Berkshire Hathaway 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

GEICO (Continued)

Premiums earned in 2008 increased 5.7% over 2007, reflecting an 8.2% increase in voluntary auto policies-in-force

partially offset by lower average premiums per policy. Average premiums per policy declined during 2007 but leveled off in

2008. The weakening economy could result in downward pressure on average premiums per policy in 2009 to the extent that

consumers raise deductibles and reduce coverages to save money. Policies-in-force over the last twelve months increased 6.6%

in the preferred risk auto line and increased 13.1% in the standard and nonstandard auto lines. Voluntary auto new business

sales in 2008 increased 2.0% compared to 2007. Voluntary auto policies-in-force at December 31, 2008 were 665,000 higher

than at December 31, 2007.

Losses and loss adjustment expenses incurred in 2008 increased 9.5% over 2007. The loss ratio was 74.8% in 2008 versus

72.2% in 2007. Incurred losses from catastrophe events for 2008 were $87 million compared to $34 million for 2007. Overall,

the increase in the loss ratio reflected higher average claim severities and lower average premiums per policy, partially offset by

lower average claims frequencies. Claims frequencies in 2008 for physical damage coverages decreased in the seven to nine

percent range from 2007 and frequencies for injury coverages decreased in the four to six percent range. Physical damage

severities in 2008 increased in the six to eight percent range and injury severities increased in the five to eight percent range

over 2007.

Underwriting expenses in 2008 increased $61 million (2.8%) over 2007. Policy acquisition expenses increased 8.5% in 2008

to $1,508 million, primarily due to increased advertising and policy issuance costs. The increase in policy acquisition expenses was

partially offset by lower other underwriting expenses, including lower interest on deferred compensation liabilities.

Premiums earned in 2007 increased 6.8% over 2006, due to higher numbers of policies-in-force, partially offset by lower

premiums per policy as a result of overall lower rates. Losses and loss adjustment expenses in 2007 increased 10.0% over 2006,

reflecting the aforementioned decline in average premiums per policy. In 2007, claims frequencies for physical damage

coverages increased in the two to four percent range over 2006 while frequencies for injury coverages decreased in the three to

five percent range. Physical damage severities increased in the second half of 2007 at an annualized rate of two to four percent.

Injury severities also increased in the latter part of 2007 at an annualized rate of three to six percent.

General Re

General Re conducts a reinsurance business offering property and casualty and life and health coverages to clients

worldwide. Property and casualty reinsurance is written in North America on a direct basis through General Reinsurance

Corporation and internationally through Cologne Re (based in Germany) and other affiliates. Property and casualty reinsurance

is also written through brokers with respect to Faraday in London. Life and health reinsurance is written worldwide through

Cologne Re. General Re strives to generate underwriting gains in essentially all of its product lines. Underwriting performance

is not evaluated based upon market share and underwriters are instructed to reject inadequately priced risks. General Re’s

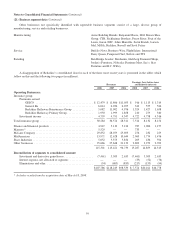

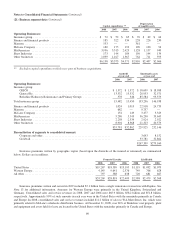

underwriting results are summarized for the past three years in the following table. Amounts are in millions.

Premiums written Premiums earned

Pre-tax underwriting

gain

2008 2007 2006 2008 2007 2006 2008 2007 2006

Property/casualty .......................... $3,383 $3,478 $3,581 $3,434 $3,614 $3,711 $163 $475 $373

Life/health ............................... 2,588 2,479 2,368 2,580 2,462 2,364 179 80 153

$5,971 $5,957 $5,949 $6,014 $6,076 $6,075 $342 $555 $526

64