Berkshire Hathaway 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

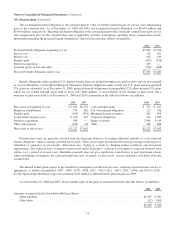

Notes to Consolidated Financial Statements (Continued)

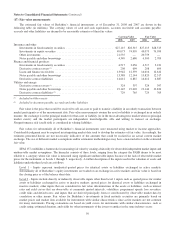

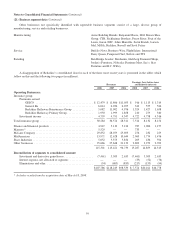

(21) Business segment data (Continued)

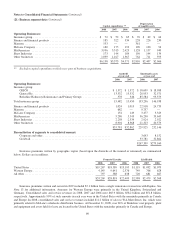

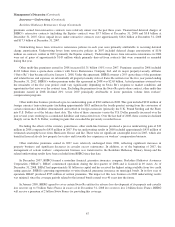

Capital expenditures **

Depreciation

of tangible assets

2008 2007 2006 2008 2007 2006

Operating Businesses:

Insurance group ............................................. $ 72 $ 52 $ 65 $ 70 $ 69 $ 64

Finance and financial products ................................. 185 322 334 228 226 230

Marmon ................................................... 553 — — 361 — —

McLane Company ........................................... 180 175 193 109 100 94

MidAmerican .............................................. 3,936 3,513 2,423 1,128 1,157 949

Shaw Industries ............................................. 173 144 189 150 144 134

Other businesses ............................................ 1,039 1,167 1,367 764 711 595

$6,138 $5,373 $4,571 $2,810 $2,407 $2,066

** Excludes capital expenditures which were part of business acquisitions.

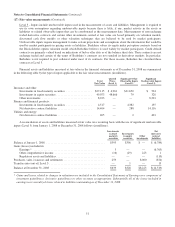

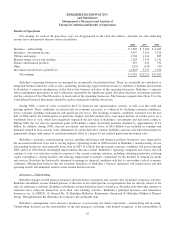

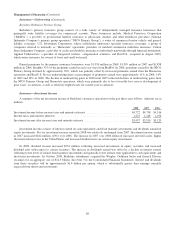

Goodwill

at year-end

Identifiable assets

at year-end

2008 2007 2008 2007

Operating Businesses:

Insurance group:

GEICO ......................................................... $ 1,372 $ 1,372 $ 18,699 $ 18,988

General Re ...................................................... 13,532 13,532 28,953 32,571

Berkshire Hathaway Reinsurance and Primary Groups ................... 578 546 85,584 95,379

Total insurance group ................................................. 15,482 15,450 133,236 146,938

Finance and financial products .......................................... 1,024 1,013 22,918 24,733

Marmon ............................................................ 682 — 9,757 —

McLane Company .................................................... 154 149 3,477 3,329

MidAmerican ....................................................... 5,280 5,543 36,290 33,645

Shaw Industries ...................................................... 2,258 2,339 2,924 2,922

Other businesses ..................................................... 8,901 8,368 21,323 20,579

$33,781 $32,862 229,925 232,146

Reconciliation of segments to consolidated amount:

Corporate and other ............................................... 3,693 8,152

Goodwill ....................................................... 33,781 32,862

$267,399 $273,160

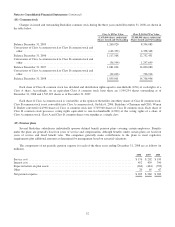

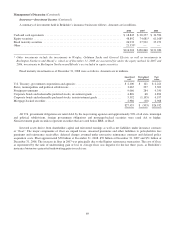

Insurance premiums written by geographic region (based upon the domicile of the insured or reinsured) are summarized

below. Dollars are in millions.

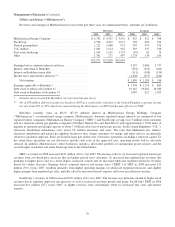

Property/Casualty Life/Health

2008 2007 2006 2008 2007 2006

United States ............................................ $19,267 $18,589 $19,195 $1,119 $1,092 $1,073

Western Europe .......................................... 4,145 9,641 2,576 749 706 628

All other ................................................ 797 588 638 720 681 667

$24,209 $28,818 $22,409 $2,588 $2,479 $2,368

Insurance premiums written and earned in 2007 included $7.1 billion from a single reinsurance transaction with Equitas. See

Note 13 for additional information. Amounts for Western Europe were primarily in the United Kingdom, Switzerland and

Germany. Consolidated sales and service revenues in 2008, 2007 and 2006 were $65.9 billion, $58.2 billion and $51.8 billion,

respectively. Approximately 90% of such amounts in each year were in the United States with the remainder primarily in Canada

and Europe. In 2008, consolidated sales and service revenues included $11.2 billion of sales to Wal-Mart Stores, Inc. which were

primarily related to McLane’s wholesale distribution business. At December 31, 2008, over 80% of Berkshire’s net property, plant

and equipment and assets held for lease are located in the United States with the remainder primarily in Canada and Europe.

60