Berkshire Hathaway 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Commentary about the current housing crisis often ignores the crucial fact that most foreclosures do

not occur because a house is worth less than its mortgage (so-called “upside-down” loans). Rather, foreclosures

take place because borrowers can’t pay the monthly payment that they agreed to pay. Homeowners who have

made a meaningful down-payment – derived from savings and not from other borrowing – seldom walk away

from a primary residence simply because its value today is less than the mortgage. Instead, they walk when they

can’t make the monthly payments.

Home ownership is a wonderful thing. My family and I have enjoyed my present home for 50 years,

with more to come. But enjoyment and utility should be the primary motives for purchase, not profit or refi

possibilities. And the home purchased ought to fit the income of the purchaser.

The present housing debacle should teach home buyers, lenders, brokers and government some simple

lessons that will ensure stability in the future. Home purchases should involve an honest-to-God down payment

of at least 10% and monthly payments that can be comfortably handled by the borrower’s income. That income

should be carefully verified.

Putting people into homes, though a desirable goal, shouldn’t be our country’s primary objective.

Keeping them in their homes should be the ambition.

************

Clayton’s lending operation, though not damaged by the performance of its borrowers, is nevertheless

threatened by an element of the credit crisis. Funders that have access to any sort of government guarantee –

banks with FDIC-insured deposits, large entities with commercial paper now backed by the Federal Reserve, and

others who are using imaginative methods (or lobbying skills) to come under the government’s umbrella – have

money costs that are minimal. Conversely, highly-rated companies, such as Berkshire, are experiencing

borrowing costs that, in relation to Treasury rates, are at record levels. Moreover, funds are abundant for the

government-guaranteed borrower but often scarce for others, no matter how creditworthy they may be.

This unprecedented “spread” in the cost of money makes it unprofitable for any lender who doesn’t

enjoy government-guaranteed funds to go up against those with a favored status. Government is determining the

“haves” and “have-nots.” That is why companies are rushing to convert to bank holding companies, not a course

feasible for Berkshire.

Though Berkshire’s credit is pristine – we are one of only seven AAA corporations in the country – our

cost of borrowing is now far higher than competitors with shaky balance sheets but government backing. At the

moment, it is much better to be a financial cripple with a government guarantee than a Gibraltar without one.

Today’s extreme conditions may soon end. At worst, we believe we will find at least a partial solution

that will allow us to continue much of Clayton’s lending. Clayton’s earnings, however, will surely suffer if we

are forced to compete for long against government-favored lenders.

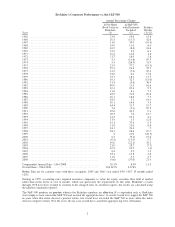

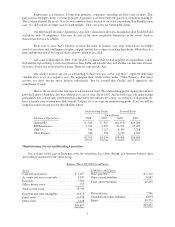

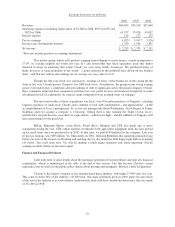

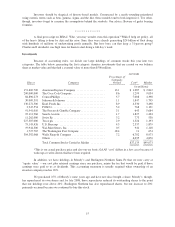

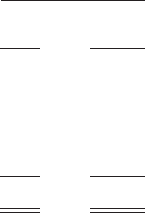

Pre-Tax Earnings

(in millions)

2008 2007

Net investment income ....................................... $330 $ 272

Life and annuity operation .................................... 23 (60)

Leasing operations .......................................... 87 111

Manufactured-housing finance (Clayton) ........................ 206 526

Other* .................................................... 141 157

Income before investment and derivatives gains or losses ........... $787 $1,006

*Includes $92 million in 2008 and $85 million in 2007 of fees that Berkshire charges Clayton for the

use of Berkshire’s credit.

12