Berkshire Hathaway 2008 Annual Report Download - page 23

Download and view the complete annual report

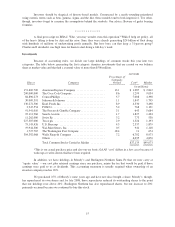

Please find page 23 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The ridiculous premium that Black-Scholes dictates in my extreme example is caused by the inclusion

of volatility in the formula and by the fact that volatility is determined by how much stocks have moved around

in some past period of days, months or years. This metric is simply irrelevant in estimating the probability-

weighted range of values of American business 100 years from now. (Imagine, if you will, getting a quote every

day on a farm from a manic-depressive neighbor and then using the volatility calculated from these changing

quotes as an important ingredient in an equation that predicts a probability-weighted range of values for the farm

a century from now.)

Though historical volatility is a useful – but far from foolproof – concept in valuing short-term options,

its utility diminishes rapidly as the duration of the option lengthens. In my opinion, the valuations that the Black-

Scholes formula now place on our long-term put options overstate our liability, though the overstatement will

diminish as the contracts approach maturity.

Even so, we will continue to use Black-Scholes when we are estimating our financial-statement

liability for long-term equity puts. The formula represents conventional wisdom and any substitute that I might

offer would engender extreme skepticism. That would be perfectly understandable: CEOs who have concocted

their own valuations for esoteric financial instruments have seldom erred on the side of conservatism. That club

of optimists is one that Charlie and I have no desire to join.

The Annual Meeting

Our meeting this year will be held on Saturday, May 2nd. As always, the doors will open at the Qwest

Center at 7 a.m., and a new Berkshire movie will be shown at 8:30. At 9:30 we will go directly to the

question-and-answer period, which (with a break for lunch at the Qwest’s stands) will last until 3:00. Then, after

a short recess, Charlie and I will convene the annual meeting at 3:15. If you decide to leave during the day’s

question periods, please do so while Charlie is talking.

The best reason to exit, of course, is to shop. We will help you do that by filling the 194,300-square-

foot hall that adjoins the meeting area with the products of Berkshire subsidiaries. Last year, the 31,000 people

who came to the meeting did their part, and almost every location racked up record sales. But you can do better.

(A friendly warning: If I find sales are lagging, I lock the exits.)

This year Clayton will showcase its new i-house that includes Shaw flooring, Johns Manville insulation

and MiTek fasteners. This innovative “green” home, featuring solar panels and numerous other energy-saving

products, is truly a home of the future. Estimated costs for electricity and heating total only about $1 per day

when the home is sited in an area like Omaha. After purchasing the i-house, you should next consider the Forest

River RV and pontoon boat on display nearby. Make your neighbors jealous.

GEICO will have a booth staffed by a number of its top counselors from around the country, all of

them ready to supply you with auto insurance quotes. In most cases, GEICO will be able to give you a

shareholder discount (usually 8%). This special offer is permitted by 44 of the 50 jurisdictions in which we

operate. (One supplemental point: The discount is not additive if you qualify for another, such as that given

certain groups.) Bring the details of your existing insurance and check out whether we can save you money. For

at least 50% of you, I believe we can.

On Saturday, at the Omaha airport, we will have the usual array of NetJets aircraft available for your

inspection. Stop by the NetJets booth at the Qwest to learn about viewing these planes. Come to Omaha by bus;

leave in your new plane. And take along – with no fear of a strip search – the Ginsu knives that you’ve purchased

at the exhibit of our Quikut subsidiary.

Next, if you have any money left, visit the Bookworm, which will be selling about 30 books and

DVDs. A shipping service will be available for those whose thirst for knowledge exceeds their carrying capacity.

21