Berkshire Hathaway 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

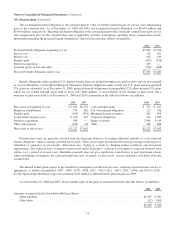

(20) Contingencies and Commitments (Continued)

In June 2005, John Houldsworth, the former Chief Executive Officer of Cologne Reinsurance Company (Dublin) Limited

(“CRD”), a subsidiary of General Re, and Richard Napier, a former Senior Vice President of General Re who had served as an

account representative for the AIG account, each pleaded guilty to a federal criminal charge of conspiring with others to

misstate certain AIG financial statements in connection with the AIG Transaction and entered into a partial settlement

agreement with the SEC with respect to such matters.

On February 25, 2008, Ronald Ferguson, General Re’s former Chief Executive Officer, Elizabeth Monrad, General Re’s

former Chief Financial Officer, Christopher Garand, a former General Reinsurance Senior Vice President and Robert Graham, a

former General Reinsurance Senior Vice President and Assistant General Counsel, were each convicted in a trial in the U.S.

District Court for the District of Connecticut on charges of conspiracy, mail fraud, securities fraud and making false statements

to the SEC in connection with the AIG Transaction. These individuals have the right to appeal their convictions. Following their

convictions, each of these individuals agreed to a judgment of a forfeiture allegation which required them to be jointly and

severally liable for a payment of $5 million to the U.S. Government. This $5 million amount, which represented the fee received

by General Reinsurance in connection with the AIG Transaction, was paid by General reinsurance in April 2008. Each of these

individuals, who had previously received a “Wells” notice in 2005 from the SEC, is also the subject of an SEC enforcement

action for allegedly aiding and abetting AIG’s violations of the antifraud provisions and other provisions of the federal securities

laws in connection with the AIG Transaction. The SEC case is presently stayed. Joseph Brandon, who resigned as the Chief

Executive Officer of General Re effective on April 14, 2008, also received a “Wells” notice from the SEC in 2005.

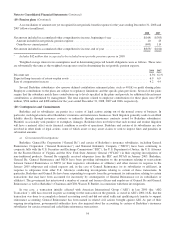

Berkshire understands that the government is evaluating the actions of General Re and its subsidiaries, as well as those of

their counterparties, to determine whether General Re or its subsidiaries conspired with others to misstate counterparty financial

statements or aided and abetted such misstatements by the counterparties. Berkshire believes that government authorities are

continuing to evaluate possible legal actions against General Re and its subsidiaries.

Various state insurance departments have issued subpoenas or otherwise requested that General Reinsurance, NICO and

their affiliates provide documents and information relating to non-traditional products. The Office of the Connecticut Attorney

General has also issued a subpoena to General Reinsurance for information relating to non-traditional products. General

Reinsurance, NICO and their affiliates have been cooperating fully with these subpoenas and requests.

CRD is also providing information to and cooperating fully with the Irish Financial Services Regulatory Authority in its

inquiries regarding the activities of CRD. The Office of the Director of Corporate Enforcement in Ireland is conducting a

preliminary evaluation in relation to CRD concerning, in particular, transactions between CRD and AIG. CRD is cooperating fully

with this preliminary evaluation.

Berkshire cannot at this time predict the outcome of these matters and is unable to estimate a range of possible loss and

cannot predict whether or not the outcomes will have a material adverse effect on Berkshire’s business or results of operations

for at least the quarterly period when these matters are completed or otherwise resolved.

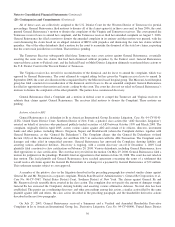

b) Civil Litigation

Litigation Related to ROA

General Reinsurance and several current and former employees, along with numerous other defendants, have been sued in

thirteen federal lawsuits involving Reciprocal of America (“ROA”) and related entities. ROA was a Virginia-based reciprocal

insurer and reinsurer of physician, hospital and lawyer professional liability risks. Nine are putative class actions initiated by

doctors, hospitals and lawyers that purchased insurance through ROA or certain of its Tennessee-based risk retention groups.

These complaints seek compensatory, treble, and punitive damages in an amount plaintiffs contend is just and reasonable.

General Reinsurance is also subject to actions brought by the Virginia Commissioner of Insurance, as Deputy Receiver of

ROA, the Tennessee Commissioner of Insurance, as Receiver for purposes of liquidating three Tennessee risk retention groups,

a state lawsuit filed by a Missouri-based hospital group that was removed to federal court and another state lawsuit filed by an

Alabama doctor that was also removed to federal court. The first of these actions was filed in March 2003 and additional actions

were filed in April 2003 through June 2006. In the action filed by the Virginia Commissioner of Insurance, the Commissioner

asserts in several of its claims that the alleged damages are believed to exceed $200 million in the aggregate as against all

defendants.

55