Berkshire Hathaway 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regulated Utility Business

Berkshire has an 87.4% (diluted) interest in MidAmerican Energy Holdings, which owns a wide

variety of utility operations. The largest of these are (1) Yorkshire Electricity and Northern Electric, whose

3.8 million end users make it the U.K.’s third largest distributor of electricity; (2) MidAmerican Energy, which

serves 723,000 electric customers, primarily in Iowa; (3) Pacific Power and Rocky Mountain Power, serving

about 1.7 million electric customers in six western states; and (4) Kern River and Northern Natural pipelines,

which carry about 9% of the natural gas consumed in the U.S.

Our partners in ownership of MidAmerican are its two terrific managers, Dave Sokol and Greg Abel,

and my long-time friend, Walter Scott. It’s unimportant how many votes each party has; we make major moves

only when we are unanimous in thinking them wise. Nine years of working with Dave, Greg and Walter have

reinforced my original belief: Berkshire couldn’t have better partners.

Somewhat incongruously, MidAmerican also owns the second largest real estate brokerage firm in the

U.S., HomeServices of America. This company operates through 21 locally-branded firms that have 16,000

agents. Last year was a terrible year for home sales, and 2009 looks no better. We will continue, however, to

acquire quality brokerage operations when they are available at sensible prices.

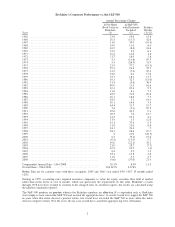

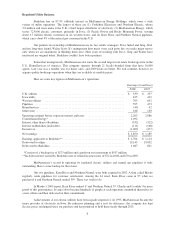

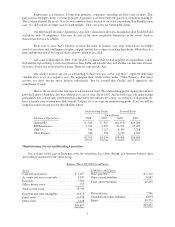

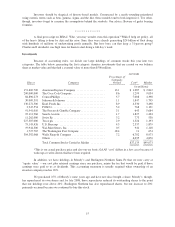

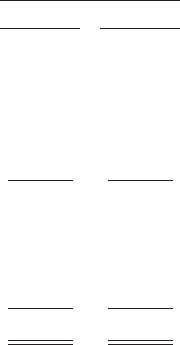

Here are some key figures on MidAmerican’s operations:

Earnings (in millions)

2008 2007

U.K. utilities ............................................................ $ 339 $ 337

Iowa utility ............................................................. 425 412

Western utilities ......................................................... 703 692

Pipelines ............................................................... 595 473

HomeServices ........................................................... (45) 42

Other (net) .............................................................. 186 130

Operating earnings before corporate interest and taxes ........................... 2,203 2,086

Constellation Energy* ..................................................... 1,092 –

Interest, other than to Berkshire ............................................. (332) (312)

Interest on Berkshire junior debt ............................................. (111) (108)

Income tax .............................................................. (1,002) (477)

Net earnings ............................................................. $ 1,850 $ 1,189

Earnings applicable to Berkshire** .......................................... $ 1,704 $ 1,114

Debt owed to others ....................................................... 19,145 19,002

Debt owed to Berkshire .................................................... 1,087 821

*Consists of a breakup fee of $175 million and a profit on our investment of $917 million.

**Includes interest earned by Berkshire (net of related income taxes) of $72 in 2008 and $70 in 2007.

MidAmerican’s record in operating its regulated electric utilities and natural gas pipelines is truly

outstanding. Here’s some backup for that claim.

Our two pipelines, Kern River and Northern Natural, were both acquired in 2002. A firm called Mastio

regularly ranks pipelines for customer satisfaction. Among the 44 rated, Kern River came in 9th when we

purchased it and Northern Natural ranked 39th. There was work to do.

In Mastio’s 2009 report, Kern River ranked 1st and Northern Natural 3rd. Charlie and I couldn’t be more

proud of this performance. It came about because hundreds of people at each operation committed themselves to

a new culture and then delivered on their commitment.

Achievements at our electric utilities have been equally impressive. In 1995, MidAmerican became the

major provider of electricity in Iowa. By judicious planning and a zeal for efficiency, the company has kept

electric prices unchanged since our purchase and has promised to hold them steady through 2013.

6