Berkshire Hathaway 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Critical Accounting Policies

Certain accounting policies require management to make estimates and judgments concerning transactions that will be

settled several years in the future. Amounts recognized in the financial statements from such estimates are necessarily based on

numerous assumptions involving varying and potentially significant degrees of judgment and uncertainty. Accordingly, the

amounts currently reflected in the financial statements will likely increase or decrease in the future as additional information

becomes available.

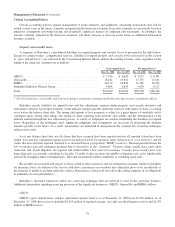

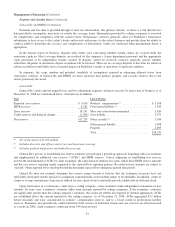

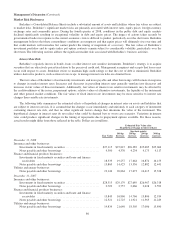

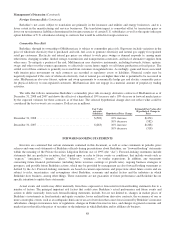

Property and casualty losses

A summary of Berkshire’s consolidated liabilities for unpaid property and casualty losses is presented in the table below.

Except for certain workers’ compensation reserves, liabilities for unpaid property and casualty losses (referred to in this section

as “gross unpaid losses”) are reflected in the Consolidated Balance Sheets without discounting for time value, regardless of the

length of the claim-tail. Amounts are in millions.

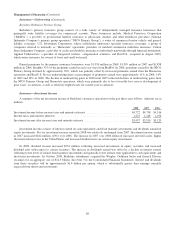

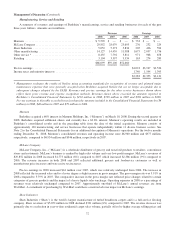

Gross unpaid losses Net unpaid losses *

Dec. 31, 2008 Dec. 31, 2007 Dec. 31, 2008 Dec. 31, 2007

GEICO ..................................................... $ 7,336 $ 6,642 $ 7,012 $ 6,341

General Re .................................................. 18,241 19,831 17,235 17,651

BHRG ..................................................... 26,179 24,894 21,386 20,223

Berkshire Hathaway Primary Group .............................. 4,864 4,635 4,470 4,127

Total ....................................................... $56,620 $56,002 $50,103 $48,342

*Net of reinsurance recoverable and deferred charges reinsurance assumed and before foreign currency translation effects.

Berkshire records liabilities for unpaid losses and loss adjustment expenses under property and casualty insurance and

reinsurance contracts based upon estimates of the ultimate amounts payable under the contracts with respect to losses occurring

on or before the balance sheet date. The timing and amount of loss payments is subject to a great degree of variability and is

contingent upon, among other things, the timing of claim reporting from insureds and cedants and the determination of the

ultimate amount through the loss adjustment process. A variety of techniques are used in establishing the liabilities for unpaid

losses. Regardless of the techniques used, significant judgments and assumptions are necessary in projecting the ultimate

amounts payable in the future. As a result, uncertainties are imbedded in and permeate the actuarial loss reserving techniques

and processes used.

As of any balance sheet date, not all claims that have occurred have been reported and not all reported claims have been

settled. Loss and loss adjustment expense reserves include provisions for reported claims (referred to as “case reserves”) and for

claims that have not been reported (referred to as incurred but not yet reported (“IBNR”) reserves). The time period between the

loss occurrence date and settlement payment date is referred to as the “claim-tail.” Property claims usually have fairly short

claim-tails and, absent litigation, are reported and settled within a few years of occurrence. Casualty losses usually have very

long claim-tails, occasionally extending for decades. Casualty claims are more susceptible to litigation and can be significantly

affected by changing contract interpretations. The legal environment further contributes to extending claim-tails.

Receivables are recorded with respect to losses ceded to other reinsurers and are estimated in a manner similar to liabilities

for insurance losses. In addition to the factors cited above, reinsurance recoverables may ultimately prove to be uncollectible if

the reinsurer is unable to perform under the contract. Reinsurance contracts do not relieve the ceding company of its obligations

to indemnify its own policyholders.

Berkshire’s insurance businesses utilize loss reserving techniques that are believed to best fit the particular business.

Additional information regarding reserving processes of the significant businesses (GEICO, General Re and BHRG) follows.

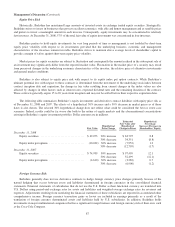

GEICO

GEICO’s gross unpaid losses and loss adjustment expense reserves as of December 31, 2008 were $7,336 million. As of

December 31, 2008, gross reserves included $5,265 million of reported average, case and case development reserves and $2,071

million of IBNR reserves.

78