Berkshire Hathaway 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

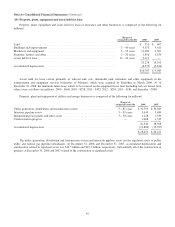

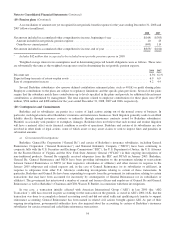

(18) Common stock

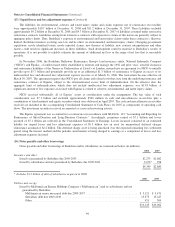

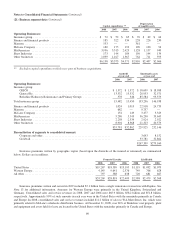

Changes in issued and outstanding Berkshire common stock during the three years ended December 31, 2008 are shown in

the table below.

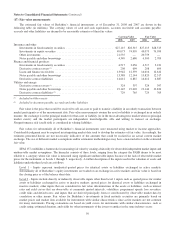

Class A, $5 Par Value Class B, $0.1667 Par Value

(1,650,000 shares authorized)

Shares Issued and Outstanding

(55,000,000 shares authorized)

Shares Issued and Outstanding

Balance December 31, 2005 ................................. 1,260,920 8,394,083

Conversions of Class A common stock to Class B common stock and

other .................................................. (143,352) 4,358,348

Balance December 31, 2006 ................................. 1,117,568 12,752,431

Conversions of Class A common stock to Class B common stock and

other .................................................. (36,544) 1,247,649

Balance December 31, 2007 ................................. 1,081,024 14,000,080

Conversions of Class A common stock to Class B common stock and

other .................................................. (22,023) 706,916

Balance December 31, 2008 ................................. 1,059,001 14,706,996

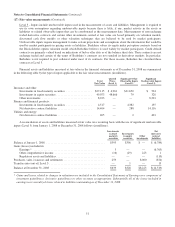

Each share of Class B common stock has dividend and distribution rights equal to one-thirtieth (1/30) of such rights of a

Class A share. Accordingly, on an equivalent Class A common stock basis there are 1,549,234 shares outstanding as of

December 31, 2008 and 1,547,693 shares as of December 31, 2007.

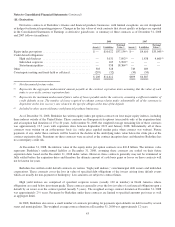

Each share of Class A common stock is convertible, at the option of the holder, into thirty shares of Class B common stock.

Class B common stock is not convertible into Class A common stock. On July 6, 2006, Berkshire’s Chairman and CEO, Warren

E. Buffett converted 124,998 shares of Class A common stock into 3,749,940 shares of Class B common stock. Each share of

Class B common stock possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of

Class A common stock. Class A and Class B common shares vote together as a single class.

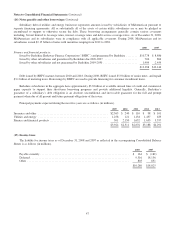

(19) Pension plans

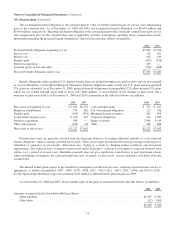

Several Berkshire subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits

under the plans are generally based on years of service and compensation, although benefits under certain plans are based on

years of service and fixed benefit rates. The companies generally make contributions to the plans to meet regulatory

requirements plus additional amounts as determined by management based on actuarial valuations.

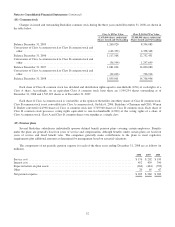

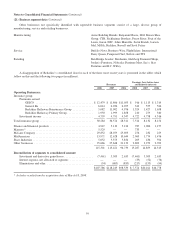

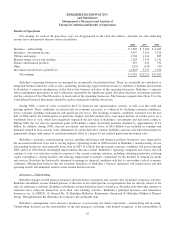

The components of net periodic pension expense for each of the three years ending December 31, 2008 are as follows (in

millions).

2008 2007 2006

Service cost ......................................................................... $176 $202 $199

Interest cost ......................................................................... 452 439 390

Expected return on plan assets .......................................................... (463) (444) (393)

Other .............................................................................. 20 65 67

Net pension expense .................................................................. $185 $262 $263

52