Berkshire Hathaway 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reinsurance is a business of long-term promises, sometimes extending for fifty years or more. This

past year has retaught clients a crucial principle: A promise is no better than the person or institution making it.

That’s where General Re excels: It is the only reinsurer that is backed by an AAA corporation. Ben Franklin once

said, “It’s difficult for an empty sack to stand upright.” That’s no worry for General Re clients.

Our third major insurance operation is Ajit Jain’s reinsurance division, headquartered in Stamford and

staffed by only 31 employees. This may be one of the most remarkable businesses in the world, hard to

characterize but easy to admire.

From year to year, Ajit’s business is never the same. It features very large transactions, incredible

speed of execution and a willingness to quote on policies that leave others scratching their heads. When there is a

huge and unusual risk to be insured, Ajit is almost certain to be called.

Ajit came to Berkshire in 1986. Very quickly, I realized that we had acquired an extraordinary talent.

So I did the logical thing: I wrote his parents in New Delhi and asked if they had another one like him at home.

Of course, I knew the answer before writing. There isn’t anyone like Ajit.

Our smaller insurers are just as outstanding in their own way as the “big three,” regularly delivering

valuable float to us at a negative cost. We aggregate their results below under “Other Primary.” For space

reasons, we don’t discuss these insurers individually. But be assured that Charlie and I appreciate the

contribution of each.

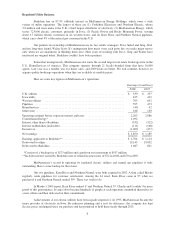

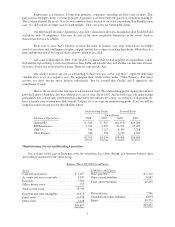

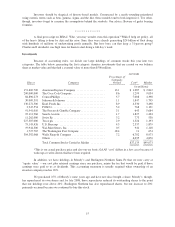

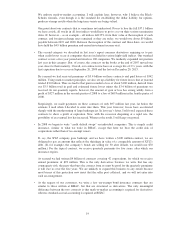

Here is the record for the four legs to our insurance stool. The underwriting profits signify that all four

provided funds to Berkshire last year without cost, just as they did in 2007. And in both years our underwriting

profitability was considerably better than that achieved by the industry. Of course, we ourselves will periodically

have a terrible year in insurance. But, overall, I expect us to average an underwriting profit. If so, we will be

using free funds of large size for the indefinite future.

Underwriting Profit Yearend Float

(in millions)

Insurance Operations 2008 2007 2008 2007

General Re ...................... $ 342 $ 555 $21,074 $23,009

BH Reinsurance .................. 1,324 1,427 24,221 23,692

GEICO ......................... 916 1,113 8,454 7,768

Other Primary ................... 210 279 4,739 4,229

$2,792 $3,374 $58,488 $58,698

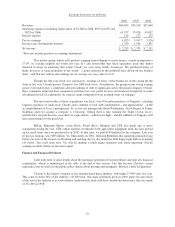

Manufacturing, Service and Retailing Operations

Our activities in this part of Berkshire cover the waterfront. Let’s look, though, at a summary balance sheet

and earnings statement for the entire group.

Balance Sheet 12/31/08 (in millions)

Assets

Cash and equivalents ................. $ 2,497

Accounts and notes receivable .......... 5,047

Inventory .......................... 7,500

Other current assets .................. 752

Total current assets ................... 15,796

Goodwill and other intangibles ......... 16,515

Fixed assets ........................ 16,338

Other assets ........................ 1,248

$49,897

Liabilities and Equity

Notes payable ....................... $ 2,212

Other current liabilities ............... 8,087

Total current liabilities ................ 10,299

Deferred taxes ...................... 2,786

Term debt and other liabilities .......... 6,033

Equity ............................. 30,779

$49,897

9