Berkshire Hathaway 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

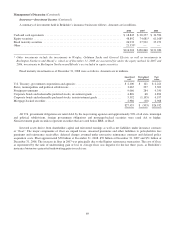

Manufacturing, Service and Retailing (Continued)

Shaw Industries (Continued)

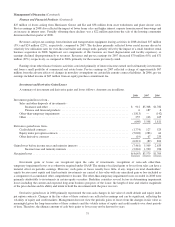

revenues from recent acquisitions. The decrease in residential carpet volume in 2008 reflected the significant downturn in

residential real estate activity that began in 2006 and was exacerbated by the credit crises during 2007 and 2008.

In 2008, pre-tax earnings declined $231 million (53%) to $205 million. The decline was attributable to both lower sales

volume and higher product costs. Increases in petrochemical based raw material costs along with reduced manufacturing

efficiencies caused the product cost increase. The gross margin rate for 2008 was approximately 3 percentage points lower as

compared to 2007. Pre-tax earnings in 2008 also included $52 million of charges in the fourth quarter related to asset

writedowns and plant closure costs. To offset the impact of rising raw material and production costs, Shaw instituted multiple

sales price increases in 2008 and closed certain manufacturing facilities. Management expects residential real estate activity

and, as a result, Shaw’s sales volume to remain weak during 2009.

Revenues of $5,373 million in 2007 declined $461 million (8%) compared to 2006. In 2007, carpet volume decreased 10%

versus 2006 due to lower sales in residential markets, partially offset by a modest increase in commercial market volume. In

2007, pre-tax earnings decreased $158 million (27%) compared to 2006. The decline reflects the aforementioned lower sales

volume and higher product costs. These factors combined to produce declines in gross margin dollars in 2007 of approximately

17% versus 2006. Selling, general and administrative costs in 2007 declined approximately 6% compared with 2006, reflecting

lower sales volume and expense control efforts.

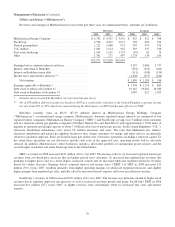

Other manufacturing

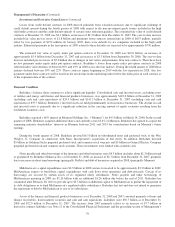

Berkshire’s other manufacturing businesses include a wide array of businesses. Included in this group are several

manufacturers of building products (Acme Building Brands, Benjamin Moore, Johns Manville and MiTek) and apparel (led by

Fruit of the Loom which includes the Russell athletic apparel and sporting goods business and the Vanity Fair Brands women’s

intimate apparel business). Also included in this group are Forest River, a leading manufacturer of leisure vehicles, CTB

International (“CTB”), a manufacturer of equipment for the livestock and agricultural industries and ISCAR Metalworking

Companies (“IMC”), an industry leader in the metal cutting tools business with operations worldwide. There are also numerous

other manufacturers of consumer and commercial products in this diverse group.

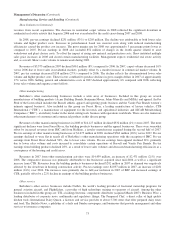

Revenues of other manufacturing businesses in 2008 of $14,127 million declined $332 million (2%) versus 2007. The most

significant declines were from Forest River, the building products businesses and the apparel businesses. These were somewhat

offset by increased revenues from IMC and from Richline, a jewelry manufacturer acquired during the second half of 2007.

Pre-tax earnings of other manufacturing businesses of $1,675 million in 2008, declined $362 million (18%) versus 2007. Pre-tax

earnings declined or were flat in nearly all of Berkshire’s other manufacturing operations with the exception of IMC. Pre-tax

earnings from Forest River declined 56%, due to lower sales volume. Pre-tax earnings from apparel declined 34%, primarily

due to lower sales volume and costs incurred to consolidate certain operations of Russell and Vanity Fair Brands. Pre-tax

earnings from building products declined 28%, as a result of lower sales volumes and decreased manufacturing efficiencies as a

consequence of the housing and credit crises.

Revenues in 2007 from other manufacturing activities were $14,459 million, an increase of $2,471 million (21%) over

2006. The comparative increase was primarily attributable to the businesses acquired since mid-2006 as well as a significant

increase from CTB. Revenues from the building products businesses declined $292 million in 2007 as demand was negatively

affected by the slowdown in housing construction activity. Pre-tax earnings were $2,037 million in 2007, an increase of $281

million (16%) over 2006. The increases were primarily due to full-year inclusion in 2007 of IMC and increased earnings of

CTB, partially offset by a 22% decline in earnings of the building products businesses.

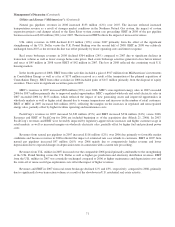

Other service

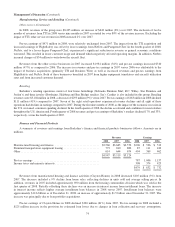

Berkshire’s other service businesses include NetJets, the world’s leading provider of fractional ownership programs for

general aviation aircraft, and FlightSafety, a provider of high technology training to operators of aircraft. Among the other

businesses included in this group are: TTI, a leading electronic components distributor (acquired March 2007); Business Wire, a

leading distributor of corporate news, multimedia and regulatory filings; The Pampered Chef, a direct seller of high quality

kitchen tools; International Dairy Queen, a licensor and service provider to about 5,700 stores that offer prepared dairy treats

and food; The Buffalo News, a publisher of a daily and Sunday newspaper; and businesses that provide management and other

services to insurance companies.

73