Berkshire Hathaway 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions

Berkshire’s long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity

and able and honest management at sensible prices. During the last three years, Berkshire acquired several businesses which are

described in the following paragraphs.

On February 28, 2006, Berkshire acquired Business Wire, a leading global distributor of corporate news, multimedia and

regulatory filings. On March 21, 2006, PacifiCorp, a regulated electric utility providing service to customers in six Western

states, was acquired for approximately $5.1 billion in cash. In conjunction with the acquisition of PacifiCorp, Berkshire

acquired additional common stock of MidAmerican for $3.4 billion, which increased its ownership interest in MidAmerican

from approximately 83% to approximately 88%. On May 19, 2006, Berkshire acquired 85% of Applied Underwriters, an

industry leader in integrated workers’ compensation solutions. On July 5, 2006, Berkshire acquired 80% of the Iscar

Metalworking Companies (“IMC”) for cash in a transaction that valued IMC at $5 billion. IMC, headquartered in Israel, is an

industry leader in the metal cutting tools business. IMC provides a comprehensive range of tools for the full scope of

metalworking applications. IMC’s products are manufactured through a global network of world-class, technologically

advanced manufacturing facilities and are sold worldwide. On August 2, 2006, Berkshire acquired Russell Corporation, a

leading branded athletic apparel and sporting goods company. Consideration paid for all businesses acquired in 2006 was

approximately $10.1 billion.

On March 30, 2007, Berkshire acquired TTI, Inc., a privately held electronic components distributor headquartered in Fort

Worth, Texas. TTI, Inc. is a leading distributor specialist of passive, interconnect and electromechanical components. Effective

April 1, 2007, Berkshire acquired the intimate apparel business of VF Corporation. Berkshire also acquired several other

relatively smaller businesses during 2007. Consideration paid for all businesses acquired in 2007 was approximately $1.6

billion.

On March 18, 2008, Berkshire acquired 60% of Marmon Holdings, Inc. (“Marmon”), a private company owned by trusts

for the benefit of members of the Pritzker Family of Chicago, for $4.5 billion. In the second quarter of 2008, Berkshire acquired

additional shares and currently owns 63.6% of Marmon. Under the terms of the purchase agreement, Berkshire will acquire the

remaining minority interests in Marmon between 2011 and 2014 for consideration to be based on the future earnings of

Marmon. Berkshire also acquired several other relatively small businesses during 2008. Consideration paid for all businesses

acquired in 2008 was approximately $6.1 billion.

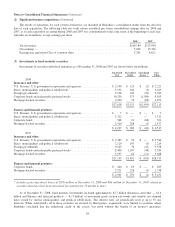

Marmon consists of approximately 130 manufacturing and service businesses that operate independently within eleven

diverse business sectors. These sectors are: Engineered Wire & Cable, serving energy related markets, residential and

non-residential construction and other industries; Building Wire, producing copper electrical wiring for residential, commercial

and industrial buildings; Transportation Services & Engineered Products, including railroad tank cars and intermodal tank

containers; Highway Technologies, primarily serving the heavy-duty highway transportation industry; Distribution Services for

specialty pipe and steel tubing; Flow Products, producing a variety of metal products and materials for the plumbing, HVAC/R,

construction and industrial markets; Industrial Products, including metal fasteners, safety products and metal fabrication;

Construction Services, providing the leasing and operation of mobile cranes primarily to the energy, mining and petrochemical

markets; Water Treatment equipment for residential, commercial and industrial applications; Retail Store Fixtures, providing

store fixtures and accessories for major retailers worldwide; and Food Service Equipment, providing food preparation

equipment and shopping carts for restaurants and retailers worldwide. Marmon operates more than 250 manufacturing,

distribution and service facilities, primarily in North America, Europe and China. The Marmon purchase price allocation is

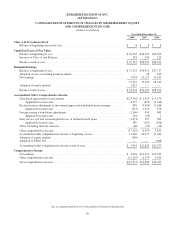

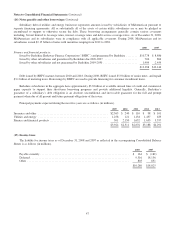

summarized below (in millions).

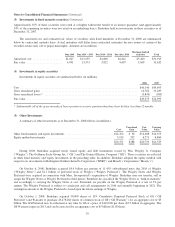

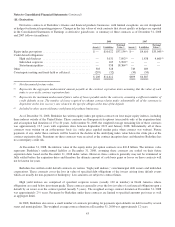

Assets: Liabilities and net assets acquired:

Cash and cash equivalents .....................$ 217 Accounts payable and other liabilities .......... $ 1,040

Accounts receivable .......................... 970 Notes payable and other borrowings ........... 1,071

Inventories ................................. 855 Income taxes, principally deferred ............ 1,733

Property, plant and equipment and leased assets .... 6,280 Minority shareholders’ interest ............... 1,568

Other, primarily goodwill and intangible assets .... 1,875 Net assets acquired ........................ 4,785

$10,197 $10,197

37