would owe about $9 billion,

payable between 2019 and 2028. Between the inception of the contract and those dates, we would

have held the $4.9 billion premium and earned investment income on it.

• The second category we described in last year’s report concerns derivatives requiring us to pay

when credit losses occur at companies that are included in various high-yield indices. Our standard

contract covers a five-year period and involves 100 companies. We modestly expanded our position

last year in this category. But, of course, the contracts on the books at the end of 2007 moved one

year closer to their maturity. Overall, our contracts now have an average life of 2

1

⁄

3

years, with the

first expiration due to occur on September 20, 2009 and the last on December 20, 2013.

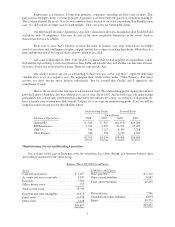

By yearend we had received premiums of $3.4 billion on these contracts and paid losses of $542

million. Using mark-to-market principles, we also set up a liability for future losses that at yearend

totaled $3.0 billion. Thus we had to that point recorded a loss of about $100 million, derived from

our $3.5 billion total in paid and estimated future losses minus the $3.4 billion of premiums we

received. In our quarterly reports, however, the amount of gain or loss has swung wildly from a

profit of $327 million in the second quarter of 2008 to a loss of $693 million in the fourth quarter of

2008.

Surprisingly, we made payments on these contracts of only $97 million last year, far below the

estimate I used when I decided to enter into them. This year, however, losses have accelerated

sharply with the mushrooming of large bankruptcies. In last year’s letter, I told you I expected these

contracts to show a profit at expiration. Now, with the recession deepening at a rapid rate, the

possibility of an eventual loss has increased. Whatever the result, I will keep you posted.

• In 2008 we began to write “credit default swaps” on individual companies. This is simply credit

insurance, similar to what we write in BHAC, except that here we bear the credit risk of

corporations rather than of tax-exempt issuers.

If, say, the XYZ company goes bankrupt, and we have written a $100 million contract, we are

obligated to pay an amount that reflects the shrinkage in value of a comparable amount of XYZ’s

debt. (If, for example, the company’s bonds are selling for 30 after default, we would owe $70

million.) For the typical contract, we receive quarterly payments for five years, after which our

insurance expires.

At yearend we had written $4 billion of contracts covering 42 corporations, for which we receive

annual premiums of $93 million. This is the only derivatives business we write that has any

counterparty risk; the party that buys the contract from us must be good for the quarterly premiums

it will owe us over the five years. We are unlikely to expand this business to any extent because

most buyers of this protection now insist that the seller post collateral, and we will not enter into

such an arrangement.

• At the request of our customers, we write a few tax-exempt bond insurance contracts that are

similar to those written at BHAC, but that are structured as derivatives. The only meaningful

difference between the two contracts is that mark-to-market accounting is required for derivatives

whereas standard accrual accounting is required at BHAC.

19