Berkshire Hathaway 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

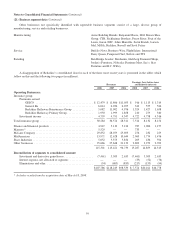

Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Berkshire Hathaway Primary Group

Berkshire’s primary insurance group consists of a wide variety of independently managed insurance businesses that

principally write liability coverages for commercial accounts. These businesses include: Medical Protective Corporation

(“MedPro”), a provider of professional liability insurance to physicians, dentists and other healthcare providers; National

Indemnity Company’s primary group operation (“NICO Primary Group”), a writer of commercial motor vehicle and general

liability coverages; U.S. Investment Corporation, whose subsidiaries underwrite specialty insurance coverages; a group of

companies referred to internally as “Homestate” operations, providers of standard commercial multi-line insurance; Central

States Indemnity Company, a provider of credit and disability insurance to individuals nationwide through financial institutions;

Applied Underwriters, a provider of integrated workers’ compensation solutions; and BoatU.S., (acquired in August 2007)

which writes insurance for owners of boats and small watercraft.

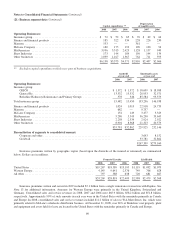

Earned premiums by the primary insurance businesses were $1,950 million in 2008, $1,999 million in 2007 and $1,858

million in 2006. Roughly 33% of the premiums earned in each year were from MedPro. In 2008, premiums earned by the NICO

Primary Group declined by approximately 30%, which was partially offset by increased premiums earned from the Homestate

operations and BoatU.S. Pre-tax underwriting gains as percentages of premiums earned were approximately 11% in 2008, 14%

in 2007 and 18% in 2006. The decline in underwriting gains in 2008 from 2007 reflected declines in underwriting gains from

the NICO Primary Group and Homestate operations, which were primarily due to less favorable loss reserve development of

prior years’ occurrences as well as relatively higher losses for current year occurrences.

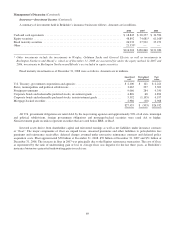

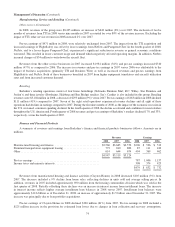

Insurance—Investment Income

A summary of the net investment income of Berkshire’s insurance operations for the past three years follows. Amounts are in

millions.

2008 2007 2006

Investment income before income taxes and minority interests .............................. $4,722 $4,758 $4,316

Income taxes and minority interests .................................................... 1,225 1,248 1,196

Investment income after income taxes and minority interests ................................ $3,497 $3,510 $3,120

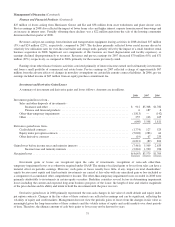

Investment income consists of interest earned on cash equivalents and fixed maturity investments and dividends earned on

equity investments. Pre-tax investment income earned in 2008 was relatively unchanged from 2007. Investment income earned

in 2007 increased $442 million (10%) over 2006. The increase in 2007 over 2006 reflected increased invested assets, higher

short-term interest rates in the United States and increased dividend rates on certain equity investments.

In 2008, dividend income increased $534 million, reflecting increased investments in equity securities and increased

dividend rates with respect to certain securities. The increase in dividends earned was offset by a decline in interest earned,

reflecting lower levels of related fixed maturity investments and generally lower interest rates applicable to cash equivalents and

short-term investments. In October 2008, Berkshire subsidiaries acquired the Wrigley, Goldman Sachs and General Electric

securities for an aggregate cost of $14.5 billion. See Note 5 to the Consolidated Financial Statements. Interest and dividends

from these securities will be approximately $1.4 billion per annum, which is substantially greater than earnings currently

expected from short-term investments.

68