Berkshire Hathaway 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

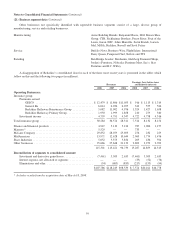

Insurance—Underwriting (Continued)

General Re (Continued)

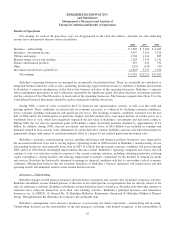

Property/casualty

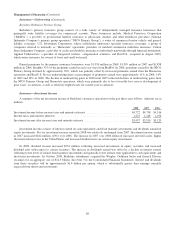

Premiums written in 2008 declined 2.7% from 2007, which declined 2.9% versus 2006. Premiums written in

2008 included $205 million with respect to a reinsurance-to-close transaction that increased General Re’s

economic interest in the runoff of Lloyd’s Syndicate 435’s 2000 year of account from 39% to 100%. A similar

transaction in 2007 generated $114 million of premiums written and increased General Re’s economic interest in

the runoff of Lloyd’s Syndicate 435’s 2001 year of account from 60% to 100%. Neither of the reinsurance-to-

close transactions had any impact on net underwriting results because premiums earned were offset by

corresponding increases to loss reserves and losses incurred. There was no similar transaction in 2006.

Premiums earned in 2008 declined 5.0% from 2007, which declined 2.6% from 2006. Excluding the effects

of the previously mentioned reinsurance-to-close transactions and exchange rates, premiums earned declined

8.2% in 2008 compared to 2007 and 10.1% in 2007 compared to 2006. The overall comparative declines in

written and earned premiums reflect continued underwriting discipline by declining to accept business where

pricing is considered inadequate with respect to the risk. Competitive conditions currently prevailing within the

industry could lead to continued declines in business written in 2009.

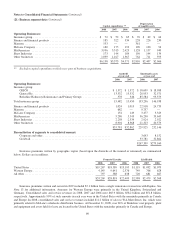

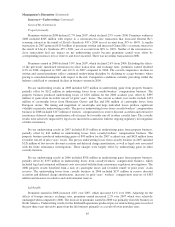

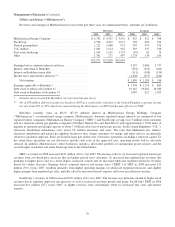

Pre-tax underwriting results in 2008 included $275 million in underwriting gains from property business

partially offset by $112 million in underwriting losses from casualty/workers’ compensation business. The

property business produced underwriting losses of $120 million for the 2008 accident year, offset by $395

million of gains from favorable run-off of prior years’ losses. The current accident year results include $174

million of catastrophe losses from Hurricanes Gustav and Ike and $56 million of catastrophe losses from

European storms. The timing and magnitude of catastrophe and large individual losses produce significant

volatility in periodic underwriting results. The pre-tax underwriting losses from casualty/workers’ compensation

business in 2008 included $117 million of workers’ compensation loss reserve discount accretion and retroactive

reinsurance deferred charge amortization, offset in part by favorable run-off in other casualty lines. The casualty

results were adversely impacted by legal costs incurred in connection with the ongoing regulatory investigations

of finite reinsurance.

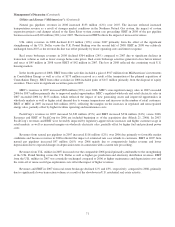

Pre-tax underwriting results in 2007 included $519 million in underwriting gains from property business,

partially offset by $44 million in underwriting losses from casualty/workers’ compensation business. The

property business produced underwriting gains of $90 million for the 2007 accident year and $429 million from

favorable run-off of prior years’ losses. The pre-tax underwriting losses from casualty business in 2007 included

$120 million of loss reserve discount accretion and deferred charge amortization, as well as legal costs associated

with the finite reinsurance investigations. These charges were largely offset by underwriting gains in other

casualty business.

Pre-tax underwriting results in 2006 included $708 million in underwriting gains from property business,

partially offset by $335 million in underwriting losses from casualty/workers’ compensation business, which

included legal and estimated settlement costs associated with the finite reinsurance regulatory investigations. The

2006 property results benefited from a lack of catastrophe losses and favorable runoff of prior years’ claim

reserves. The underwriting losses from casualty business in 2006 included $137 million in reserve discount

accretion and deferred charge amortization, increases in prior years’ workers’ compensation reserves of $103

million and increases in asbestos and environmental reserves.

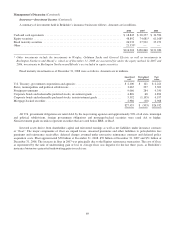

Life/health

Premiums earned in 2008 increased 4.8% over 2007, which increased 4.1% over 2006. Adjusting for the

effects of foreign currency exchange rates, premiums earned increased 2.2% over 2007 which were relatively

unchanged when compared to 2006. The increase in premiums earned in 2008 was primarily from life business in

North America. Underwriting results for the life/health operations produced pre-tax underwriting gains in each of

the past three years driven by gains from the life business primarily as a result of lower mortality rates.

65