Berkshire Hathaway 2008 Annual Report Download - page 6

Download and view the complete annual report

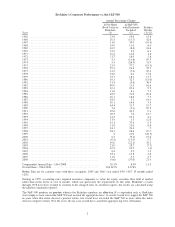

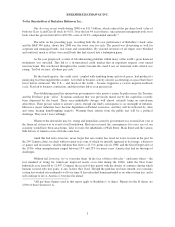

Please find page 6 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Take a look again at the 44-year table on page 2. In 75% of those years, the S&P stocks recorded a

gain. I would guess that a roughly similar percentage of years will be positive in the next 44. But neither Charlie

Munger, my partner in running Berkshire, nor I can predict the winning and losing years in advance. (In our

usual opinionated view, we don’t think anyone else can either.) We’re certain, for example, that the economy will

be in shambles throughout 2009 – and, for that matter, probably well beyond – but that conclusion does not tell

us whether the stock market will rise or fall.

In good years and bad, Charlie and I simply focus on four goals:

(1) maintaining Berkshire’s Gibraltar-like financial position, which features huge amounts of

excess liquidity, near-term obligations that are modest, and dozens of sources of earnings

and cash;

(2) widening the “moats” around our operating businesses that give them durable competitive

advantages;

(3) acquiring and developing new and varied streams of earnings;

(4) expanding and nurturing the cadre of outstanding operating managers who, over the years,

have delivered Berkshire exceptional results.

Berkshire in 2008

Most of the Berkshire businesses whose results are significantly affected by the economy earned below

their potential last year, and that will be true in 2009 as well. Our retailers were hit particularly hard, as were our

operations tied to residential construction. In aggregate, however, our manufacturing, service and retail

businesses earned substantial sums and most of them – particularly the larger ones – continue to strengthen their

competitive positions. Moreover, we are fortunate that Berkshire’s two most important businesses – our

insurance and utility groups – produce earnings that are not correlated to those of the general economy. Both

businesses delivered outstanding results in 2008 and have excellent prospects.

As predicted in last year’s report, the exceptional underwriting profits that our insurance businesses

realized in 2007 were not repeated in 2008. Nevertheless, the insurance group delivered an underwriting gain for

the sixth consecutive year. This means that our $58.5 billion of insurance “float” – money that doesn’t belong to

us but that we hold and invest for our own benefit – cost us less than zero. In fact, we were paid $2.8 billion to

hold our float during 2008. Charlie and I find this enjoyable.

Over time, most insurers experience a substantial underwriting loss, which makes their economics far

different from ours. Of course, we too will experience underwriting losses in some years. But we have the best

group of managers in the insurance business, and in most cases they oversee entrenched and valuable franchises.

Considering these strengths, I believe that we will earn an underwriting profit over the years and that our float

will therefore cost us nothing. Our insurance operation, the core business of Berkshire, is an economic

powerhouse.

Charlie and I are equally enthusiastic about our utility business, which had record earnings last year

and is poised for future gains. Dave Sokol and Greg Abel, the managers of this operation, have achieved results

unmatched elsewhere in the utility industry. I love it when they come up with new projects because in this

capital-intensive business these ventures are often large. Such projects offer Berkshire the opportunity to put out

substantial sums at decent returns.

4