Berkshire Hathaway 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Insurance—Investment Income (Continued)

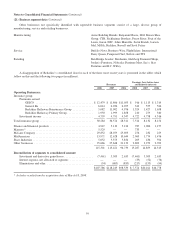

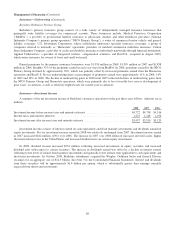

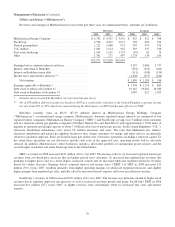

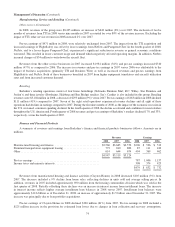

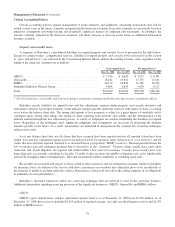

A summary of investments held in Berkshire’s insurance businesses follows. Amounts are in millions.

2008 2007 2006

Cash and cash equivalents ..................................................... $ 18,845 $ 28,257 $ 34,590

Equity securities ............................................................. 48,892 74,681* 61,168*

Fixed maturity securities ...................................................... 26,932 27,922 25,272

Other ...................................................................... 21,535* — —

$116,204 $130,860 $121,030

*Other investments include the investments in Wrigley, Goldman Sachs and General Electric as well as investments in

Burlington Northern and Moody’s, which as of December 31, 2008 are accounted for under the equity method. In 2007 and

2006, investments in Burlington Northern and Moody’s are included in equity securities.

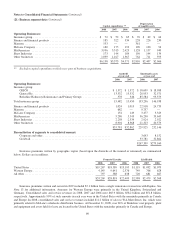

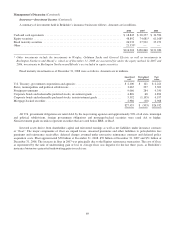

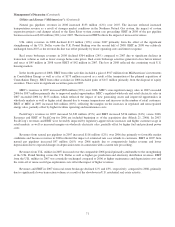

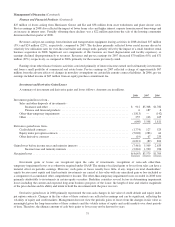

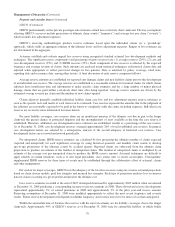

Fixed maturity investments as of December 31, 2008 were as follows. Amounts are in millions.

Amortized

cost

Unrealized

gains/losses

Fair

value

U.S. Treasury, government corporations and agencies ................................ $ 2,100 $ 121 $ 2,221

States, municipalities and political subdivisions ..................................... 3,065 237 3,302

Foreign governments .......................................................... 9,066 284 9,350

Corporate bonds and redeemable preferred stocks, investment grade .................... 4,826 68 4,894

Corporate bonds and redeemable preferred stocks, non-investment grade ................. 5,392 (1,195) 4,197

Mortgage-backed securities ..................................................... 2,986 (18) 2,968

$27,435 $ (503) $26,932

All U.S. government obligations are rated AAA by the major rating agencies and approximately 90% of all state, municipal

and political subdivisions, foreign government obligations and mortgage-backed securities were rated AA or higher.

Non-investment grade securities represent securities that are rated below BBB- or Baa3.

Invested assets derive from shareholder capital and reinvested earnings as well as net liabilities under insurance contracts

or “float.” The major components of float are unpaid losses, unearned premiums and other liabilities to policyholders less

premiums and reinsurance receivables, deferred charges assumed under retroactive reinsurance contracts and deferred policy

acquisition costs. Float approximated $58 billion at December 31, 2008, $59 billion at December 31, 2007 and $51 billion at

December 31, 2006. The increase in float in 2007 was principally due to the Equitas reinsurance transaction. The cost of float,

as represented by the ratio of underwriting gain or loss to average float, was negative for the last three years, as Berkshire’s

insurance businesses generated underwriting gains in each year.

69