Berkshire Hathaway 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Financial Condition (Continued)

Discussion for additional information). As of December 31, 2008, notes payable and other borrowings of $13.4 billion included

$10.8 billion of medium-term notes issued by BHFC. During 2008, BHFC issued debt of $5.0 billion and repaid $3.1 billion of

notes. BHFC notes are guaranteed by Berkshire and mature at various dates extending through 2018. The proceeds from these

notes were used to finance originated and acquired loans of Clayton Homes.

During 2008, credit markets became increasingly restricted as a consequence of the ongoing worldwide credit crisis. As a

result, the availability of credit to corporations has declined significantly and interest rates for new issues increased relative to

government obligations, even for companies with strong credit histories and ratings. Although management believes that the

credit crisis is temporary and that Berkshire has ample liquidity and capital to withstand these conditions, restricted access to

credit markets over longer periods could have a significant negative impact on operations, particularly the utilities and energy

business and certain finance and financial products operations. Management believes that it currently maintains ample liquidity

to cover its contractual obligations and provide for contingent liquidity needs.

During 2008, Berkshire’s consolidated shareholders’ equity declined from $120.7 billion at the end of 2007 to

$109.3 billion at December 31, 2008. This reduction was largely due to significant price declines in Berkshire’s equity

investments and an increase in the fair value of the liabilities arising from Berkshire’s equity index put option contracts. The

worldwide economic crisis has continued during the first part of 2009 and prices of Berkshire’s equity investments have

declined further and the fair values of liabilities arising from equity index put option contracts have increased further. Berkshire

estimates that its consolidated shareholders’ equity has been reduced by approximately $8 billion since the end of 2008.

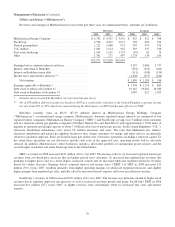

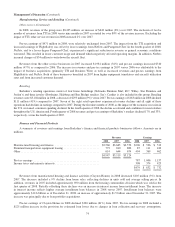

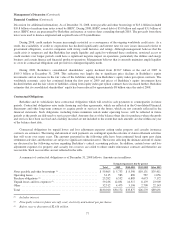

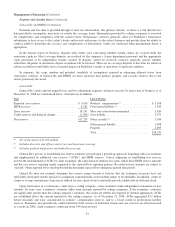

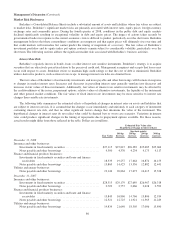

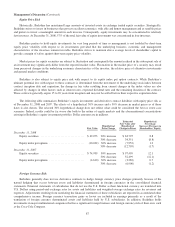

Contractual Obligations

Berkshire and its subsidiaries have contractual obligations which will result in cash payments to counterparties in future

periods. Contractual obligations arise under financing and other agreements, which are reflected in the Consolidated Financial

Statements and other long-term contracts to acquire goods or services in the future, which are not currently reflected in the

financial statements. Such obligations, including future minimum rentals under operating leases, will be reflected in future

periods as the goods are delivered or services provided. Amounts due as of the balance sheet date for purchases where the goods

and services have been received and a liability incurred are not included to the extent that such amounts are due within one year

of the balance sheet date.

Contractual obligations for unpaid losses and loss adjustment expenses arising under property and casualty insurance

contracts are estimates. The timing and amount of such payments are contingent upon the outcome of claim settlement activities

that will occur over many years. The amounts presented in the following table have been estimated based upon past claim

settlement activities and therefore are subject to significant estimation error. The factors affecting the ultimate amount of claims

are discussed in the following section regarding Berkshire’s critical accounting policies. In addition, certain losses and loss

adjustment expenses for property and casualty loss reserves are ceded to others under reinsurance contracts and therefore are

recoverable. Such recoverables are not reflected in the table.

A summary of contractual obligations as of December 31, 2008 follows. Amounts are in millions.

Estimated payments due by period

Total 2009 2010-2011 2012-2013 After 2013

Notes payable and other borrowings (1) ........................... $ 59,865 $ 5,733 $ 8,590 $10,131 $35,411

Operating leases ............................................ 3,115 583 889 587 1,056

Purchase obligations (2) ....................................... 25,282 6,552 6,885 4,673 7,172

Unpaid losses and loss expenses (3) .............................. 59,236 12,831 14,317 8,179 23,909

Other ..................................................... 32,512 4,473 3,196 2,700 22,143

Total ..................................................... $180,010 $30,172 $33,877 $26,270 $89,691

(1) Includes interest.

(2) Principally relates to future aircraft, coal, electricity and natural gas purchases.

(3) Before reserve discounts of $2,616 million.

77