Berkshire Hathaway 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(19) Pension plans (Continued)

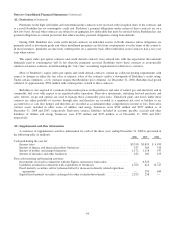

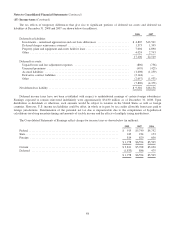

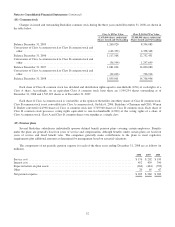

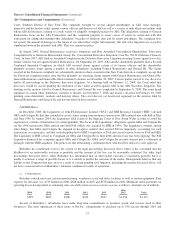

A reconciliation of amounts not yet recognized in net periodic benefit expense for the years ending December 31, 2008 and

2007 follows (in millions).

2008 2007

Net amount included in accumulated other comprehensive income, beginning of year .................... $(164) $(303)

Amount included in net periodic pension expense ............................................... 10 25

Gains/losses current period ................................................................. (699) 114

Net amount included in accumulated other comprehensive income, end of year ......................... $(853)*$(164)

*Includes $42 million that is expected to be included in net periodic pension expense in 2009.

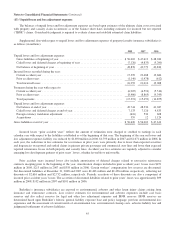

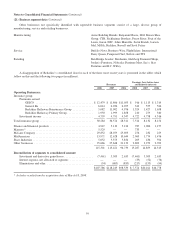

Weighted average interest rate assumptions used in determining projected benefit obligations were as follows. These rates

are substantially the same as the weighted average rates used in determining the net periodic pension expense.

2008 2007

Discount rate .................................................................................. 6.3% 6.1%

Expected long-term rate of return on plan assets ...................................................... 6.9 6.9

Rate of compensation increase .................................................................... 4.2 4.4

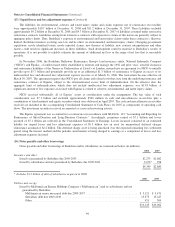

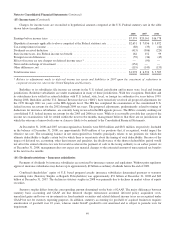

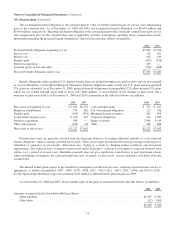

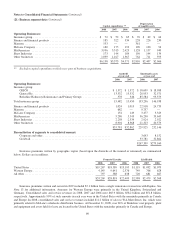

Several Berkshire subsidiaries also sponsor defined contribution retirement plans, such as 401(k) or profit sharing plans.

Employee contributions to the plans are subject to regulatory limitations and the specific plan provisions. Several of the plans

require that the subsidiary match these contributions up to levels specified in the plans and provide for additional discretionary

contributions as determined by management. The total expenses related to employer contributions for these plans were $519

million, $506 million and $498 million for the years ended December 31, 2008, 2007 and 2006, respectively.

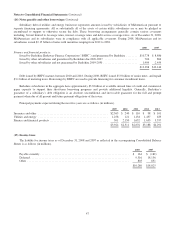

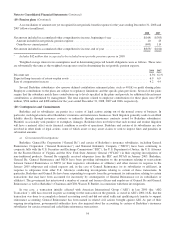

(20) Contingencies and Commitments

Berkshire and its subsidiaries are parties in a variety of legal actions arising out of the normal course of business. In

particular, such legal actions affect Berkshire’s insurance and reinsurance businesses. Such litigation generally seeks to establish

liability directly through insurance contracts or indirectly through reinsurance contracts issued by Berkshire subsidiaries.

Plaintiffs occasionally seek punitive or exemplary damages. Berkshire does not believe that such normal and routine litigation

will have a material effect on its financial condition or results of operations. Berkshire and certain of its subsidiaries are also

involved in other kinds of legal actions, some of which assert or may assert claims or seek to impose fines and penalties in

substantial amounts.

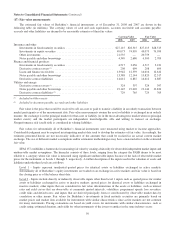

a) Governmental Investigations

Berkshire, General Re Corporation (“General Re”) and certain of Berkshire’s insurance subsidiaries, including General

Reinsurance Corporation (“General Reinsurance”) and National Indemnity Company (“NICO”) have been continuing to

cooperate fully with the U.S. Securities and Exchange Commission (“SEC”), the U.S. Department of Justice, the U.S. Attorney

for the Eastern District of Virginia and the New York State Attorney General (“NYAG”) in their ongoing investigations of

non-traditional products. General Re originally received subpoenas from the SEC and NYAG in January 2005. Berkshire,

General Re, General Reinsurance and NICO have been providing information to the government relating to transactions

between General Reinsurance or NICO (or their respective subsidiaries or affiliates) and other insurers in response to the

January 2005 subpoenas and related requests and, in the case of General Reinsurance (or its subsidiaries or affiliates), in

response to subpoenas from other U.S. Attorneys conducting investigations relating to certain of these transactions. In

particular, Berkshire and General Re have been responding to requests from the government for information relating to certain

transactions that may have been accounted for incorrectly by counterparties of General Reinsurance (or its subsidiaries or

affiliates). The government has interviewed a number of current and former officers and employees of General Re and General

Reinsurance as well as Berkshire’s Chairman and CEO, Warren E. Buffett, in connection with these investigations.

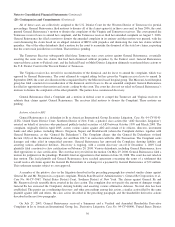

In one case, a transaction initially effected with American International Group (“AIG”) in late 2000 (the “AIG

Transaction”), AIG has corrected its prior accounting for the transaction on the grounds, as stated in AIG’s 2004 10-K, that the

transaction was done to accomplish a desired accounting result and did not entail sufficient qualifying risk transfer to support

reinsurance accounting. General Reinsurance has been named in related civil actions brought against AIG. As part of their

ongoing investigations, governmental authorities have also inquired about the accounting by certain of Berkshire’s insurance

subsidiaries for certain assumed and ceded finite reinsurance transactions.

54