Berkshire Hathaway 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Utilities and Energy (“MidAmerican”)

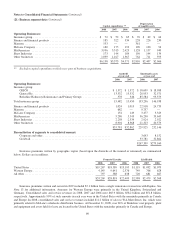

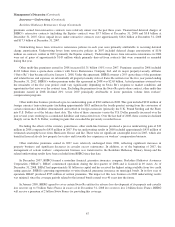

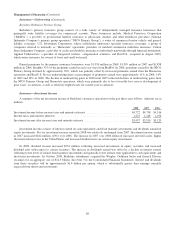

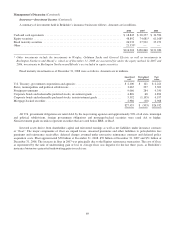

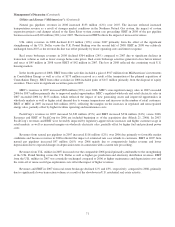

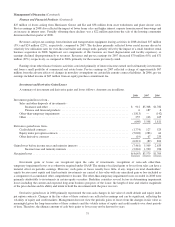

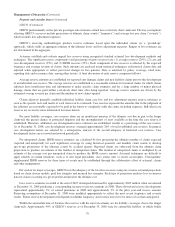

Revenues and earnings of MidAmerican for each of the past three years are summarized below. Amounts are in millions.

Revenues Earnings

2008 2007 2006 2008 2007 2006

MidAmerican Energy Company .......................... $ 4,742 $ 4,325 $ 3,519 $ 425 $ 412 $ 348

PacifiCorp ........................................... 4,558 4,319 2,971 703 692 356

Natural gas pipelines ................................... 1,221 1,088 972 595 473 376

U.K. utilities ......................................... 1,001 1,114 961 339 337 338

Real estate brokerage .................................. 1,147 1,511 1,724 (45) 42 74

Other ............................................... 1,302 271 497 1,278 130 245

$13,971 $12,628 $10,644

Earnings before corporate interest and taxes ................ 3,295 2,086 1,737

Interest, other than to Berkshire .......................... (332) (312) (261)

Interest on Berkshire junior debt .......................... (111) (108) (134)

Income taxes and minority interests ** ..................... (1,002) (477) (426)

Net earnings ...................................... $ 1,850 $ 1,189 $ 916

Earnings applicable to Berkshire * ........................ $ 1,704 $ 1,114 $ 885

Debt owed to others at December 31 ...................... 19,145 19,002 16,946

Debt owed to Berkshire at December 31 ................... 1,087 821 1,055

*Includes interest earned by Berkshire (net of related income taxes).

** Net of $58 million deferred income tax benefit in 2007 as a result of the reduction in the United Kingdom corporate income

tax rate from 30% to 28% which was enacted during the third quarter of 2007 and became effective in 2008.

Berkshire currently owns an 88.2% (87.4% diluted) interest in MidAmerican Energy Holdings Company

(“MidAmerican”), an international energy company. MidAmerican’s domestic regulated energy interests are comprised of two

regulated utility companies (MidAmerican Energy Company (“MEC”) and PacifiCorp) serving over 3 million retail customers

and two interstate natural gas pipeline companies (Northern Natural Gas and Kern River) with approximately 17,000 miles of

pipeline in operation and design capacity of about 7.0 billion cubic feet of natural gas per day. In the United Kingdom (“U.K.”),

electricity distribution subsidiaries serve about 3.8 million electricity end users. The rates that MidAmerican’s utilities,

electricity distribution and natural gas pipeline businesses may charge customers for energy and other services are generally

subject to regulatory approval. Rates are based in large part on the costs of business operations, including a return on capital. To

the extent these operations are not allowed to include such costs in the approved rates, operating results will be adversely

affected. In addition, MidAmerican’s other businesses include a diversified portfolio of independent power projects and the

second-largest residential real estate brokerage firm in the United States.

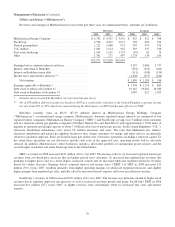

MEC’s revenues in 2008 increased $417 million (10%) over 2007. The increase reflects (1) increased regulated natural gas

revenues from cost based price increases that are largely passed on to customers, (2) increased non-regulated gas revenues due

primarily to higher prices and, to a lesser degree, increased volume and (3) increased wholesale regulated electricity revenues

driven by volume increases. Earnings before corporate interest and income taxes (“EBIT”) of MEC in 2008 increased $13

million (3%) versus 2007, resulting primarily from higher operating margins on wholesale regulated electricity and slightly

higher margins from regulated gas sales, partially offset by increased interest expense and lower miscellaneous income.

PacifiCorp’s revenues in 2008 increased $239 million (6%) over 2007. The increase was primarily related to higher retail

revenues due to regulator approved rate increases as well as increased customer growth and usage. PacifiCorp’s EBIT in 2008

increased $11 million (2%) versus 2007, as higher revenues were substantially offset by increased fuel costs and interest

expense.

70