Berkshire Hathaway 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

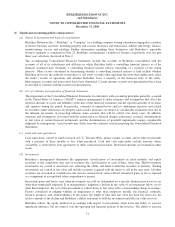

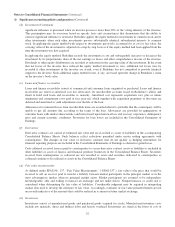

Notes to Consolidated Financial Statements (Continued)

(3) Investments in fixed maturity securities (Continued)

Approximately 65% of these securities were rated A or higher without the benefit of an insurer guarantee (and approximately

54% of the remaining securities were not rated on an underlying basis). Berkshire held no investments in these securities as of

December 31, 2007.

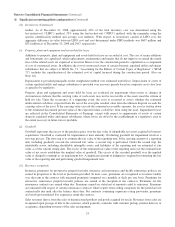

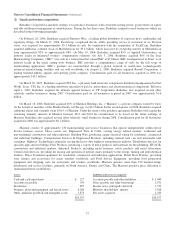

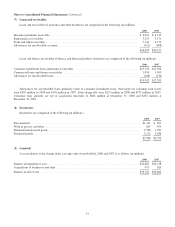

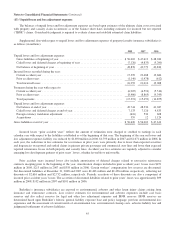

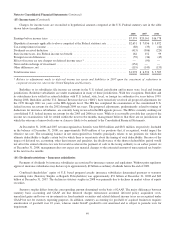

The amortized cost and estimated fair values of securities with fixed maturities at December 31, 2008 are summarized

below by contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of the

securities retain early call or prepayment rights. Amounts are in millions.

Due 2009 Due 2010 – 2013 Due 2014 – 2018 Due after 2018

Mortgage-backed

securities Total

Amortized cost ..................... $4,027 $13,239 $4,808 $4,441 $5,400 $31,915

Fair value ......................... 4,091 13,373 3,822 4,697 5,649 31,632

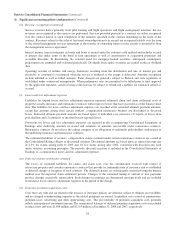

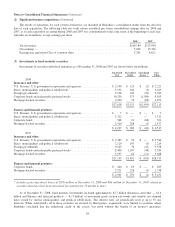

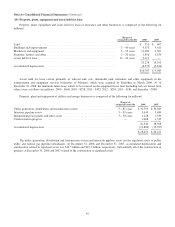

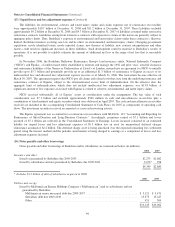

(4) Investments in equity securities

Investments in equity securities are summarized below (in millions).

2008 2007

Cost .................................................................................. $40,140 $44,695

Gross unrealized gains ................................................................... 14,782 31,289

Gross unrealized losses * ................................................................. (5,849) (985)

Fair value .............................................................................. $49,073 $74,999

* Substantially all of the gross unrealized losses pertain to security positions that have been held for less than 12 months.

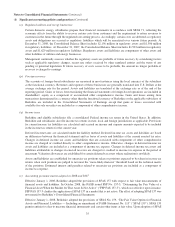

(5) Other Investments

A summary of other investments as of December 31, 2008 follows (in millions).

Cost

Unrealized

Gain

Fair

Value

Carrying

Value

Other fixed maturity and equity investments ................................ $14,452 $ 36 $14,488 $14,675

Equity method investments .............................................. 5,919 352 6,271 6,860

$20,371 $388 $20,759 $21,535

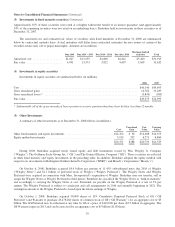

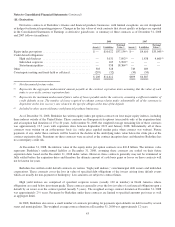

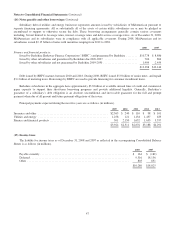

During 2008, Berkshire acquired newly issued equity and debt instruments issued by Wm. Wrigley Jr. Company

(“Wrigley”), The Goldman Sachs Group, Inc. (“GS”) and The General Electric Company (“GE”). These securities are reflected

in other fixed maturity and equity investments in the preceding table. In addition, Berkshire adopted the equity method with

respect to its investments in Burlington Northern Santa Fe Corporation (“BNSF”) and Moody’s Corporation (“Moody’s”).

On October 6, 2008, Berkshire acquired $4.4 billion par amount of 11.45% subordinated notes due 2018 of Wrigley

(“Wrigley Notes”) and $2.1 billion of preferred stock of Wrigley (“Wrigley Preferred”). The Wrigley Notes and Wrigley

Preferred were acquired in connection with Mars, Incorporated’s acquisition of Wrigley. Berkshire may not transfer, sell or

assign the Wrigley Notes or Wrigley Preferred to third parties. Berkshire has classified the Wrigley Notes as “held-to-maturity”

and accordingly is carrying the Wrigley Notes at cost. Dividends are payable on the Wrigley Preferred at a rate of 5% per

annum. The Wrigley Preferred is subject to certain put and call arrangements in 2016 and annually beginning in 2021. The

redemption amount of the Wrigley Preferred is based upon the future earnings of Wrigley.

On October 1, 2008, Berkshire acquired 50,000 shares of 10% Cumulative Perpetual Preferred Stock of GS (“GS

Preferred”) and Warrants to purchase 43,478,260 shares of common stock of GS (“GS Warrants”) for an aggregate cost of $5

billion. The GS Preferred may be redeemed at any time by GS at a price of $110,000 per share ($5.5 billion in aggregate). The

GS Warrants expire in 2013 and can be exercised for an aggregate cost of $5 billion ($115/share).

39