Berkshire Hathaway 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

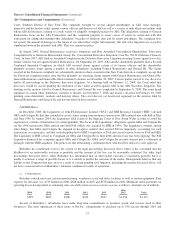

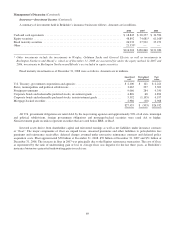

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

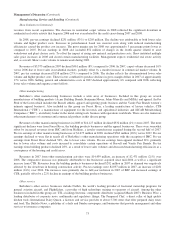

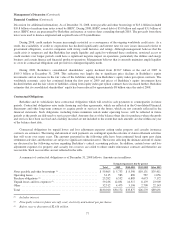

premiums earned from retroactive contracts were relatively minor over the past three years. Unamortized deferred charges of

BHRG’s retroactive contracts (including the Equitas contract) were $3.7 billion at December 31, 2008 and $3.8 billion at

December 31, 2007. Gross unpaid losses under retroactive contracts were approximately $16.6 billion at December 31, 2008

and $17.3 billion at December 31, 2007.

Underwriting losses from retroactive reinsurance policies in each year were primarily attributable to recurring deferred

charge amortization. Underwriting losses from retroactive policies in 2007 included deferred charge amortization of $156

million on contracts written in 2007 (primarily the Equitas contract). Underwriting losses from retroactive reinsurance in 2006

were net of gains of approximately $145 million which primarily derived from contracts that were commuted or amended

during that year.

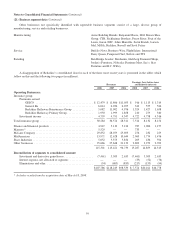

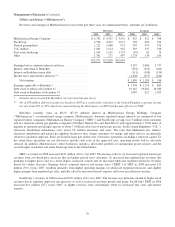

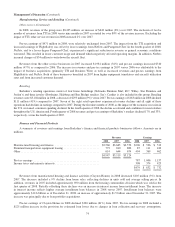

Other multi-line premiums earned in 2008 increased $1.31 billion (50%) over 2007. Premiums earned in 2008 included

$1.83 billion from a quota-share contract with Swiss Reinsurance Company Ltd. and its major property/casualty affiliates

(“Swiss Re”) that became effective January 1, 2008. Under the agreement, BHRG assumes a 20% quota-share of the premiums

and related losses and expenses on substantially all property/casualty risks of Swiss Re written over the five year period ending

December 31, 2012. BHRG’s written premium under this agreement in 2008 was $2.65 billion. Actual premiums assumed over

the remainder of the five year period could vary significantly depending on Swiss Re’s response to market conditions and

opportunities that arise over the contract term. Excluding the premiums from the Swiss Re quota-share contract, other multi-line

premiums earned in 2008 declined 20% versus 2007 principally attributable to lower premium volume from workers’

compensation programs.

Other multi-line business produced a pre-tax underwriting gain of $962 million in 2008. This gain included $930 million of

foreign currency transaction gains (including approximately $615 million in the fourth quarter) arising from the conversion of

certain reinsurance liabilities denominated and settled in foreign currencies (primarily the U.K. Pound Sterling and the Euro)

into U.S. Dollars as of the balance sheet date. The value of these currencies versus the U.S. Dollar generally increased over the

past several years resulting in accumulated liabilities and transaction losses. Over the last half of 2008, these currencies declined

sharply versus the U.S. Dollar, resulting in gains that exceeded the previously recorded losses.

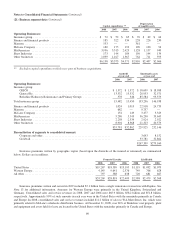

Excluding the effects of the currency gains/losses, other multi-line business produced a pre-tax underwriting gain of $32

million in 2008 compared to $435 million in 2007. Pre-tax underwriting results in 2008 included approximately $435 million of

estimated catastrophe losses from Hurricanes Gustav and Ike. There were no significant catastrophe losses in 2007, which also

benefited from relatively low property loss ratios and favorable loss experience on workers’ compensation business.

Other multi-line premiums earned in 2007 were relatively unchanged from 2006, reflecting significant increases in

property business and significant decreases in casualty excess reinsurance. In addition, as of the beginning of 2007, the

management of certain workers’ compensation business was transferred to the Berkshire Hathaway Primary Group and the

related underwriting results have been excluded from BHRG since that date.

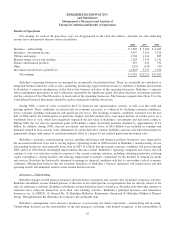

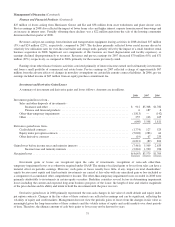

In December 2007, BHRG formed a monoline financial guarantee insurance company, Berkshire Hathaway Assurance

Corporation (“BHAC”). BHAC commenced operations during the first quarter of 2008 and is licensed in 49 states. As of

December 31, 2008, BHAC had approximately $1 billion in capital and has received the highest rating available from two credit

rating agencies. BHRG is pursuing opportunities to write financial guarantee insurance on municipal bonds. In its first year of

operation, BHAC produced $595 million of written premiums. The impact of this new business on 2008 underwriting results

was minimal, since the coverage periods related to the insured bonds extend over 40 years into the future.

In January 2009, BHRG agreed to cover certain Swiss Re entities for adverse loss development of its property and casualty

loss reserves up to 5 billion Swiss Francs in excess of its December 31, 2008 loss reserves less 2 billion Swiss Francs. BHRG

will receive a premium of 2 billion Swiss Francs for providing this coverage.

67