Berkshire Hathaway 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Equity Price Risk

Historically, Berkshire has maintained large amounts of invested assets in exchange traded equity securities. Strategically,

Berkshire strives to invest in businesses that possess excellent economics, with able and honest management and at sensible prices

and prefers to invest a meaningful amount in each investee. Consequently, equity investments may be concentrated in relatively

few investees. At December 31, 2008, 57% of the total fair value of equity investments was concentrated in four investees.

Berkshire prefers to hold equity investments for very long periods of time so management is not troubled by short-term

equity price volatility with respect to its investments provided that the underlying business, economic and management

characteristics of the investees remain favorable. Berkshire strives to maintain above average levels of shareholder capital to

provide a margin of safety against short-term equity price volatility.

Market prices for equity securities are subject to fluctuation and consequently the amount realized in the subsequent sale of

an investment may significantly differ from the reported market value. Fluctuation in the market price of a security may result

from perceived changes in the underlying economic characteristics of the investee, the relative price of alternative investments

and general market conditions.

Berkshire is also subject to equity price risk with respect to its equity index put option contracts. While Berkshire’s

ultimate potential loss with respect to these contracts is determined from the movement of the underlying stock index between

contract inception date and expiration, the change in fair value resulting from current changes in the index values are also

affected by changes in other factors such as interest rates, expected dividend rates and the remaining duration of the contract.

These contracts generally expire 15 to 20 years from inception and may not be settled before their respective expiration dates.

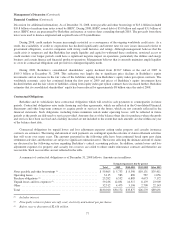

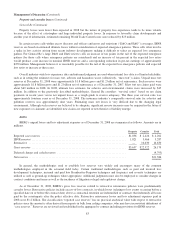

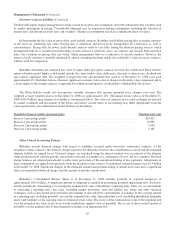

The following table summarizes Berkshire’s equity investments and derivative contract liabilities with equity price risk as

of December 31, 2008 and 2007. The effects of a hypothetical 30% increase and a 30% decrease in market prices as of those

dates is also shown. The selected 30% hypothetical change does not reflect what could be considered the best or worst case

scenarios. Indeed, results could be far worse due both to the nature of equity markets and the aforementioned concentrations

existing in Berkshire’s equity investment portfolio. Dollar amounts are in millions.

Fair Value

Hypothetical

Price Change

Estimated

Fair Value after

Hypothetical

Change in Prices

Hypothetical

Percentage

Increase (Decrease) in

Shareholders’ Equity

December 31, 2008

Equity securities ............................... $49,073 30% increase $ 63,795 8.8

30% decrease 34,351 (8.8)

Equity index put options ......................... (10,022) 30% increase (7,952) 1.2

30% decrease (12,799) (1.7)

December 31, 2007

Equity securities ............................... $74,999 30% increase $ 97,499 12.1

30% decrease 52,499 (12.1)

Equity index put options ......................... (4,610) 30% increase (3,282) 0.7

30% decrease (6,900) (1.2)

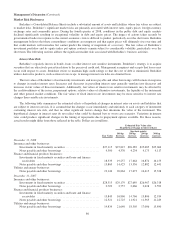

Foreign Currency Risk

Berkshire generally does not use derivative contracts to hedge foreign currency price changes primarily because of the

natural hedging that occurs between assets and liabilities denominated in foreign currencies in the consolidated financial

statements. Financial statements of subsidiaries that do not use the U.S. Dollar as their functional currency are translated into

U.S. Dollars using period-end exchange rates for assets and liabilities and weighted-average exchange rates for revenues and

expenses. Adjustments resulting from translating the financial statements of these subsidiaries are reported in accumulated other

comprehensive income. Foreign currency transaction gains or losses are included in earnings primarily as a result of the

translation of foreign currency denominated assets and liabilities held by U.S. subsidiaries. In addition, Berkshire holds

investments in major multinational companies that have significant foreign business and foreign currency risk of their own, such

as the Coca-Cola Company.

87