Berkshire Hathaway 2008 Annual Report Download - page 22

Download and view the complete annual report

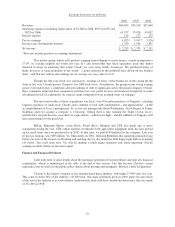

Please find page 22 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.But this difference can produce some strange results. The bonds covered – in effect, insured – by

these derivatives are largely general obligations of states, and we feel good about them. At yearend,

however, mark-to-market accounting required us to record a loss of $631 million on these

derivatives contracts. Had we instead insured the same bonds at the same price in BHAC, and used

the accrual accounting required at insurance companies, we would have recorded a small profit for

the year. The two methods by which we insure the bonds will eventually produce the same

accounting result. In the short term, however, the variance in reported profits can be substantial.

We have told you before that our derivative contracts, subject as they are to mark-to-market

accounting, will produce wild swings in the earnings we report. The ups and downs neither cheer nor bother

Charlie and me. Indeed, the “downs” can be helpful in that they give us an opportunity to expand a position on

favorable terms. I hope this explanation of our dealings will lead you to think similarly.

************

The Black-Scholes formula has approached the status of holy writ in finance, and we use it when

valuing our equity put options for financial statement purposes. Key inputs to the calculation include a contract’s

maturity and strike price, as well as the analyst’s expectations for volatility, interest rates and dividends.

If the formula is applied to extended time periods, however, it can produce absurd results. In fairness,

Black and Scholes almost certainly understood this point well. But their devoted followers may be ignoring

whatever caveats the two men attached when they first unveiled the formula.

It’s often useful in testing a theory to push it to extremes. So let’s postulate that we sell a 100- year $1

billion put option on the S&P 500 at a strike price of 903 (the index’s level on 12/31/08). Using the implied

volatility assumption for long-dated contracts that we do, and combining that with appropriate interest and

dividend assumptions, we would find the “proper” Black-Scholes premium for this contract to be $2.5 million.

To judge the rationality of that premium, we need to assess whether the S&P will be valued a century

from now at less than today. Certainly the dollar will then be worth a small fraction of its present value (at only

2% inflation it will be worth roughly 14¢). So that will be a factor pushing the stated value of the index higher.

Far more important, however, is that one hundred years of retained earnings will hugely increase the value of

most of the companies in the index. In the 20th Century, the Dow-Jones Industrial Average increased by about

175-fold, mainly because of this retained-earnings factor.

Considering everything, I believe the probability of a decline in the index over a one-hundred-year

period to be far less than 1%. But let’s use that figure and also assume that the most likely decline – should one

occur – is 50%. Under these assumptions, the mathematical expectation of loss on our contract would be $5

million ($1 billion X 1% X 50%).

But if we had received our theoretical premium of $2.5 million up front, we would have only had to

invest it at 0.7% compounded annually to cover this loss expectancy. Everything earned above that would have

been profit. Would you like to borrow money for 100 years at a 0.7% rate?

Let’s look at my example from a worst-case standpoint. Remember that 99% of the time we would pay

nothing if my assumptions are correct. But even in the worst case among the remaining 1% of possibilities – that

is, one assuming a total loss of $1 billion – our borrowing cost would come to only 6.2%. Clearly, either my

assumptions are crazy or the formula is inappropriate.

20