Berkshire Hathaway 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

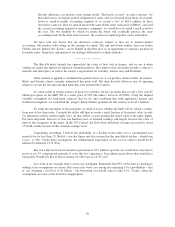

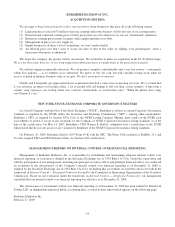

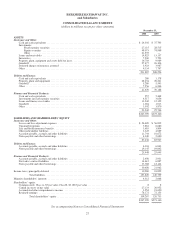

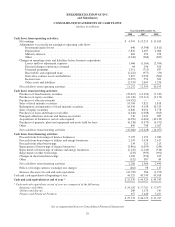

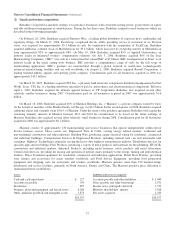

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions except per share amounts)

December 31,

2008 2007

ASSETS

Insurance and Other:

Cash and cash equivalents ...................................................................... $ 24,302 $ 37,703

Investments:

Fixed maturity securities ................................................................... 27,115 28,515

Equity securities ......................................................................... 49,073 74,999

Other .................................................................................. 21,535 —

Loans and receivables ......................................................................... 14,925 13,157

Inventories .................................................................................. 7,500 5,793

Property, plant, equipment and assets held for lease .................................................. 16,703 9,969

Goodwill ................................................................................... 27,477 26,306

Deferred charges reinsurance assumed ............................................................ 3,923 3,987

Other ...................................................................................... 9,334 7,797

201,887 208,226

Utilities and Energy:

Cash and cash equivalents ...................................................................... 280 1,178

Property, plant and equipment ................................................................... 28,454 26,221

Goodwill ................................................................................... 5,280 5,543

Other ...................................................................................... 7,556 6,246

41,570 39,188

Finance and Financial Products:

Cash and cash equivalents ...................................................................... 957 5,448

Investments in fixed maturity securities ........................................................... 4,517 3,056

Loans and finance receivables ................................................................... 13,942 12,359

Goodwill ................................................................................... 1,024 1,013

Other ...................................................................................... 3,502 3,870

23,942 25,746

$267,399 $273,160

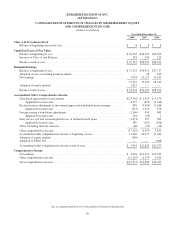

LIABILITIES AND SHAREHOLDERS’ EQUITY

Insurance and Other:

Losses and loss adjustment expenses ............................................................. $ 56,620 $ 56,002

Unearned premiums .......................................................................... 7,861 6,680

Life and health insurance benefits ................................................................ 3,619 3,804

Other policyholder liabilities .................................................................... 3,243 4,089

Accounts payable, accruals and other liabilities ..................................................... 11,744 10,672

Notes payable and other borrowings .............................................................. 4,349 2,680

87,436 83,927

Utilities and Energy:

Accounts payable, accruals and other liabilities ..................................................... 6,303 6,043

Notes payable and other borrowings .............................................................. 19,145 19,002

25,448 25,045

Finance and Financial Products:

Accounts payable, accruals and other liabilities ..................................................... 2,656 2,931

Derivative contract liabilities ................................................................... 14,612 6,887

Notes payable and other borrowings .............................................................. 13,388 12,144

30,656 21,962

Income taxes, principally deferred ................................................................... 10,280 18,825

Total liabilities ....................................................................... 153,820 149,759

Minority shareholders’ interests ..................................................................... 4,312 2,668

Shareholders’ equity:

Common stock: Class A, $5 par value; Class B, $0.1667 par value ...................................... 8 8

Capital in excess of par value ................................................................... 27,133 26,952

Accumulated other comprehensive income ........................................................ 3,954 21,620

Retained earnings ............................................................................ 78,172 72,153

Total shareholders’ equity .............................................................. 109,267 120,733

$267,399 $273,160

See accompanying Notes to Consolidated Financial Statements

27