Berkshire Hathaway 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Indeed, recent events demonstrate that certain big-name CEOs (or former CEOs) at major financial

institutions were simply incapable of managing a business with a huge, complex book of derivatives. Include

Charlie and me in this hapless group: When Berkshire purchased General Re in 1998, we knew we could not get

our minds around its book of 23,218 derivatives contracts, made with 884 counterparties (many of which we had

never heard of). So we decided to close up shop. Though we were under no pressure and were operating in

benign markets as we exited, it took us five years and more than $400 million in losses to largely complete the

task. Upon leaving, our feelings about the business mirrored a line in a country song: “I liked you better before I

got to know you so well.”

Improved “transparency” – a favorite remedy of politicians, commentators and financial regulators for

averting future train wrecks – won’t cure the problems that derivatives pose. I know of no reporting mechanism

that would come close to describing and measuring the risks in a huge and complex portfolio of derivatives.

Auditors can’t audit these contracts, and regulators can’t regulate them. When I read the pages of “disclosure” in

10-Ks of companies that are entangled with these instruments, all I end up knowing is that I don’t know what is

going on in their portfolios (and then I reach for some aspirin).

For a case study on regulatory effectiveness, let’s look harder at the Freddie and Fannie example.

These giant institutions were created by Congress, which retained control over them, dictating what they could

and could not do. To aid its oversight, Congress created OFHEO in 1992, admonishing it to make sure the two

behemoths were behaving themselves. With that move, Fannie and Freddie became the most intensely-regulated

companies of which I am aware, as measured by manpower assigned to the task.

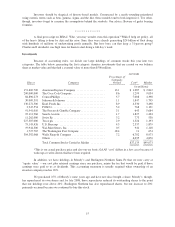

On June 15, 2003, OFHEO (whose annual reports are available on the Internet) sent its 2002 report to

Congress – specifically to its four bosses in the Senate and House, among them none other than Messrs. Sarbanes

and Oxley. The report’s 127 pages included a self-congratulatory cover-line: “Celebrating 10 Years of

Excellence.” The transmittal letter and report were delivered nine days after the CEO and CFO of Freddie had

resigned in disgrace and the COO had been fired. No mention of their departures was made in the letter, even

while the report concluded, as it always did, that “Both Enterprises were financially sound and well managed.”

In truth, both enterprises had engaged in massive accounting shenanigans for some time. Finally, in

2006, OFHEO issued a 340-page scathing chronicle of the sins of Fannie that, more or less, blamed the fiasco on

every party but – you guessed it – Congress and OFHEO.

The Bear Stearns collapse highlights the counterparty problem embedded in derivatives transactions, a

time bomb I first discussed in Berkshire’s 2002 report. On April 3, 2008, Tim Geithner, then the able president of

the New York Fed, explained the need for a rescue: “The sudden discovery by Bear’s derivative counterparties

that important financial positions they had put in place to protect themselves from financial risk were no longer

operative would have triggered substantial further dislocation in markets. This would have precipitated a rush by

Bear’s counterparties to liquidate the collateral they held against those positions and to attempt to replicate those

positions in already very fragile markets.” This is Fedspeak for “We stepped in to avoid a financial chain reaction

of unpredictable magnitude.” In my opinion, the Fed was right to do so.

A normal stock or bond trade is completed in a few days with one party getting its cash, the other its

securities. Counterparty risk therefore quickly disappears, which means credit problems can’t accumulate. This

rapid settlement process is key to maintaining the integrity of markets. That, in fact, is a reason for NYSE and

NASDAQ shortening the settlement period from five days to three days in 1995.

Derivatives contracts, in contrast, often go unsettled for years, or even decades, with counterparties

building up huge claims against each other. “Paper” assets and liabilities – often hard to quantify – become

important parts of financial statements though these items will not be validated for many years. Additionally, a

frightening web of mutual dependence develops among huge financial institutions. Receivables and payables by

the billions become concentrated in the hands of a few large dealers who are apt to be highly-leveraged in other

ways as well. Participants seeking to dodge troubles face the same problem as someone seeking to avoid venereal

disease: It’s not just whom you sleep with, but also whom they are sleeping with.

17