Berkshire Hathaway 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Berkshire’s Chairman and CEO, Warren E. Buffett. Accordingly, Berkshire evaluates performance of underwriting operations

without any allocation of investment income.

Periodic underwriting results can be affected significantly by changes in estimates for unpaid losses and loss adjustment

expenses, including amounts established for occurrences in prior years. See the Critical Accounting Policies section of this

discussion for information concerning the loss reserve estimation process. In addition, the timing and amount of catastrophe

losses produce significant volatility in periodic underwriting results. Berkshire’s property and casualty reinsurance operations

benefited from relatively minor levels of catastrophe losses in 2007 and 2006. During 2008, Berkshire’s underwriting results

include estimated losses of approximately $900 million from Hurricanes Gustav and Ike. The impact on earnings of these losses

was substantially offset by unrealized foreign currency transaction gains during the last half of 2008 that arose from the

valuation of certain non-U.S. Dollar denominated reinsurance liabilities as a result of the significant strengthening of the U.S.

Dollar.

A key marketing strategy followed by all of the insurance businesses is the maintenance of extraordinary capital strength.

Statutory surplus of Berkshire’s insurance businesses was approximately $51 billion at December 31, 2008. This superior capital

strength creates opportunities, especially with respect to reinsurance activities, to negotiate and enter into insurance and reinsurance

contracts specially designed to meet the unique needs of insurance and reinsurance buyers. Additional information regarding

Berkshire’s insurance and reinsurance operations follows.

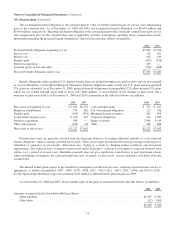

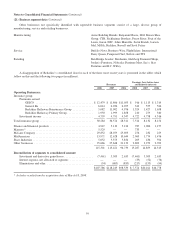

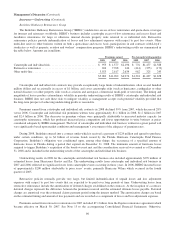

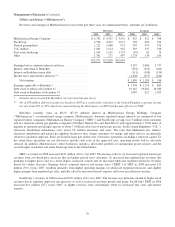

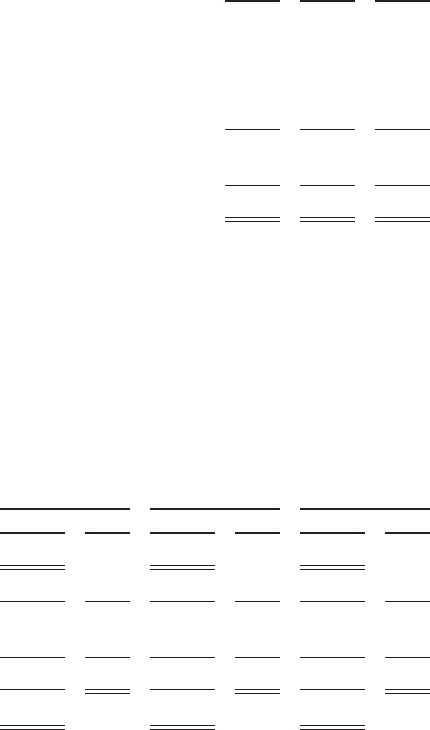

A summary follows of underwriting results from Berkshire’s insurance businesses for the past three years. Amounts are in

millions.

2008 2007 2006

Underwriting gain attributable to:

GEICO ...................................................................... $ 916 $1,113 $1,314

General Re ................................................................... 342 555 526

Berkshire Hathaway Reinsurance Group ............................................ 1,324 1,427 1,658

Berkshire Hathaway Primary Group ............................................... 210 279 340

Pre-tax underwriting gain ............................................................ 2,792 3,374 3,838

Income taxes and minority interests .................................................... 987 1,190 1,353

Net underwriting gain ....................................................... $1,805 $2,184 $2,485

GEICO

GEICO provides primarily private passenger automobile coverages to insureds in 49 states and the District of Columbia.

GEICO policies are marketed mainly by direct response methods in which customers apply for coverage directly to the

company via the Internet, over the telephone or through the mail. This is a significant element in GEICO’s strategy to be a

low-cost insurer. In addition, GEICO strives to provide excellent service to customers, with the goal of establishing long-term

customer relationships.

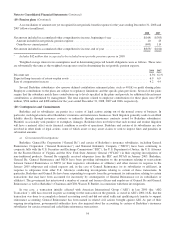

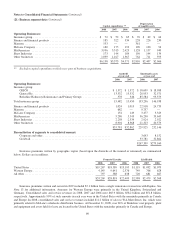

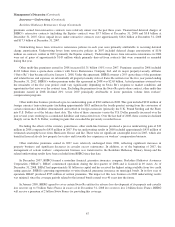

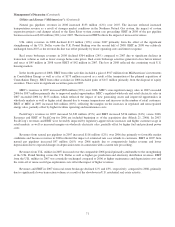

GEICO’s underwriting results for the past three years are summarized below. Dollars are in millions.

2008 2007 2006

Amount % Amount % Amount %

Premiums written ........................................... $12,741 $11,931 $11,303

Premiums earned ............................................ $12,479 100.0 $11,806 100.0 $11,055 100.0

Losses and loss adjustment expenses ............................ 9,332 74.8 8,523 72.2 7,749 70.1

Underwriting expenses ....................................... 2,231 17.9 2,170 18.4 1,992 18.0

Total losses and expenses ..................................... 11,563 92.7 10,693 90.6 9,741 88.1

Pre-tax underwriting gain ..................................... $ 916 $ 1,113 $ 1,314

63