Berkshire Hathaway 2008 Annual Report Download - page 73

Download and view the complete annual report

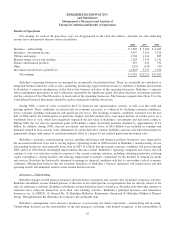

Please find page 73 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

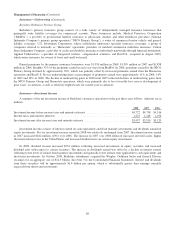

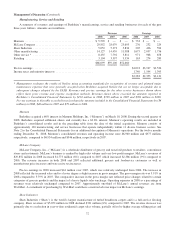

Utilities and Energy (“MidAmerican”) (Continued)

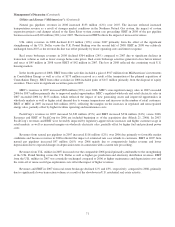

Natural gas pipelines revenues in 2008 increased $133 million (12%) over 2007. The increase reflected increased

transportation revenue as a result of stronger market conditions in the Northern Natural Gas system, the impact of system

expansion projects and changes related to the Kern River system current rate proceeding. EBIT in 2008 of the gas pipeline

businesses increased $122 million (26%) over 2007. The increase in EBIT reflects the impact of increased revenues.

U.K. utility revenues in 2008 declined $113 million (10%) versus 2007 primarily from the effect of the significant

strengthening of the U.S. Dollar versus the U.K. Pound Sterling over the second half of 2008. EBIT in 2008 was relatively

unchanged from 2007 as the revenue decline was offset primarily by lower operating costs and interest expense.

Real estate brokerage revenues in 2008 declined $364 million (24%) compared to 2007 due to significant declines in

transaction volume as well as lower average home sales prices. Real estate brokerage activities generated a loss before interest

and taxes of $45 million in 2008 versus EBIT of $42 million in 2007. The loss in 2008 reflected the continuing weak U.S.

housing markets.

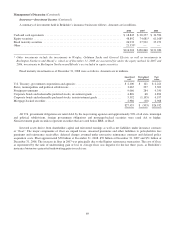

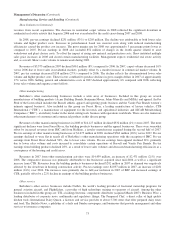

In the fourth quarter of 2008, EBIT from other activities included a gain of $917 million from MidAmerican’s investments

in Constellation Energy as well as a fee of $175 million received as a result of the termination of the planned acquisition of

Constellation Energy. EBIT from other activities in 2006 included gains of $117 million primarily from the disposal of equity

securities. There were no significant securities gains in 2007.

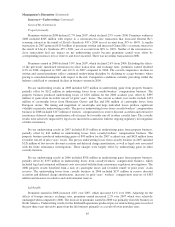

MEC’s revenues in 2007 increased $806 million (23%) over 2006. MEC’s non-regulated energy sales in 2007 exceeded

2006 by $597 million primarily due to improved market opportunities. MEC’s regulated wholesale and retail electricity sales in

2007 exceeded 2006 by $155 million, which reflected the impact of new generating assets and improved opportunities in

wholesale markets as well as higher retail demand due to warmer temperatures and increases in the number of retail customers.

EBIT of MEC in 2007 increased $64 million (18%), reflecting the margins on the increases in regulated and non-regulated

energy sales, partially offset by higher facilities operating and maintenance costs.

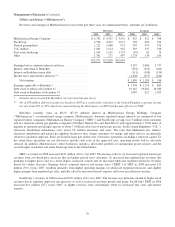

PacifiCorp’s revenues in 2007 increased $1,348 million (45%) and EBIT increased $336 million (94%) versus 2006.

Revenues and EBIT of PacifiCorp for 2006 are included beginning as of the acquisition date (March 21, 2006). In 2007,

PacifiCorp’s revenues and EBIT were favorably impacted by regulatory-approved rate increases and higher customer usage in

retail markets, as well as increased margins on wholesale electricity sales, partially offset by higher fuel and purchased power

costs.

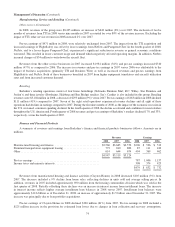

Revenues from natural gas pipelines in 2007 increased $116 million (12%) over 2006 due primarily to favorable market

conditions and because revenues in 2006 reflected the impact of estimated rate case refunds to customers. EBIT in 2007 from

natural gas pipelines increased $97 million (26%) over 2006 mainly due to comparatively higher revenue and lower

depreciation due to expected changes in depreciation rates in connection with a current rate proceeding.

Revenues from U.K. utilities in 2007 increased over the comparable 2006 period primarily attributable to the strengthening

of the U.K. Pound Sterling versus the U.S. Dollar as well as higher gas production and electricity distribution revenues. EBIT

from the U.K. utilities in 2007 was essentially unchanged compared to 2006 as higher maintenance and depreciation costs and

the write-off of unsuccessful gas exploration costs offset the impact of higher revenues.

Revenues and EBIT in 2007 from real estate brokerage declined 12% and 43%, respectively, compared to 2006, primarily

due to significantly lower transaction volume as a result of the slowdown in U.S. residential real estate activity.

71